Chainlink Sharks on Strong Accumulation Spree, LINK Price Surges

While the broad3r crypto market consolidates, Chainlink (LINK) has reversed its trajectory to the north and is making bold moves. As per on-chain data, Chainlink shark and whale addresses have accumulated $10 million worth of LINK just over the last three days.

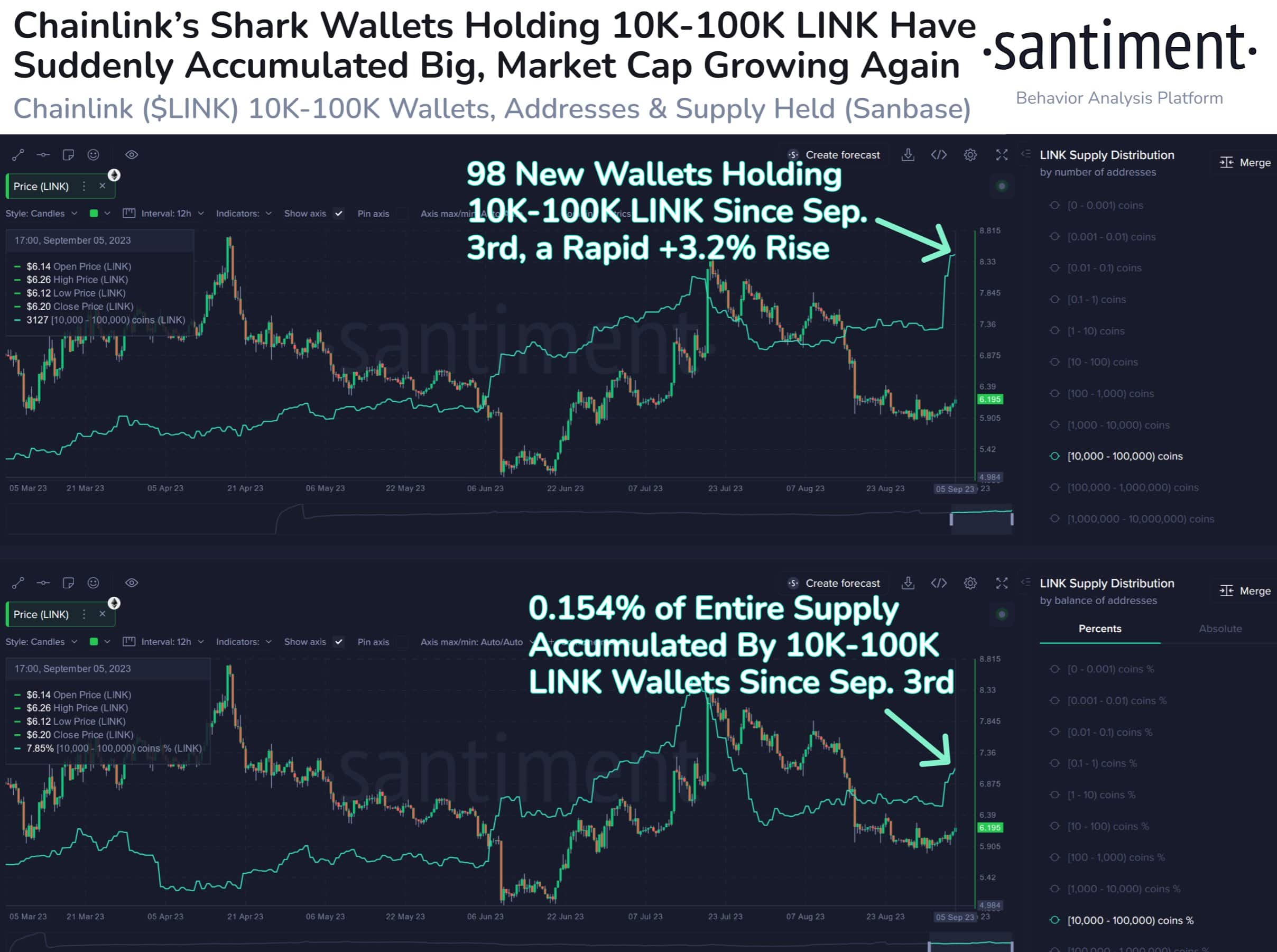

The significant “shark” tier of Chainlink holders, possessing 10,000 to 100,000 $LINK tokens each, has been actively accumulating. As of now, there are 3,127 wallets within this tier, marking the highest count since December 3, 2022, reports Santiment.

Over the last three weeks, Chainlink’s on-chain data has been showing good development with renewed investor interest in the altcoin. As of press time, LINK price is trading 2.67% up at $6.37 with a market cap of $187 million. Over the last week, the LINK Price is up by 6.29% while most of the altcoins are in the red.

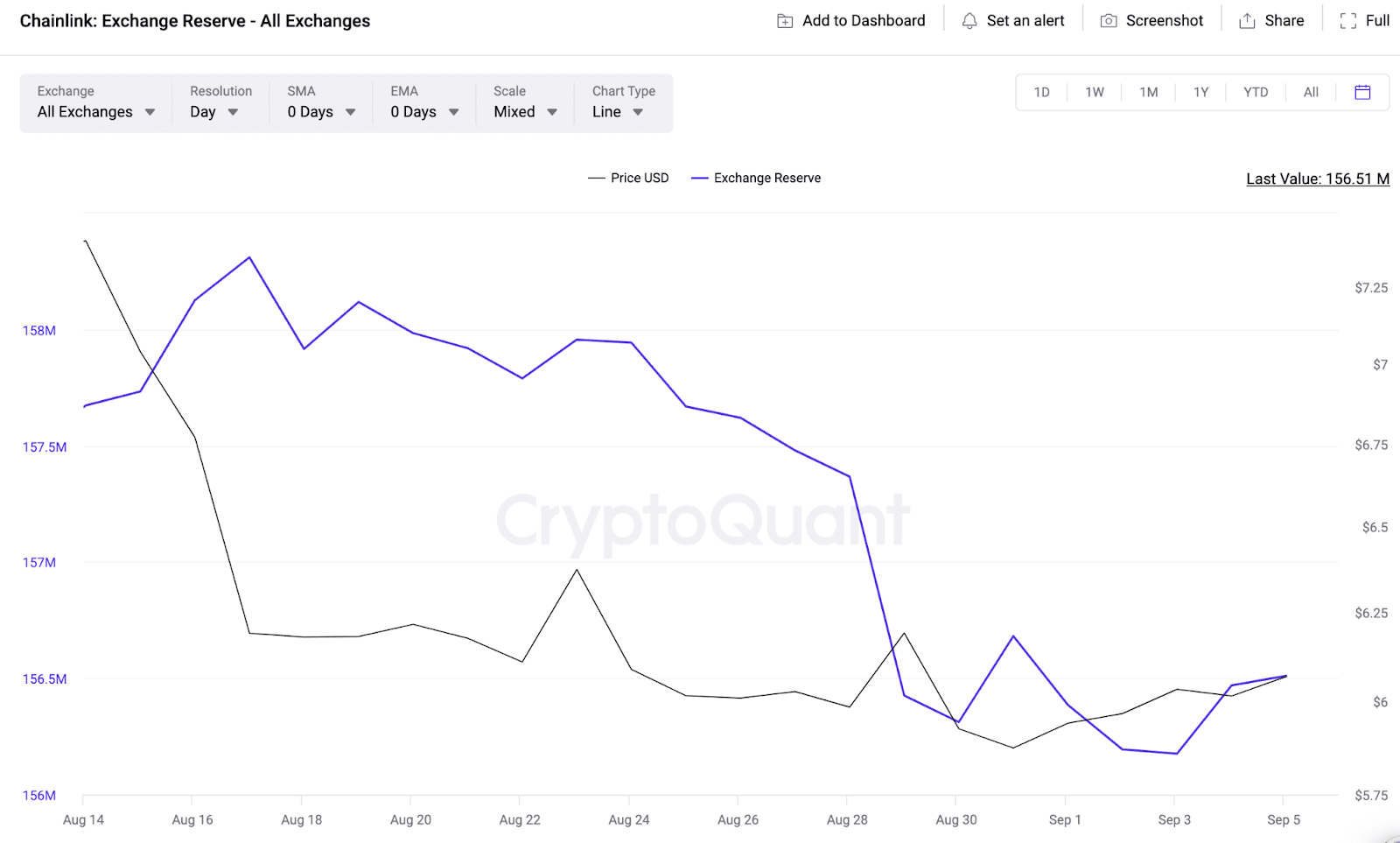

Another positive development for Chainlink (LINK) is that despite the current price surge, investors are not looking for any profit booking. Instead, the exchange reserves for LINK have been dropping. Over the last three weeks, Chainlink investors have withdrawn nearly 1.8 million LINK tokens.

Chainlink Conducts Tokenization Tests With SWIFT, LINK Price to $10?

The whale interest in Chainlink has suddenly shot up after the SWIFT Network announced on August 31st that they have successfully conducted tokenization tests in collaboration with Chainlink, Citibank, and other financial institutions.

SWIFT, the global payment processing platform, has recently unveiled the outcomes of transactional tests in which Chainlink infrastructure was employed to facilitate the transfer of tokenized value across various public and private blockchains.

From an on-chain perspective, the LINK price appears poised to regain the $10 level should the prevailing bearish sentiment across altcoins diminish.

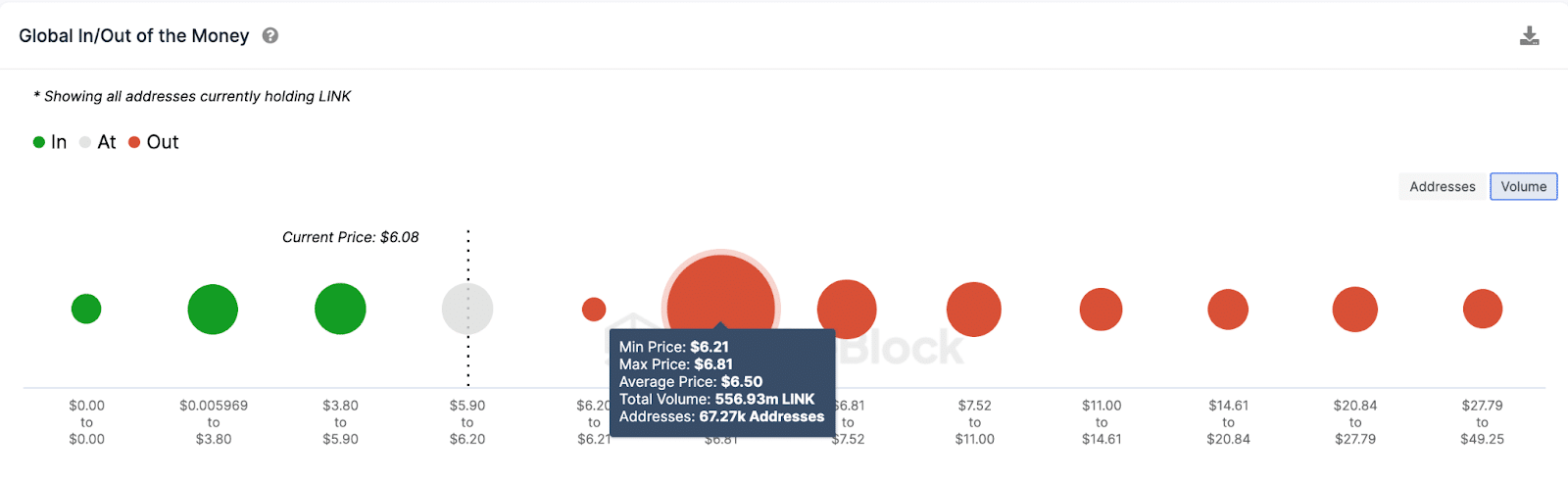

This optimistic outlook is further substantiated by the Global In/Out of Money Around Price data, which outlines the buying price distribution among existing Chainlink investors. This data indicates that once LINK’s price surpasses the $6.50 threshold, it encounters minimal resistance on its journey toward $10.

As shown in the above figure, approximately 67,300 addresses collectively acquired 557 million LINK tokens at an average price of $6.50. Should these strategic retail investors align their trading activities with the bullish sentiments of larger holders, it has the potential to propel the Chainlink price rally to $10.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs