Cathie Wood’s Ark Invest Continues Crypto Buying Spree with ARKB Units Purchase

Highlights

- ARK Next Generation Internet ETF (ARKW) purchased 58,468 units of Ark 21Shares spot Bitcoin ETF (ARKB) this week

- Cathie Wood's ARK Invest funds double down on Tesla and Robinhood shares

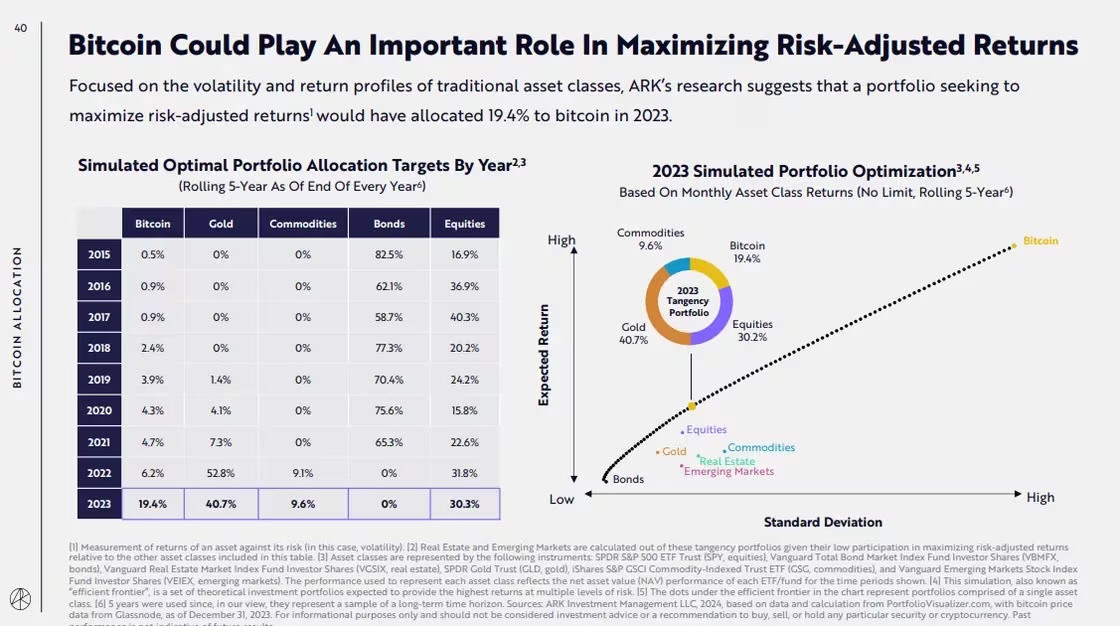

- Ark Invest has increased its Bitcoin allocation to 19.4% in 2023

- Coinbase and Robinhood to announce earnings in few weeks

Cathie Wood’s investment management firm Ark Invest is on a buying spree for crypto-related shares including its Ark 21Shares spot Bitcoin ETF (ARKB). ARK Next Generation Internet ETF (ARKW) purchased 1.27 million ARKB units worth $51 million last week.

Cathie Wood’s Ark Invest Bought ARKB Units

Cathie Wood’s ARK Next Generation Internet ETF (ARKW) continued its purchase of Ark 21Shares spot Bitcoin ETF (ARKB) this week. However, ARKW didn’t purge ProShares Bitcoin Strategy ETF (BITO) to buy ARKB this week amid a number of earning announcements this week.

ARKW purchased 58,468 units of ARKB worth $2.5 million on January 29. ARK Innovation ETF (ARKK) and ARKW funds also purchased Tesla shares worth millions. ARKK has over $600 million worth of Tesla (TSLA) shares.

ARK Next Generation Internet ETF holds 2,480,644 ARKB shares worth $106,816,530, as per holdings data by ARK Invest. The funds also reduced its ProShares Bitcoin Strategy ETF (BITO) to 285,167 shares valued at $5.81 million. It will likely hold on to the remaining BITO holdings.

As per Ark Invest data, ARKB has 15,890 bitcoin with a market value of $684.18 million until February 2.

ARK Buying Robinhood and Tesla

Ark Invest funds ARK Innovation ETF (ARKK) and ARK Next Generation Internet ETF (ARKW) continue to accumulate Robinhood Markets (HOOD) and Tesla (TSLA) shares worth millions this week.

On Feb 2, ARKK purchased 39,572 HOOD shares and 87,721 TSLA shares. ARKW bought 8,354 HOOD shares and 27,090 TSLA shares.

TSLA price closed 0.70% lower at $187.91 on Saturday. Whereas, HOOD price closed 0.09% higher at $10.92.

Ark Invest has increased its Bitcoin allocation in 2023 to 19.4% from 6.2% in 2022, emphasizing effectiveness in diversifying and balancing traditional assets. Bitcoin has played a crucial role in maximizing risk-adjusted returns.

Coinbase and Robinhood are about to release quarterly results for the period ending December 31, 2023. Robinhood Markets to release earnings on Feb 13, with expected revenue of $452.8 million. In addition, Coinbase’s earnings is due on February 15, with expected revenue of $811.50 million.

Concurrently, Cathie Wood has thrown a bombshell on Bitcoin claiming that it could go up to $2.3 million per coin. The forecast is based on the what-if situation in which global investible assets valued at $250 trillion are matched to a 19.4% Bitcoin allocation as per the recommendations given in Ark Invest’s Big Ideas report for 2024. Although this forecast is very optimistic it reflects Wood’s confidence in value proposition of Bitcoin and its use in future investment portfolios.

Also Read:

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- U.S.–Iran War: Bitcoin Price Extends Decline as Oil Prices Surge To Two-Year High

- Bitcoin Treasury Firm MARA Considers Selling BTC Reserves After Policy Update

- Cardano Founder Warns Over CLARITY Act, Cites Lack of Protection for DeFi, Stablecoins, Prediction Markets

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

Buy $GGs

Buy $GGs