CEL Holders Make Desperate Attempt To Recover Funds Through Short Squeeze

Beleaguered crypto lender Celsius has left its customers or depositors in limbo as it files for Chapter 11 bankruptcy in New York. Users plan a community-led “CEL Short Squeeze” to recover their money as they believe the crypto lender may not resume withdrawals.

A short squeeze refers to intentionally creating a sharp rally fueled by the unwinding of bearish positions or sellers rushing to take profits. A strong buying pressure “squeezes” the short sellers out of positions. In fact, pumping token prices of insolvent businesses seems to be becoming a trend nowadays.

Celsius Community Looks for CEL Short Squeeze

“CEL Short Squeeze” is not new, it’s happening since Celsius locked out customers from making withdrawals, swaps, and transfers on June 13. The CEL token prices have jumped over $1 many times as a result of short squeezes since last month. For instance, a major short squeeze was triggered between June 20-21, resulting in an over 150% rise in prices.

As the reports of bankruptcy filing surfaced, the CEL prices dived to a low of $0.42 from the day high of $0.95. As customers might not be able to recover their money, “#CELShortSqueeze” started trending on social media.

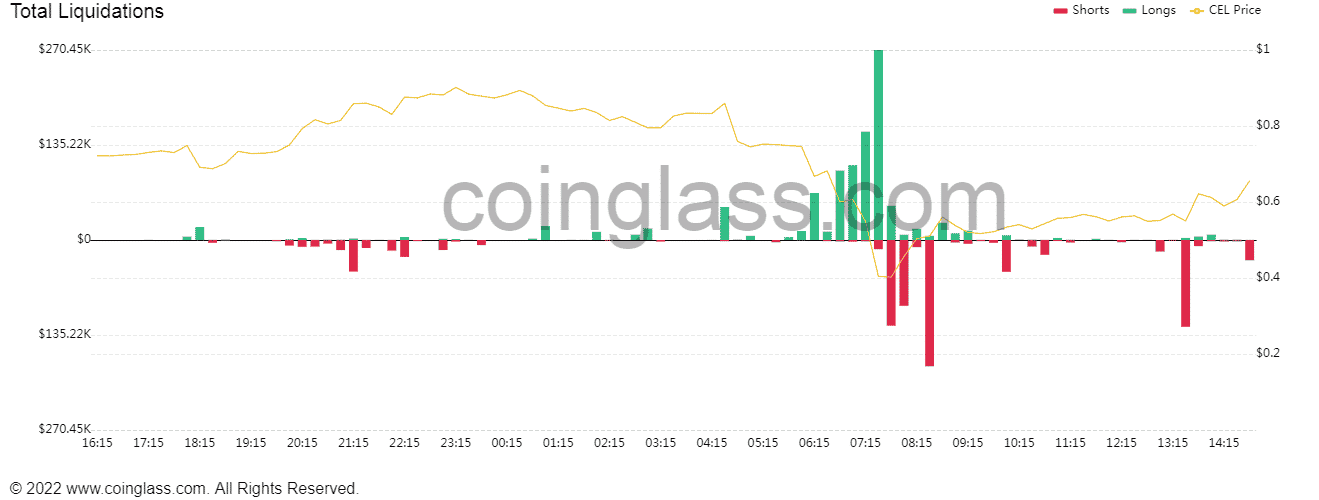

According to data from Coinglass, massive shorts have been liquidated in the last few hours pushing the CEL token prices to rise above $0.60. Short sellers started shorting CEL tokens as many influencers pushed for a “short squeeze.”

In the last 12 hours, over 80% of short positions have been seen across major exchanges including FTX, Huobi, and Okex. Celsius can’t sell the CEL token at the market. The spot market shorters on FTX are destined to buy CEL coins to close their positions. Currently, FTX only holds about 364,000 CEL, with 6.6 million CEL short positions.

Voyager’s VGX Token Jumps on Short Squeeze

Voyager Digital’s VGX token has jumped nearly 500% from $0.14 to $1 in the last three days as a result of a short squeeze by users to recover their money after it filed for bankruptcy.

Currently, the price is trading at $0.55, up 10% in the last 24 hours. MetaForm Labs is supposed to be behind the recent rally in the price due to its “PumpVGXJuly18” plan.

Celsius users might also be looking for a similar approach to recover their funds.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Core Scientific Sells 1,900 BTC as Bitcoin Miner Pivots to AI, CORZ Stock Dips

- Bitcoin News: VanEck CEO Projects Gradual BTC Rally in 2026 as ETFs Sees $458M Inflows

- Bitcoin, Gold Slip as Donald Trump Says “Unlimited Munition Stockpiles” for US-Iran War

- Crypto Prices Today: BTC, ETH, XRP Prices Surge Despite Iran’s Strait of Hormuz Closure

- Nasdaq Brings Prediction Markets to Wall Street with New SEC Filing

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

Buy $GGs

Buy $GGs