Bitcoin [BTC] Prepares for Volatility with CME Contract Expiration This Week

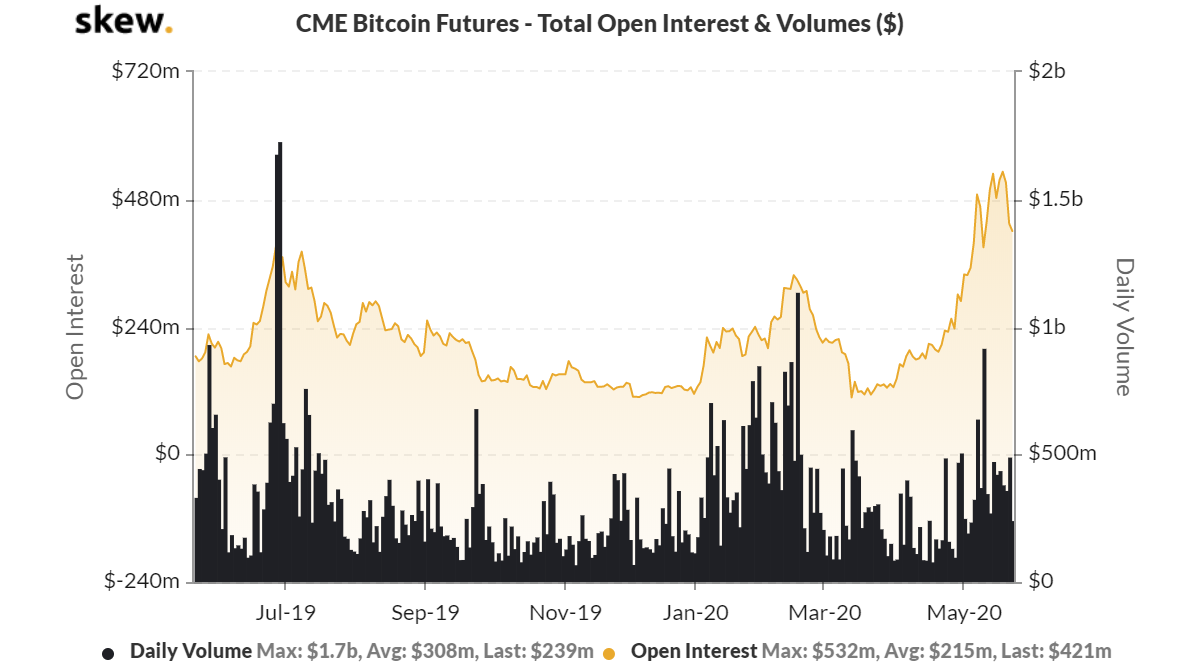

With the CME Bitcoin [BTC] monthly futures contract expiry set to occur this Friday, the market can expect a lot of volatility. Moreover, as the Open Interest (OI) is significantly large, the price moves could be of large proportions.

The futures investors are not motivated to take delivery of the contracts, especially the ones trading on CME. Hence, they will either settle their contracts before expiry or roll-over to the next month.

