Coinbase Data Signals Institutional Investors Buying Bitcoin Again

Highlights

- Bitcoin price stays strong and continue to trade above $70,000.

- Coinbase premium gap data indicates institutional investors buying Bitcoin again.

- Analysts remain bullish on BTC price due to Bitcoin halving in mid-April.

Bitcoin price continues to stay afloat above $70,000 despite the long holiday weekend. The crypto market mostly saw subdued activity amid some economic events including the US PCE inflation release, which came slightly hot. The total crypto market volume over the last 24 hours has dropped over 15%. However, Coinbase premium gap indicates institutional investors are buying again.

Coinbase Premium Gap Indicates Bitcoin Buying

Institutional buying started fading on March 27 and the Coinbase premium gap turned green again late March 29 after the Fed preferred inflation gauge PCE. Since March 30 morning, the Coinbase premium gap exceeded 50, revealed on-chain analyst Maartunn. He asserts that US institutions may have started to buy Bitcoin again.

The metric is commonly used to determine when US institutions are starting to purchase Bitcoin, as it is a highly accurate indicator. This suggests odds of high inflow in spot Bitcoin ETFs in the next week before the Bitcoin halving, expected to happen in mid-April.

Coinbase premium gap is the gap between Coinbase Pro price (USD pair) and Binance price (USDT pair). High premium values typically indicate US investors’ strong buying pressure on crypto exchange Coinbase. Traders can keep a close watch on the metric and trading volumes to confirm the market direction.

Analysts Remains Bullish on BTC Price

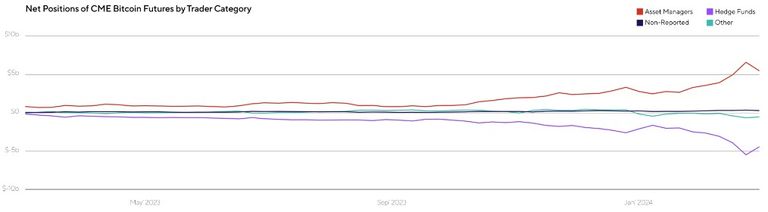

Analysts at Ryze Labs revealed the gap between hedge funds (in purple) and asset managers (in red) continues to widen. “This divergence indicates that while asset managers continue to purchase Bitcoin futures, hedge funds are increasingly short-selling. In the current bullish climate, this dynamic hints at a potential short squeeze, which could propel Bitcoin’s next upward movement,” they said.

Popular analyst Michael van de Poppe said the sideways action for Bitcoin caused a consolidation near $70K. However, he assures that Bitcoin still following the general 4-year cycle path. He added,”Honestly, this cycle is likely going to surprise many people. In a five years time, $70,000 per Bitcoin is classified cheap.”

Meanwhile, futures and options buying remain dull due to holidays and traders awaiting further drop in BTC price. CME BTC futures open interest fell 0.32% to $11.64 billion. Total BTC options open interest dropped from $32.31 billion to $21.52 billion.

BTC price moving sideways, with the price currently trading at $70,189. The 24-hour low and high are $69,076 and $70,513, respectively. Furthermore, trading volume is down by over 25%.

Also Read:

- LUNC Price Rallied 400%, Analyst Predicts Further 270% Upside on Breakout

- US SEC Settles Long-Running Crypto Lawsuit: Law360

- Ripple CLO Stuart Alderoty Hints At SEC Claims During XRP “Settlement Conference”

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?