Chainlink Price Forecast: LINK Downward Momentum Gains Traction

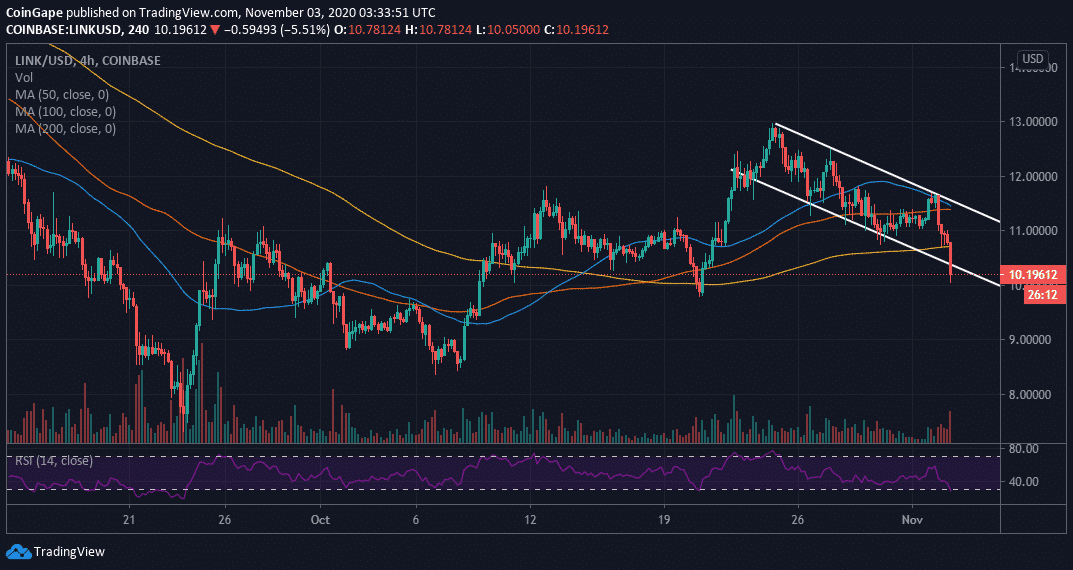

- Chainlink was rejected at $13, culminating in losses within a descending parallel channel.

- LINK/USD downside eyes $9.5 if the short term buyer congestion at $10 caved in.

Chainlink recently recovered in October, almost brushing shoulders with $13. This was the highest level the decentralized oracle live price feed token has reached since the support established at $7.2 in September. Before the breakdown, LINK/USD had rallied from the March 2020 lows of $1.5 to trade a yearly high at $20.

In the meantime, Chainlink can barely hold above $10 following a gust of headwinds across the cryptocurrency market which followed news that the Securities and Futures Commission (SFC) in Hong Kong made a decision to regulation all crypto trading platforms in the city. The region had for a long time allowed cryptocurrency exchanges and similar platforms to operate without direct oversight.

Bitcoin dived under $13,500 after the news, pulling the entire market downwards. Ethereum plunged under $380 as had been predicted in the price analysis. On other hand, Chainlink is teetering at $10.2 after sliding under a descending parallel channel which refused to confirm a bull flag pattern. The moving averages; 200 SMA, 100 SMA and 200 SMA add pressure on the downtrend.

LINK/USD 4-hour chart

The Relative Strength Index (RSI) highlighted on the 4-hour chart that the path of least resistance is downwards. Besides, if the price slipped under $10, Chainlink would extend the bearish leg to either $9.5 or $8.5.

It is worth mentioning that the bearish picture will be invalidated if Chainlink reclaims the position inside the channel. Recovery above the 200 SMA would also add credence to the bullish case, thereby calling for more buy orders to support the journey back to $13.

Chainlink Intraday Levels

Spot rate: $10.2

Relative change: -0.6

Percentage change: -5

Trend: Bearish

Volatility: High

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs