Celsius (CEL) Token Price Soars Massively Despite Bankruptcy Filing, Here’s Why

Celsius’ CEL token price is soaring despite the crypto lending firm filing for Chapter 11 bankruptcy. In the last 24 hours, the CEL token price has skyrocketed nearly 80% as a result of the community-led “CEL Short Squeeze.” Will we see a VGX-like pump and dump?

Celsius (CEL) Price Skyrockets Amid “CEL Short Squeeze”

Celsius bankruptcy filing has revealed $1.2 billion of bad deals including $750 million worth of mining rigs, liquidation of $840 million in debt from Tether, and 38,000 ETH loss from staking. Moreover, it has $411 million in outstanding loans to retail borrowers, backed by collateral of digital assets worth $765.5 million.

With customers and depositors unlikely to withdraw or recover their funds, many have started looking at “CEL Short Squeeze” as a possible solution. In just a day, the CEL token price has skyrocketed from a low of $0.42 to a high of $0.83, making a rally of nearly 80%. At the time of writing, Celsius (CEL) is trading at $0.78, up nearly 30%.

Users are planning a VGX-like pump and dump, which saw a massive 500% rally in its price in just 3 days. The price rose from $0.14 to $1 in a day, before losing some gains as a result of profit taking. After crypto lender Voyager Digital filed for bankruptcy, customers were in limbo over the recovery of their funds. Thereafter, many influencers and groups including MetaForm Labs revealed a “PumpVGXJuly18” plan to pump the VGX price through a short squeeze.