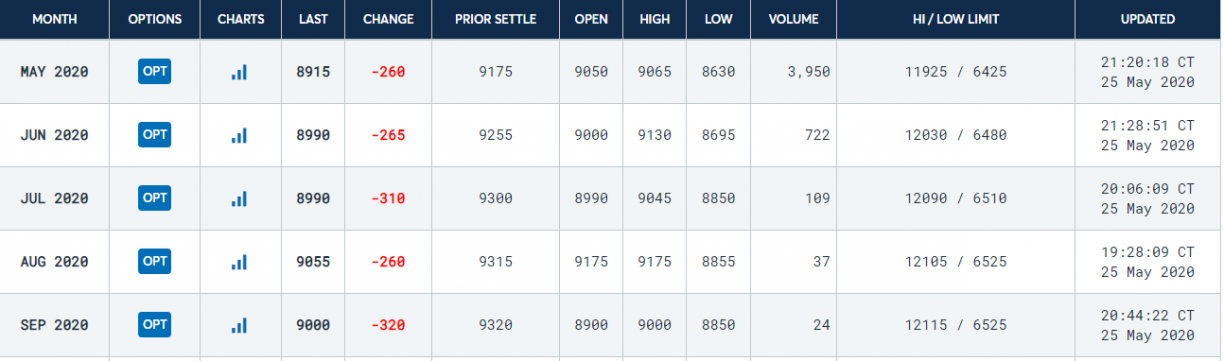

Due to the small difference in the prices of futures contracts for the months of June and July, roll-over might seem like a lucrative option as well. Overall, the markets are marginally in Contango. Nevertheless, the volatility is expected from the ones who settle their trades and buy opposing contracts.

The OI (Open Interest) in Bitcoin futures is significantly large (above the high in 2019), and settlement of a percentage of those contracts can bring large volatility in prices.

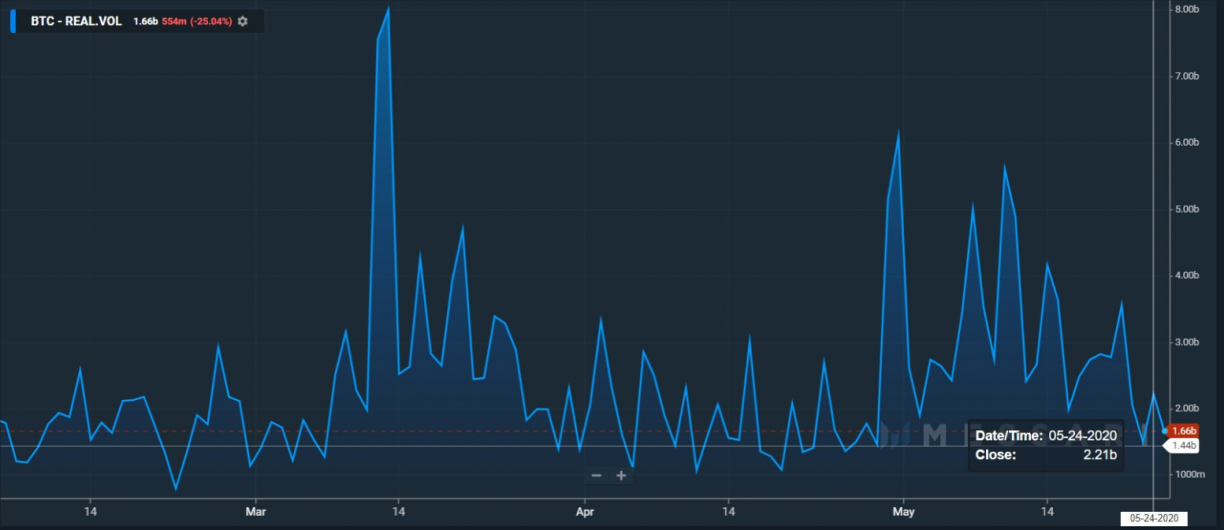

The volume of option contracts is also significantly high (about 10x from previous highs). Moreover, the spot exchange volumes have been lower this week after the end to the halving hype and the memorial day holiday. Mati Greenspan, a financial and crypto analyst, and founder of Quantum Economics tweeted,

When institutional players are running the show, #bitcoin exchange volumes take a hit on #MemorialDayWeekend.

GAP Analysis

The CME gap which continues to have the tendency of filling around the same week is currently at $9175. If the price sees reversal from this level, it is likely that the gap filling was the only motivation driving the bulls, and can expect further downfall.

However, the price has held the 200-Day MA (Moving Average) as support all around the month. Currently, the indicator is sitting at $8528, which is would be critical for the bulls.

The funding rate and BTC basis (difference between futures prices and spot) of perpetual contracts at BitMEX and Okex is negative with the drop below $9000. Hence, the sentiments are inclined towards the bears.

Do you think that a contrarian uptrend to $9500 is likely or further sell-off is imminent? Please share your views with us.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs