CME Bitcoin Futures Turns Mega Bullish, BTC Price Rally To $45,000 In Play

BTC price surpassed the $38,000 level for the first time since May 2022 as Bitcoin bulls held strongly this month. The Bitcoin futures trading on CME continued to rise and surpassed the world’s largest crypto exchange Binance, indicating massive demand from institutional investors. CME Bitcoin futures has now turned bullish for a rally past $40,000.

CME Bitcoin Futures Suggest Rally To $40,000

Bitcoin bulls continue to push BTC price upside as the market sentiment improves after the delivery of the monthly options. Retail and institutional investors are now more confident about BTC price hitting $40,000 and closing the year near $45,000.

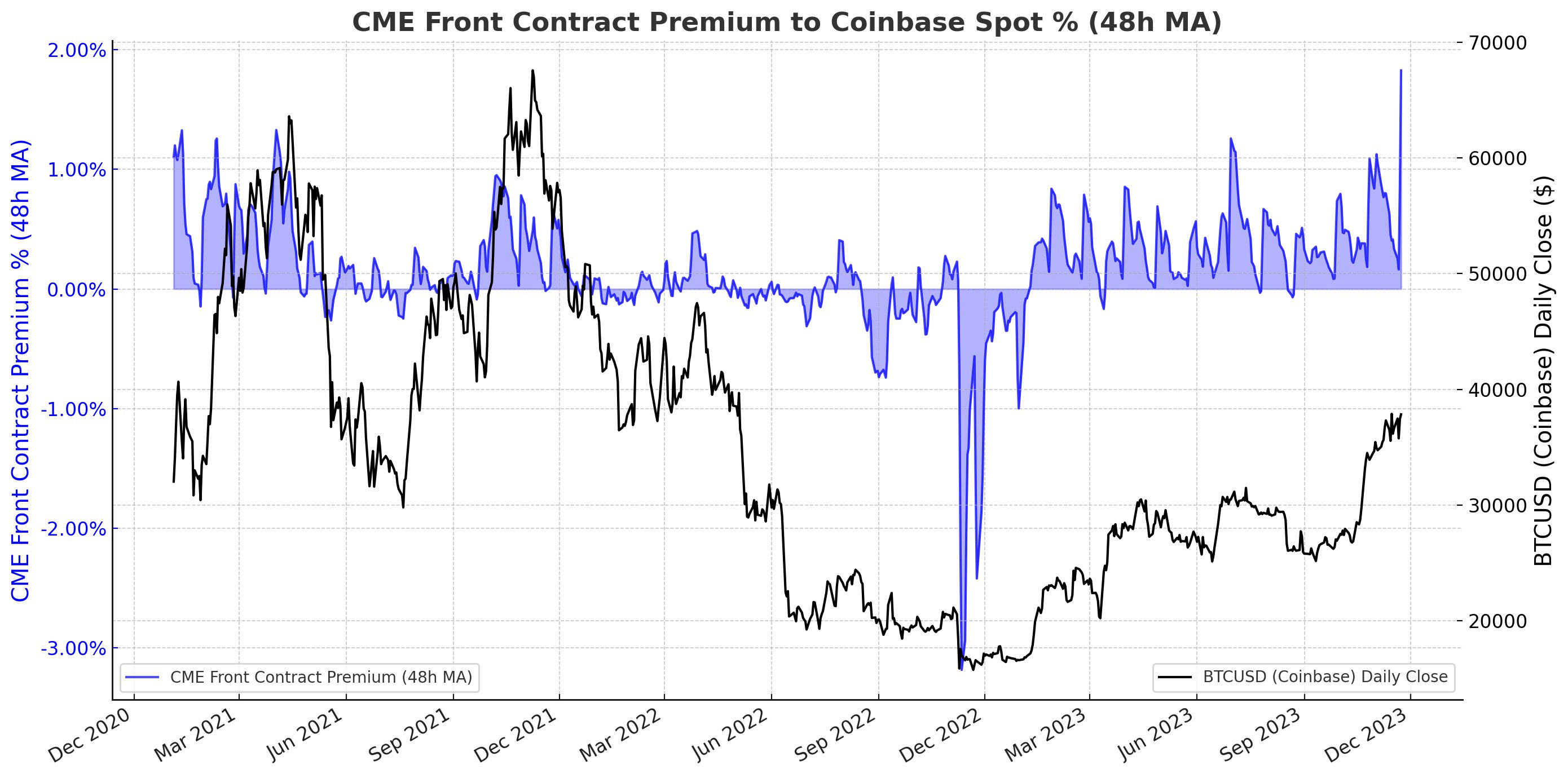

CME Front Contract Premium percent to Coinbase spot at an all-time high amid positive sentiment. CME Bitcoin futures traded at a high of $39,300 at one point in the last 24 hours, almost a $1,000 premium to the spot price. It happens as futures and options traders remain bullish on Bitcoin.

Improved market and bullish sentiment from institutional investors ETFs like ProShares’ BITO, which invests in CME-listed bitcoin futures, contributes to the premium.

