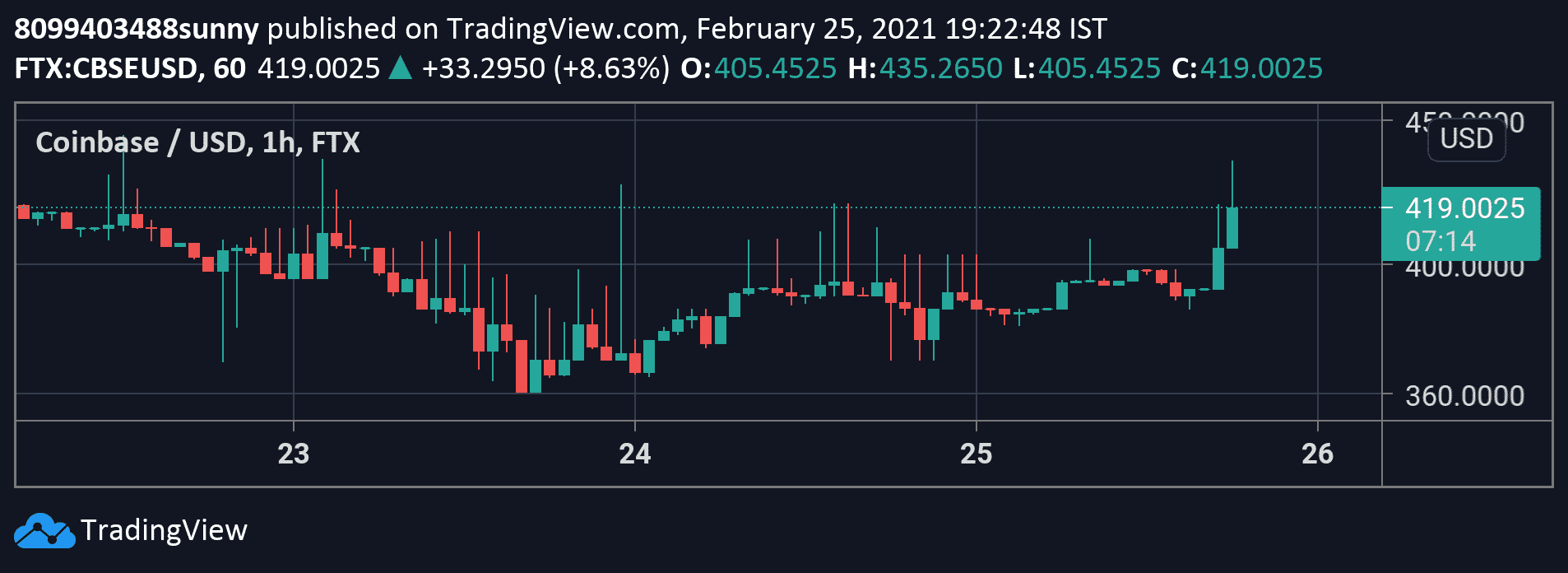

Coinbase Pre-IPO Share Soars on FTX Post S-1 Filing With the SEC

Coinbase announced its direct listing on NASDAQ after an S-1 IPO filing with the SEC for a direct listing. The news of the public listing soared the pre-IPO shares listed on FTX, rising from $390 to over $430 in a matter of a couple of hours.

The pre-market valuation of Coinbase is estimated to be as high as $100 billion with the firm targeting a share price of $400 each. The rise in pre-IPO shares of Coinbase did not come as a big surprise for many given the crypto exchange had announced its public debut back in December last year.

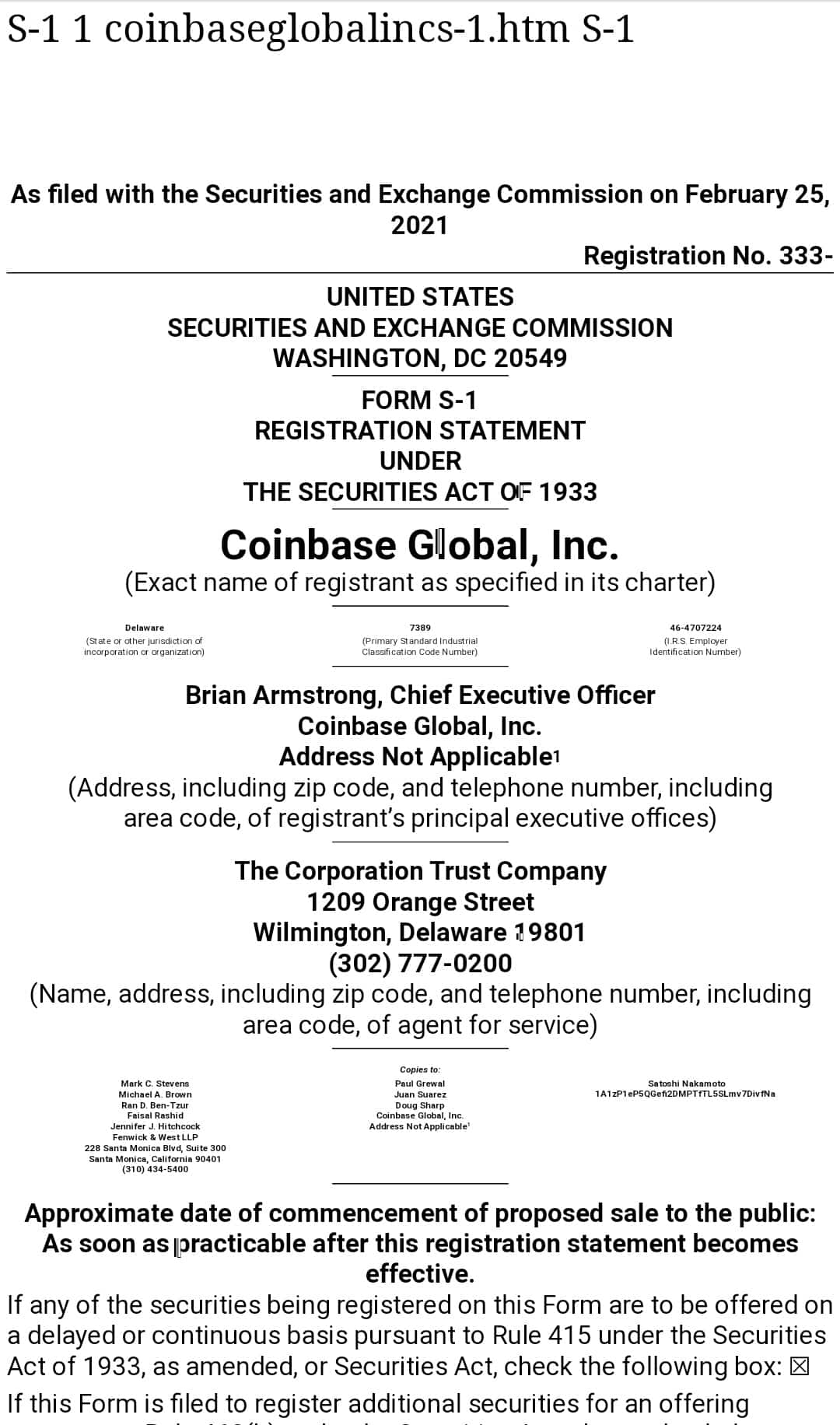

The S-1 IPO filing with the SEC revealed interesting details about the exchange which started its journey back in 2012. The filing revealed that the total number of customers on the platform has reached 43 million while the total revenue of the firm reached $3.4 billion out of which $1.28 billion came in 2020 alone.

Coinbase Put Satoshi Nakamoto in S-1 Filing

The Coinbase S-1 IPO filing also mentioned the pseudo-anonymous creator Satoshi Nakamoto in CC drawing a lot of Twitter attention. The trend of encoding messages in Bitcoin blocks was first started by Nakamoto himself.

.@coinbase put Satoshi on cc for their S-1 ????$COIN pic.twitter.com/3lPk2X9498

— Michael Sonnenshein (@Sonnenshein) February 25, 2021

Coinbase in its run-up to the IPO filing had earlier revealed that they had invested in Bitcoin and Ethereum during the nascent stage and have held on to their investments up until now. The firm also became truly decentralized with no physical headquarters anywhere in the world which was only aided by the growing pandemic.

As we’ve moved to a remote first environment, we realized that we no longer have a headquarters located in any one city. https://t.co/8SpdJgylx1

— Coinbase (@coinbase) February 24, 2021

The much-awaited public announcement by Coinbase had a positive impact on Bitcoin price as it rose above $51k after spending most of the past 4-days under $50k after the direct NASDAQ listing was announced. Bitcoin touched a new all-time high of $58,543 last week before registering a sharp 20% fall. The top cryptocurrency could see a bullish rally as on-chain metrics along with MicroStrategy and Squre Inc and Coinbase public listing is believed to help it extend the next leg of the bull run.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Is Bitcoin Dead? Here’s What the Data Really Says

- US-Iran War: Meme Coin Market Plunges After Iranian Drone Hits US Embassy in Kuwait

- Arthur Hayes Sees 5x HYPE Token Rally as Oil Perps Pump on Hyperliquid Amid U.S.–Iran War

- How BTC, ETH and XRP Prices React as Crude Oil and Safe Havens Surge After Khamenei’s Death

- BREAKING: Iran Refutes WSJ’s Claims on Push to Resume Nuclear Talks with US, Bitcoin Slips

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs