Coinbase Files S-1 With the U.S. SEC to Go Public on Nasdaq via Direct Listing

Coinbase, one of the largest crypto exchanges is going public on Nasdaq via direct listing after months of speculations over its public debut post its announcement in December.

*COINBASE FILES TO GO PUBLIC ON NASDAQ VIA DIRECT LISTING

— zerohedge (@zerohedge) February 25, 2021

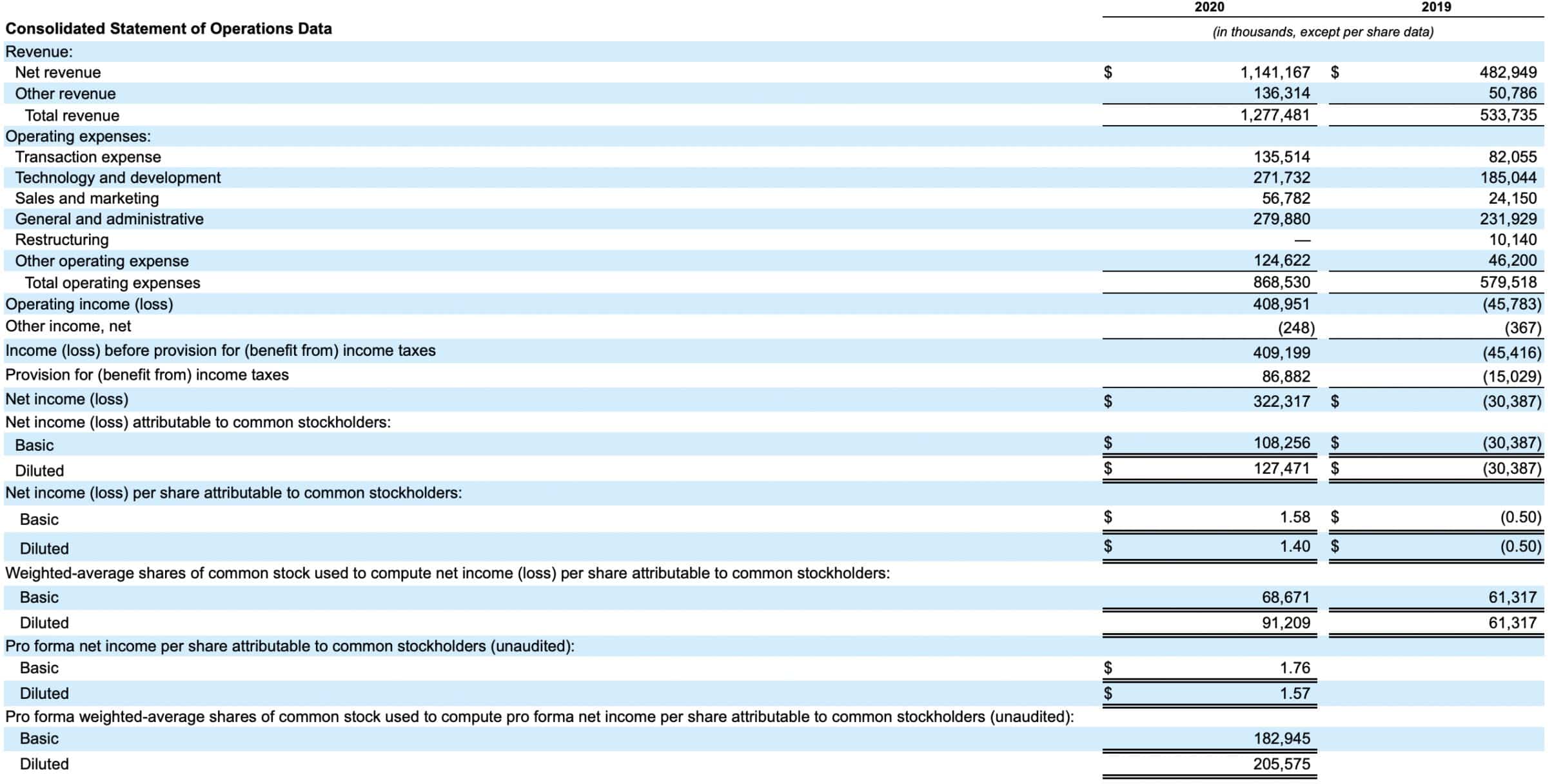

The crypto exchange in its S-1 filing with the SEC revealed,

- $3.4 billion in total revenue until 2020.

- largely from transaction fees (96% of net revenue).

- net income of $322.3 million in 2020, a net loss of $30.4 million in 2019.

- 43M verified users.

- 2.8 monthly transacting users.

The S-1 filing in itself is the testimony of the exchange’s growth since its launch in 2012 having amassed 43 million users over the past 9 years. The exchange has also become the go-to platform for institutions venturing into Bitcoin and has facilitated the famous $1.5 billion purchase made by Tesla.

Direct Listing Rumors Confirmed

After Coinbase announcement of going public, rumors were rife on the valuation and listing platform especially after Bakkt went for SPAC listing. A couple of weeks ago, a report suggested that Coinbase might look for a direct listing with a share target price of $200. Today’s filing has cleared the rumors about direct listing and now all eyes are set on the share target price.

Coinbase had also announced a secondary private listing on Nasdaq Private Market for company users and the crypto exchange’s total valuation was supposedly $100 billion. Coinbase is also said to set the trend for crypto companies going public as after its announcement in December last year, Bakkt and a couple of crypto mining companies also announced their plans of going public.

The timing of the Coinbase public listing is also crucial as 2021 is said to be the year of cryptocurrencies going mainstream especially Bitcoin and Etheruem which has registered a significant institutional investment in 2021. With traditional financial giants and banks looking to offer direct crypto services from their platform owing to its growing demand, crypto companies could bank on the adoption and go public to gain mainstream adoption.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- U.S.–Iran War: Bitcoin Price Extends Decline as Oil Prices Surge To Two-Year High

- Bitcoin Treasury Firm MARA Considers Selling BTC Reserves After Policy Update

- Cardano Founder Warns Over CLARITY Act, Cites Lack of Protection for DeFi, Stablecoins, Prediction Markets

- Core Scientific Sells 1,900 BTC as Bitcoin Miner Pivots to AI, CORZ Stock Dips

- Bitcoin News: VanEck CEO Projects Gradual BTC Rally in 2026 as ETFs Sees $458M Inflows

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

Buy $GGs

Buy $GGs