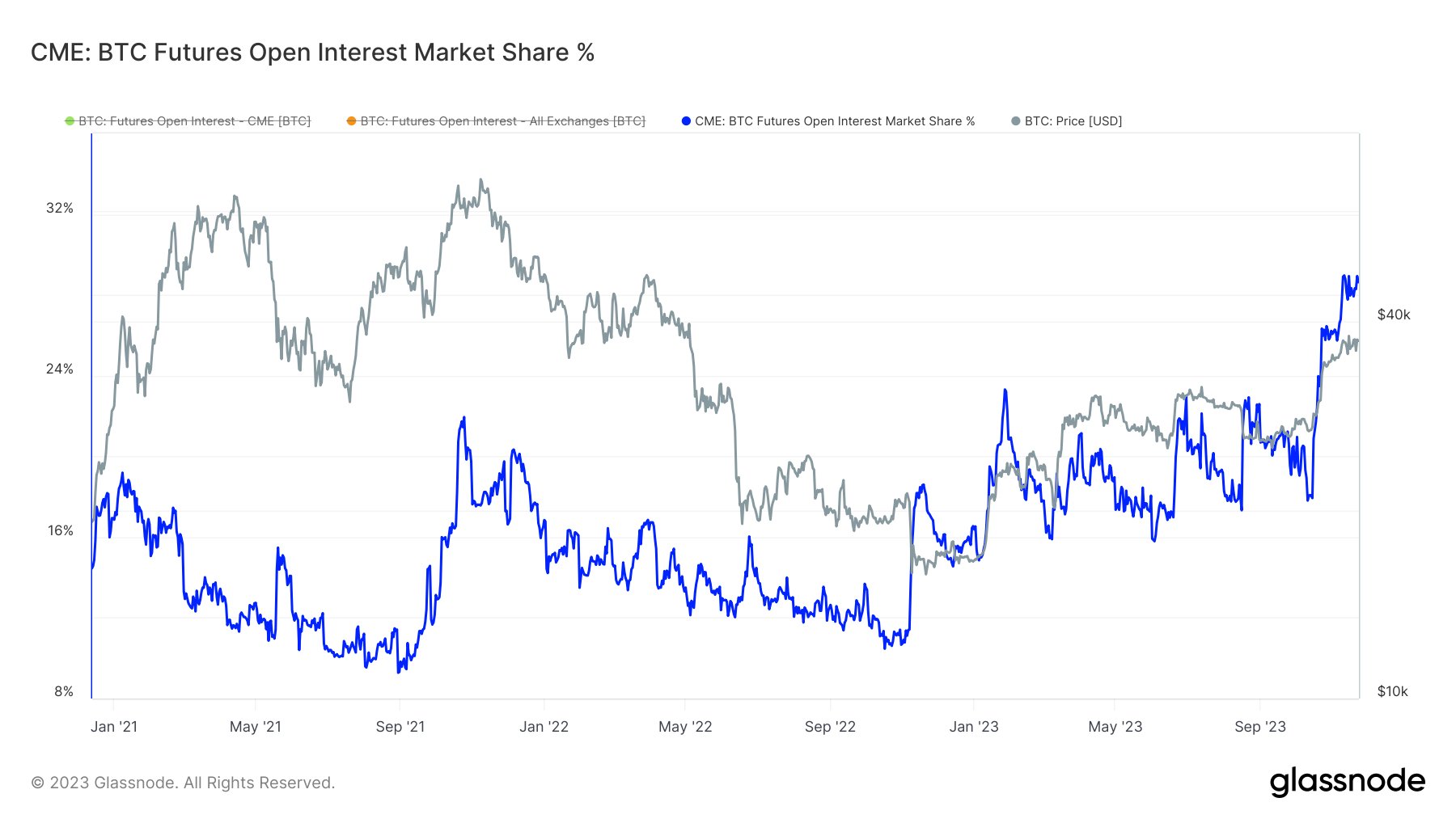

Meanwhile, CME Bitcoin Futures Open Interest Market Share Percent has also hit higher, reaching almost 30%. It follows as Bitcoin and former CEO CZ agreed to federal criminal charges and pay $4.3 billion in settlement with U.S. authorities.

Moreover, it indicates institutional investors remain bullish and continue to make bets on Bitcoin. Crypto funds inflow has significantly increased in the last few weeks, with Bitcoin driving the crypto market to rally higher.

Also Read: Crypto Market Continues Rally With BTC, Pepe Coin, SEI Rising

BTC Price Gains Strength

BTC price jumped 2% in the past 24 hours, with the price currently trading at $37,818. The 24-hour low and high are $37,369 and $38,415, respectively. Furthermore, the trading volume has increased by 70% in the last 24 hours, indicating a rise in the interest of traders.

This surge is attributed to various factors, with a significant contributor being the top 100 largest Tether (USDT) addresses, which have collectively added $1.67 billion in the past six months. This confirms an upcoming rally backed by positive sentiment and higher trading volumes.

Matrixport research predicted that Bitcoin price would hit $45k in 2023 and $125K by December 2024 after a massive post-halving rally.

Also Read: BLUR & Blast Founder Responds to Rumors of Ponzi Scheme, Addresses Security Concerns

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- “There Is Only One Gold,” Billionaire Ray Dalio Says Amid BTC’s Quantum Threats

- Goldman Sachs CEO Predicts ‘Weeks’ of Crypto Market Crash as U.S Iran War Continues

- Polymarket Axes ‘Nuclear Detonation’ Prediction Market Amid Public Fury

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

Buy $GGs

Buy $GGs