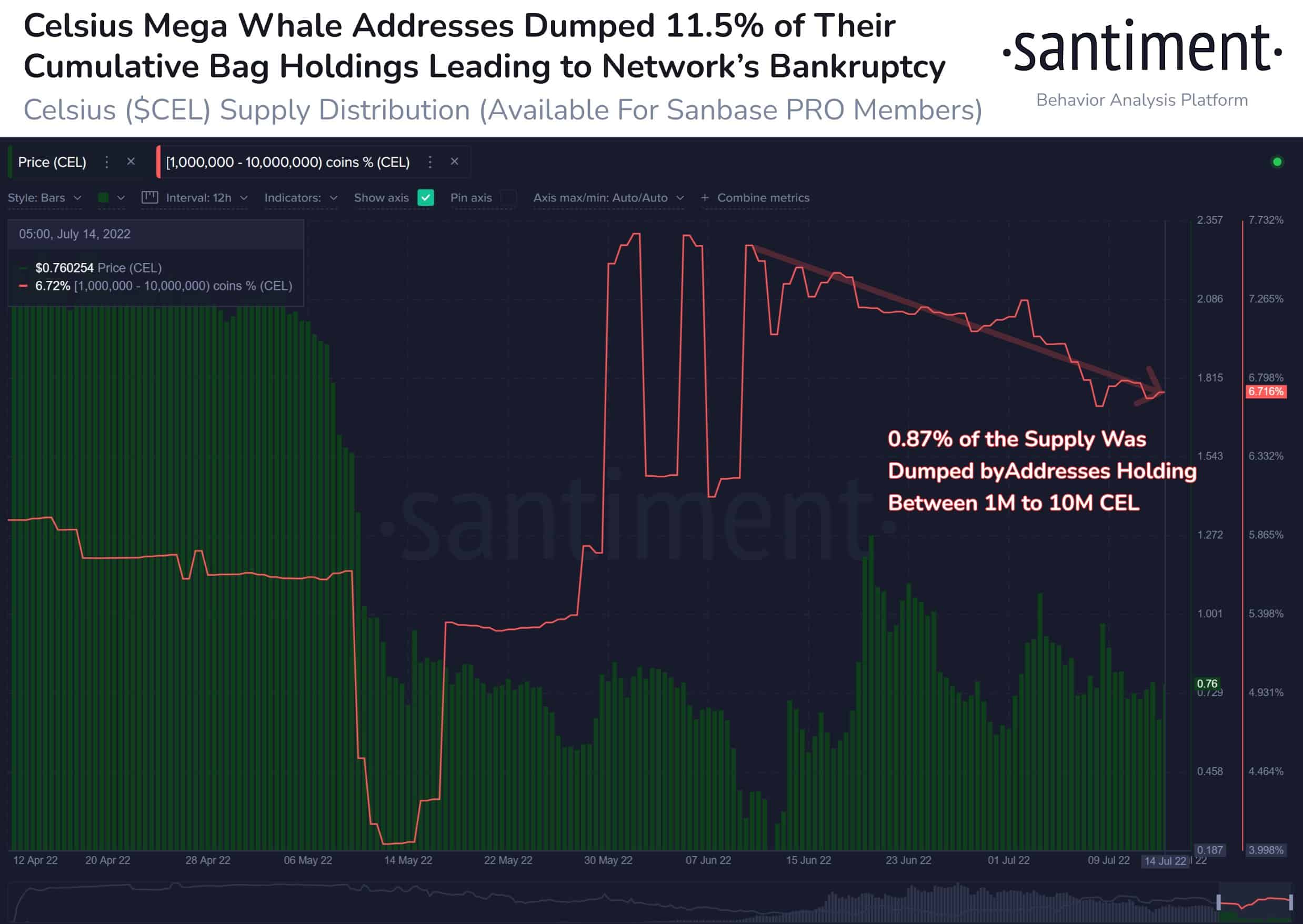

Moreover, according to the on-chain platform Santiment, the Celsius (CEL) Whale Distribution data indicates whales holding 1-10 million CEL tokens dumped only 0.87% of the supply between withdrawal cease and bankruptcy filing. It shows whales hold a large number of the CEL tokens and continuously dumping the tokens.

“After the Celsius Network halted withdrawals, it wasn’t a major surprise to see their bankruptcy this week. Top holders were dumping, but not significantly. And the network was only showing losses recorded for the past month.”

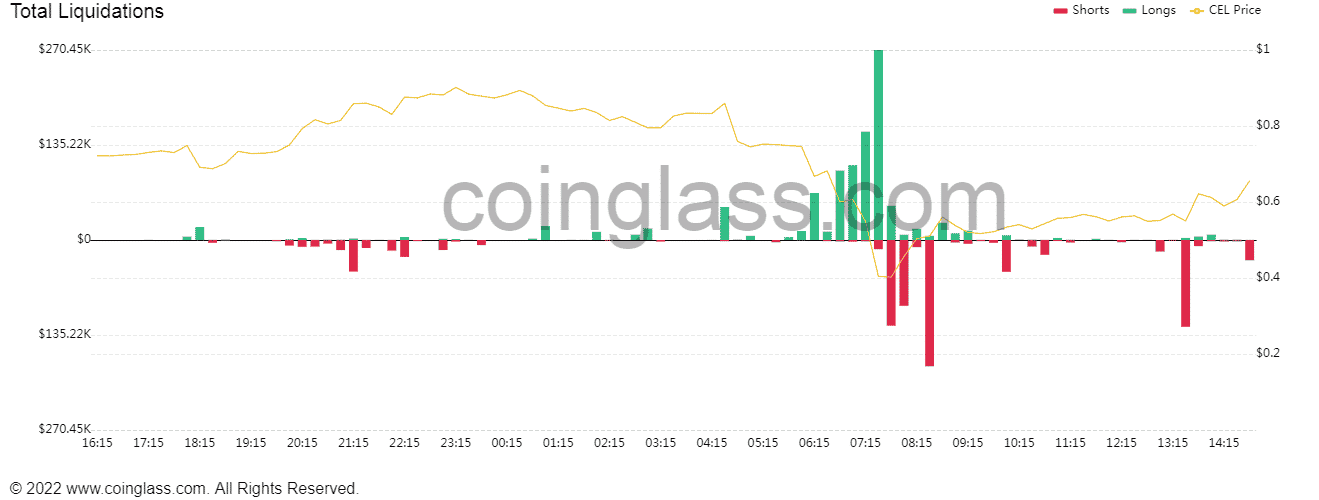

CEL Liquidations in Amid Short Squeeze

Celsius’ CEL price is jumping as a result of short sellers shorting the CEL tokens on exchanges.

According to Coinglass, the exchanges including FTX, Okex, and Huobi are witnessing more than 80% shorts. Moreover, Celsius can’t sell the CEL token at the market. The spot market shorters on FTX are destined to buy CEL coins to close their positions.

The data shows massive shorts in the last 24 hours, pushing the price upwards. In fact, the CEL short squeeze seems to be continuing as the chart depicts massive shorts today.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- $3B Western Union Expands Into Crypto With USDPT Stablecoin Launch on Solana

- XRP News: Key Ripple Whale Indicator Turns Bullish After Months, Price Rally Ahead?

- Crypto Market Today: BTC, ETH, XRP, SOL, and DOGE Rally as Geopolitical Tensions Ease

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

Buy $GGs

Buy $GGs