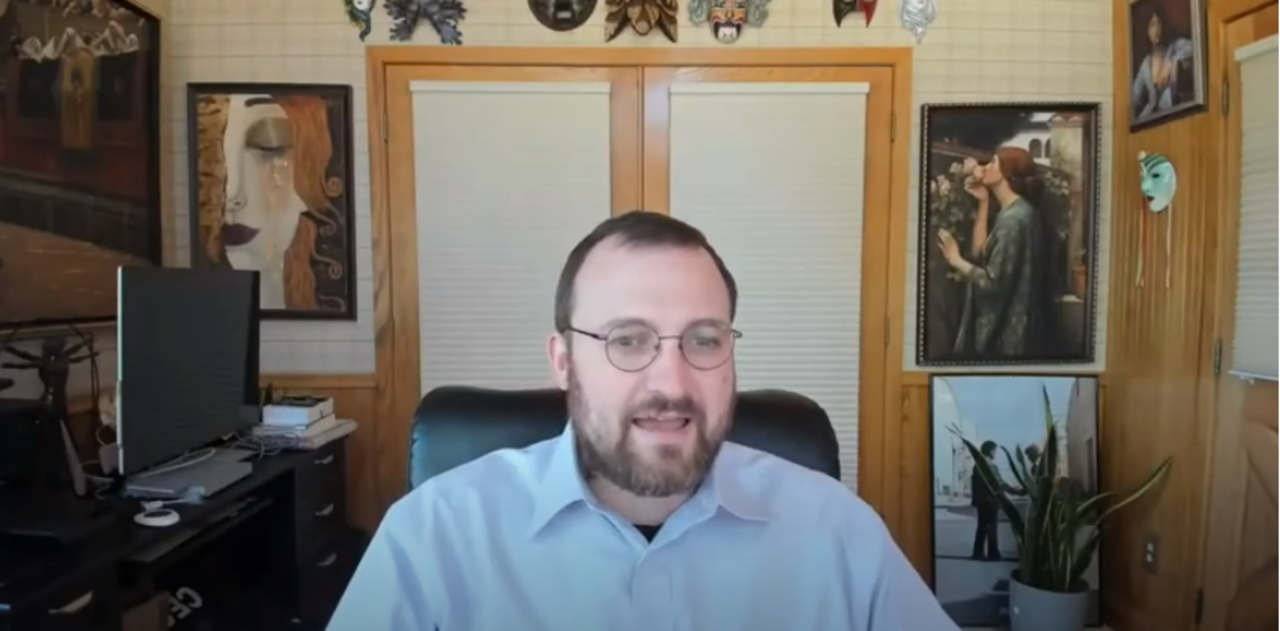

Cardano Founder Firmly Opposes “$ADA Burn” Proposal, Here’s Why

Cardano ($ADA) founder Charles Hoskinson is strongly against the idea of deflationary economics which has become quite popular in the crypto world. Hoskinson during a recent AMA session on Youtube expressed his strong displeasure against the idea of token burn, comparing it to stealing food. He said the proposal reflects people’s greed and stupidity and explained,

“We are so glad that you can tell us that we gotta destroy other people’s money so that you can make a little extra money and then sell the ADA and move on to something else.”

The token burn or deflationary tokenomics proposes to remove a certain amount of tokens from the circulating supply making the existing tokens more valuable. Ethereum ($ETH) became the latest to join on the deflationary token bandwagon post London Hardfork, and it has already burnt over $1 billion worth of Ether since Eip-1559 implementation. Apart from $ETH, Binance also burn its BNB supply on a quaterly basis.

Hoskinson is known to be a straight shooter and never minces his words despite the flood of criticism and trolling leading up to the latest smart contract upgrade on Cardano. However, earlier the Cardano founder has urged developers to create a “Proof-of-Burn” app that would allow users to send their $ADA to an address to destroy it. Thus, he believes those who want to burn their token are free to do so, but not any someone else’s cost.

Proof of Burn Challenge https://t.co/VD7E1wVb6P

— Charles Hoskinson (@IOHK_Charles) August 20, 2021

Cardano (ADA) Loses 3rd Spot

The native token $ADA touched a new ATH of $3.10 just a week prior to the Alonzo upgrade and many believed the key update would act as a catalyst for $ADA price. However, the token price has continued to slump post the upgrade as bears continued to dominate September. $ADA is currently trading at $2.12 down by 10.54% over the past 24-hours and needs to hold $2.0 key support to avoid any decline further.

$ADA also lost its third spot on the coin market cap rankings to Tether’s USDT, as its market cap fell below $70 billion. The altcoin looks to hold $2.0 support to make a bounce back as development activity and smart contract deployment surge.

- Breaking: CME Group To Launch 24/7 BTC, ETH, XRP, SOL Futures Trading On May 29

- White House to Hold CLARITY Act Meeting With Ripple, Coinbase, Banks Today

- Senator Warren Warns Fed Against Bitcoin Crash Rescue Amid Liquidity Pump Claims

- Top 5 Reasons Ethereum Price Is Down Today

- Crypto Market Slides as Hawkish FOMC Minutes Trigger BTC, ETH, XRP Sell-Off

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum