Coinbase Launches AEVO, ENA, ETHFI, Prices To Surge?

Highlights

- Coinbase introduces the AEVO, ENA, and ETHFI cryptos, sparking market speculation and interest.

- Markets transition from post-only to full-trading mode, offering various order types for investors.

- Listing on Coinbase suggests bullish sentiment, potentially driving up demand and prices.

A leading crypto exchange, Coinbase, has gained notable traction today in the crypto market with its recent announcement regarding three prominent cryptocurrencies: AEVO, Ethena (ENA), and ether.fi (ETHFI). Notably, the exchange’s announcement to list these assets on its platform has ignited speculation across the crypto market, with traders and enthusiasts eagerly anticipating the potential impact on their prices amidst the current volatile market conditions.

Coinbase’s Crypto Listing Sparks Speculation

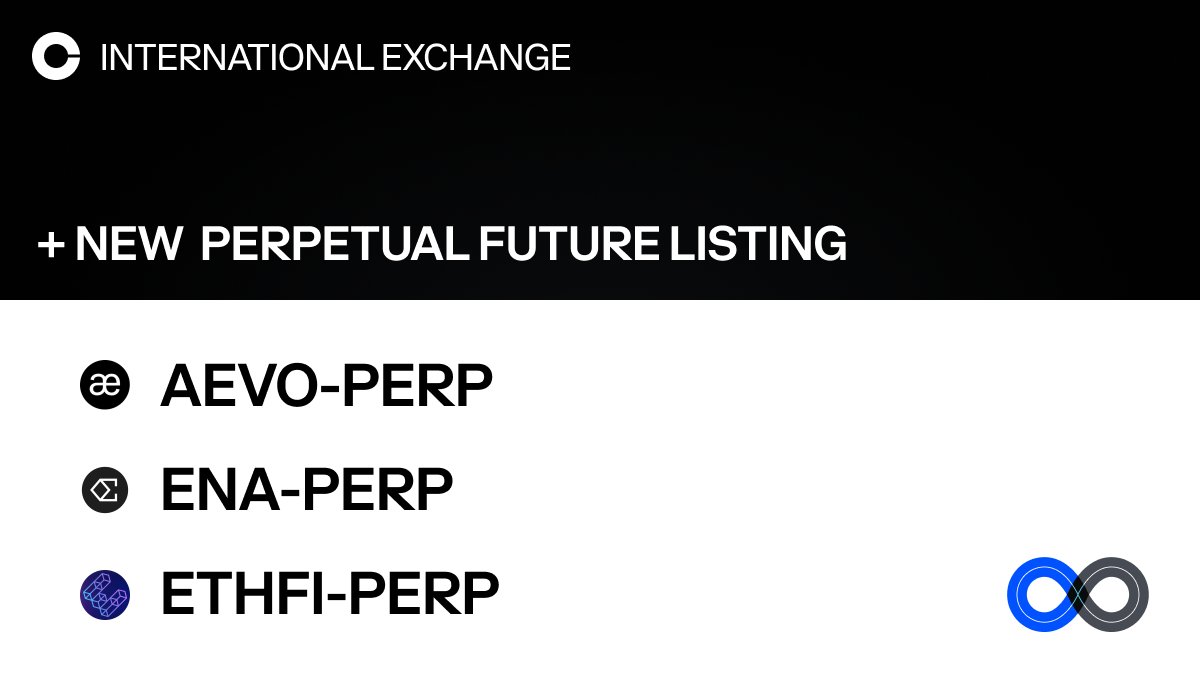

In a move that has grabbed the attention of market participants, Coinbase International Exchange has announced the launch of AEVO-PERP, ENA-PERP, and ETHFI-PERP markets. Initially, these markets entered a post-only mode, allowing customers to post and cancel limit orders without executing matches.

However, shortly after, Coinbase transitioned these markets into full-trading mode, enabling various order types, including limit, market, stop, and stop limit orders. Traditionally, support from prominent crypto exchanges like Coinbase tends to influence crypto prices positively.

Meanwhile, with the heightened volatility prevailing in the market, investors and enthusiasts are closely monitoring the potential impact of Coinbase’s listing announcement on AEVO, Ethena (ENA), and ETHFI prices. Notably, this development underscores the significance of exchange listings as catalysts for price movements in the dynamic crypto landscape.

Also Read: Shiba Inu Magazine’s 23rd Edition Is Out, Know All About Shibarium Hard Fork

Analyzing the Potential Price Impact

As market sentiment remains sensitive to external factors, including exchange announcements, the addition of AEVO, ENA, and ETHFI to Coinbase’s platform could signal a bullish sentiment for these cryptocurrencies. The transition from post-only to full-trading mode signifies increased liquidity and trading opportunities for investors, potentially driving up demand and prices.

In addition, Coinbase’s reputation and user base position it as a significant player in the cryptocurrency space, amplifying the impact of its listings on market sentiment. While crypto markets are inherently volatile, the listing of AEVO, ENA, and ETHFI on the leading crypto exchange may inject renewed optimism and momentum into these assets, potentially fueling a rally in their prices in the coming days.

Meanwhile, as of writing, the Ethena price was down 0.64% and traded at $0.797, while its one-day trading volume fell 31.45% to $315.20 million. Amid the recent volatile scenario in the broader market, the crypto has lost nearly 6% over the last seven days, while noting a monthly gain of 39%.

On the other hand, the ETHFI price rose 2.45% following Coinbase’s announcement and traded at $3.75, with its trading volume falling 28% to $249.33 million. Over the last 24 hours, the crypto has touched a high of $3.89 and a low of $3.48.

Also Read: Banksters’ Public BARS Token Sale Attracts Strong Interest On GamesPad, BullPerks and StormGain

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- $3B Western Union Expands Into Crypto With USDPT Stablecoin Launch on Solana

- XRP News: Key Ripple Whale Indicator Turns Bullish After Months, Price Rally Ahead?

- Crypto Market Today: BTC, ETH, XRP, SOL, and DOGE Rally as Geopolitical Tensions Ease

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

Buy $GGs

Buy $GGs