Circle’s USDC Stablecoin Continues to See Heavy Redemptions Despite Market Recovery

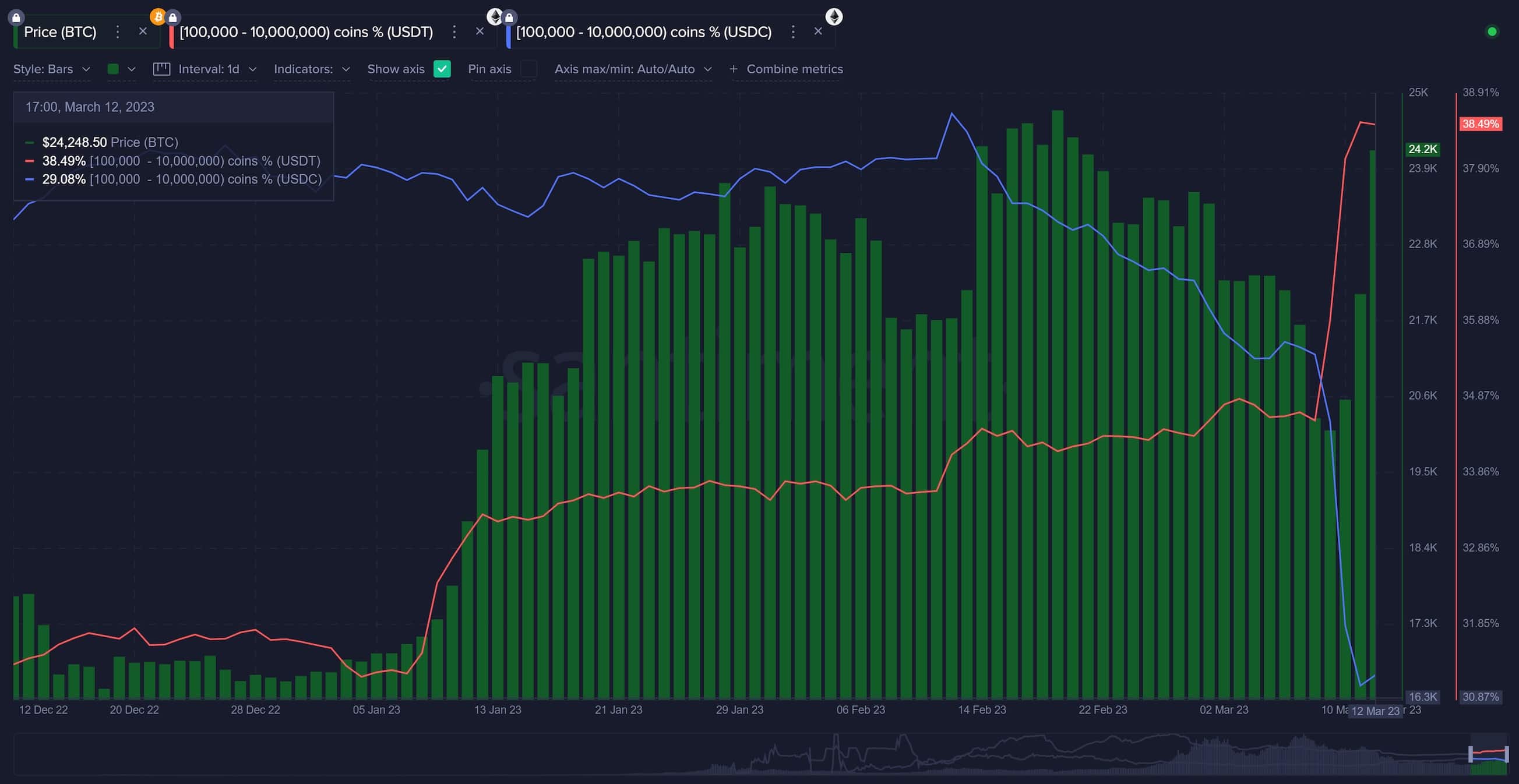

Massive redemptions for Circle’s USDC stablecoin continued on Monday, March 13, after the weekend panic and de-peg in the stablecoin. As per blockchain researcher Nansen, over $1.74 billion of USDC stablecoins were redeemed on Monday.

USDC stablecoin issuer Circle faced a major blow after the Silicon Valley Bank (SVB) announced its shutdown last Friday. Circle had a staggering 43.3 billion of its reserves with SVB which led to a panic among USDC holders.

The result was that the USDC stablecoin started to de-peg dropping 90 cents over the last weekend. Circle CEO Jeremy Allaire, however, assured investors that their USDC reserves were safe. But this didn’t stop USDC holders from redeeming their coins against USD as the banks opened on Monday. Also, the strong recovery in the broader crypto market didn’t help the redemptions to slow down.

Nansen data shows that more than 2% of USDC’s circulating supply was redeemed yesterday. Andrew Thurman, head of content at Nansen said:

“We have not seen this kind of drawdown in the stablecoin supply since the regulatory crackdown on BUSD last month”.

Holdings of the USDC stablecoin among institutional players have also dropped to a several-month low. It shows that institutional players are either redeeming or staying on the sidelines. “Institutional investors are still holding a huge amount of USDC, but it seems that those who got rid of it are hesitant to get back in,” said Thurman.

USDT Benefits From USDC Rout

As USDC holders panicked from the company’s exposure to Silicon Valley Bank, Tether’s USDT stablecoin saw strong inflows. On-chain data provider Santiment reported:

There’s a “massive flip between USDC and USDT whale holdings due to fears that USD Coin could potentially collapse. This FUD, at least for now, looks like it may have been overblown. But that hasn’t stopped the large holders of these two stablecoins to have massively merged into Tether at the expense of USD Coin”.

On Monday, Circle CEO Jeremy Allaire thanked the US government from stepping in and stopping the contagion to spread further. He said: “100% of deposits from SVB are secure and will be available at banking open tomorrow. 100% of USDC reserves are also safe and secure, and we will complete our transfer for remaining SVB cash to BNY Mellon.”

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs