Cardano’s Charles Hoskinson Urges Traders to “Hold the Line” as Bitcoin Surges Back to $96K

Highlights

- Cardano founder tells investors to stay calm and avoid panic-selling.

- Hoskinson says volatility is part of the industry's cycle despite nearly $1 trillion wiped from the crypto market.

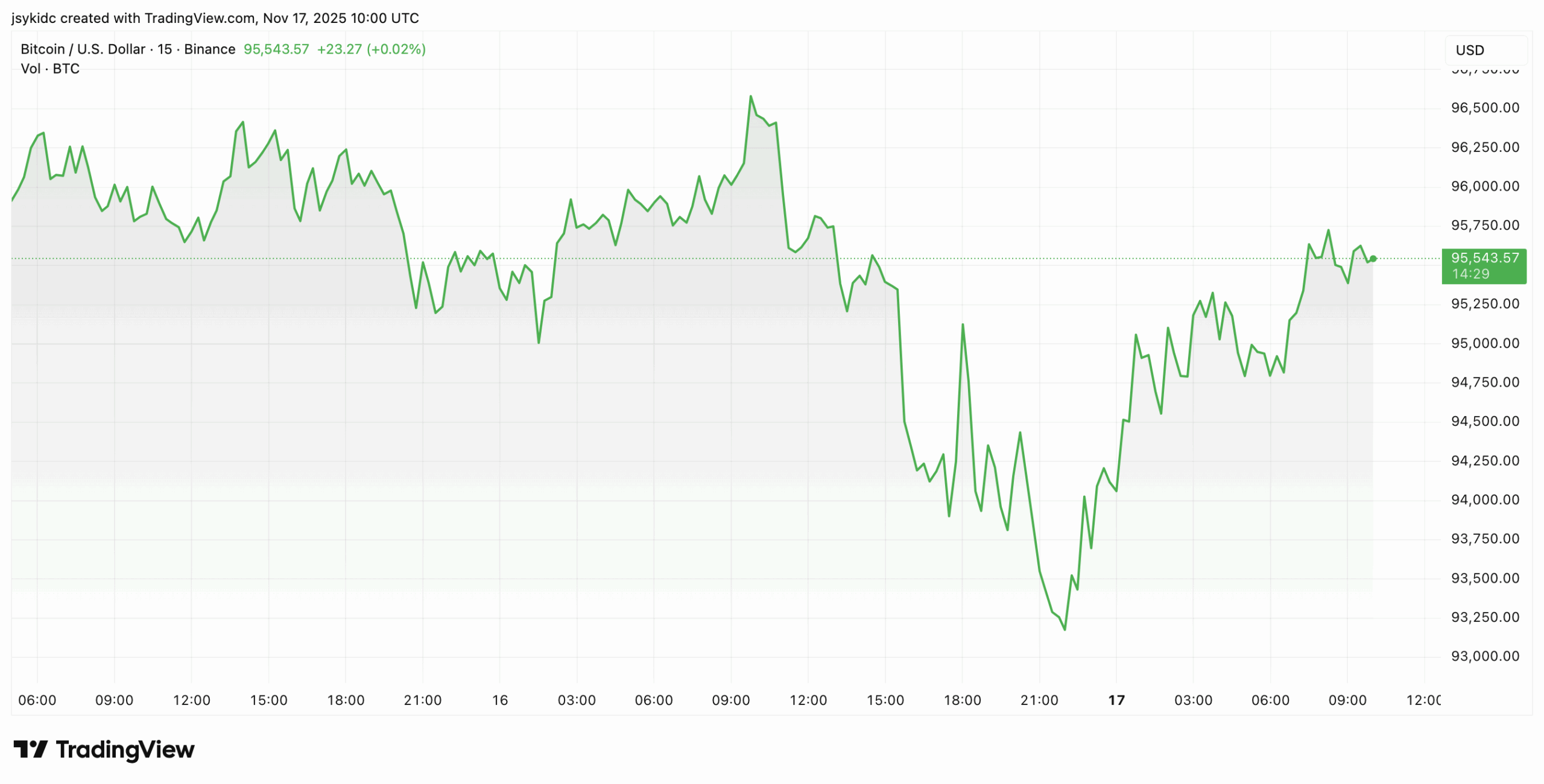

- Bitcoin briefly reclaimed $96,000 after dipping as low $93,000 in the past week.

Cardano founder Charles Hoskinson called on investors to remain call despite the market crash. This is in light of Bitcoin rebounding to $96,000 as it looks to recover to its previous highs.

Charles Hoskinson Calls for Calm Amid Market Decline

During a recent podcast, Cardano founder Charles Hoskinson has called on crypto investors to hold firm against the market downturn. He urged them not to give in to the temptation to move out of crypto into fiat.

Hoskinson acknowledged the near $1 trillion in market value that has been wiped out since October. He also said this is part of the crypto market moves. “Markets rise, markets fall, and panic follows. Paper hands everywhere,” he said. He mentioned the coin’s long-term trajectory remains upward because of growing adoption.

The founder also went on to give a critique of fiat money. He described it as a “Ponzi scheme” that can be manipulated. He argued that, in contrast with fiat, “No one can turn off your ADA. No one can turn off your Bitcoin.”

CryptoQuant CEO Ki Young Ju was even more bullish. He said Bitcoin’s rising realized cap as evidence of ongoing demand for the asset. Ju added that sustained capital flows could support a reversal. “A recovery can happen at any time,” Ju said.

Bitcoin Regains $96K as Investors Reassess the Pullback

Bitcoin briefly reclaimed the $96,000 level after going as low as $93,000. The token is maintaining its price and currently trading around $95,500.

Still some bearish claims have emerged. Chairman of BitMine, Tom Lee, believes that the latest declines in the prices of the BTC could hint at serious problems occurring within the market. According to him, the possible reason for such sell-offs could be due to a lack of funds among major market makers.

In previous interviews, Lee has said Bitcoin might fall by as much as 50%. He also warned that traders are taking advantage of its current weakness to push prices down.

Similarly, analyst Timothy Peterson warned that there is a 75% chance Bitcoin could fall further. He pointed to the multi-year low in the fear-and-greed index and said a potential bottom may not form until December.

While fear sets in, Charles Hoskinson remained bullish. He said that selling now means giving up control over finance to centralized systems. Instead, he encourages investors to see crypto as a way to gain personal freedom.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise