Circle Is A Steal Deal for Ripple: Chamath Palihapitiya

Highlights

- Circle's ongoing IPO seeks to raise $1.1 billion, making it among the top ten offering of 2025.

- Chamath praised Circle for building robust infrastructure and positioning itself ahead of potential US stablecoin regulations.

- USDC has seen significant adoption, with its supply growing from $3 billion in 2020 to over $60 billion in 2025.

Billionaire investor Chamath Palihapitiya stated Ripple or Coinbase acquiring USDC stablecoin issuer Circle, would prove to be a steal deal. His comments come as Circle IPO seeks to raise $1.1 billion, putting it among the top 10 IPOs this year, by issuance size. With USDC capturing 30% of the stablecoin market at $60B valuation, the offering puts the CRCL stock at a listing price of $31 per share.

Buying Circle at $12 Billion Is Also A Steal Deal

The current offering at $31 per share gives Circle a fully diluted valuation of $8.1 billion. With the IPO subscribed 25x, Chamath stated in his recent X post that “If someone can buy it for even $12-13b, that’s a steal, imo, for what this business could be worth in 20 years”.

The venture capitalist also lauded the Circle for building a solid infrastructure and positioning itself ahead of the upcoming US stablecoin bill aka GENIUS Act. Chamath believes that eventually there will be a fierce competition in the USD stablecoin market with major players like Stripe, Square, Ripple, and Coinbase aiming for market dominance.

Although this could be good for end businesses and consumers, it will be tough for issuers as profit margins would decline. Chamath wrote:

“The company that builds the most efficient infrastructure and sells it for cheapest: cost-plus (with a thin margin on top) will probably take this market”.

However, Ripple CEO Brad Garlinghouse said that Ripple never made a bid to acquire the USDC issuer, putting earlier speculations to rest.

Chamath’s post on X led to community reactions. Scott Melker, host of the popular Wolf of All Streets podcast, stated that Circle’s success depends a lot on the “shakeout of Tether” in the United States.

“If they get a regulatory green light, they will be hard to beat,” he added. As we know, Tether is already out of Europe as it failed to comply with the MiCA rules. It will be interesting to see whether it can pass through the US regulatory developments.

On the other hand, Wall Street banking giants are also putting collective efforts into stablecoins. Arthur Hayes said that any fruitful development could lead to the death of USDC and other small players.

Circle Posts Stellar Growth

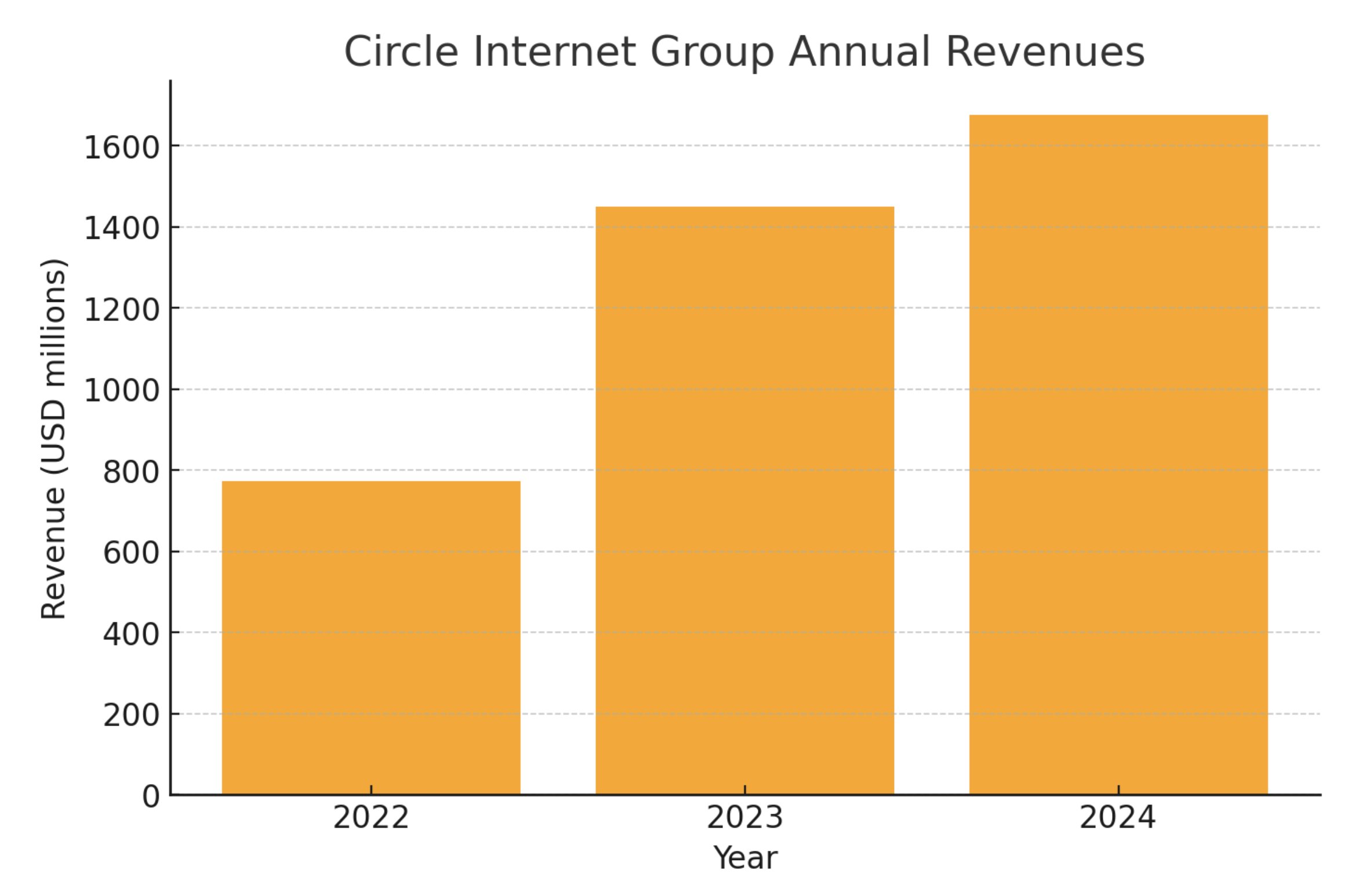

The USDC stablecoin issuer has registered impressive growth in the last two years. From 2022 to 2024, the company achieved a 118% increase in annual revenues, driven by the soaring adoption of USDC in decentralized finance (DeFi) and broader payment systems.

USDC’s circulating supply has surged from under $3 billion in 2020 to more than $60 billion in 2025. Monthly transaction volumes have followed a similar trajectory, growing from less than $50 billion in 2020 to over $2.3 trillion as of May 2025.

USDC’s circulating supply has surged from under $3 billion in 2020 to more than $60 billion in 2025. Similarly, monthly transaction volumes have surged from less than $50 billion in 2020 to over $2.3 trillion as of May 2025.

Ethereum remains the dominant blockchain for USDC, with over 70% of the supply now residing on its network, including its Layer 2 ecosystem. While Solana dominated USDC transactions in 2024, the focus has moved to Ethereum and Coinbase’s Base Layer 2 solution in 2025.

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act