Breaking: Coinbase to Launch Mag7 Crypto-Equity Index Futures In ‘Everything Exchange’ Push

Highlights

- The Mag7 Crypto Equity Index futures will offer exposure to both traditional equities and crypto ETFs.

- The derivatives product will launch on September 22.

- The index will include the Mag stocks, COIN stock, and BlackRock's crypto ETFs.

- This comes as the exchange looks to become the 'everything exchange.'

Crypto exchange Coinbase is forging ahead with plans to expand its offerings into traditional equities. As part of this move, the exchange plans to launch a derivatives product, which will offer exposure to the ‘Magnificent 7’ (Mag7) stocks and crypto ETFs.

Coinbase Announces Mag 7 Crypto Equity Index Futures

In a blog post, the crypto exchange announced that it is expanding its product suite with the launch of equity index futures, starting with the Mag7 and Crypto Equity Index futures, which will launch on September 22. This will be the first product to offer combined exposure to both traditional equities and crypto ETFs.

Coinbase is looking to diversify its derivatives platform beyond single-asset offerings for the first time, with the launch of this equity index product that provides exposure to several assets. The top crypto exchange added that this product marks the next evolution of its product suite, paving the way for a new era of multi-asset derivatives.

Notably, this move comes amid the crypto exchange’s push to become the ‘everything exchange.’ Last month, it revealed plans to offer tokenized equities and prediction markets in the U.S. Meanwhile, the company recently completed its $2.9 billion acquisition of the crypto options platform Deribit.

Composition of the Index Futures

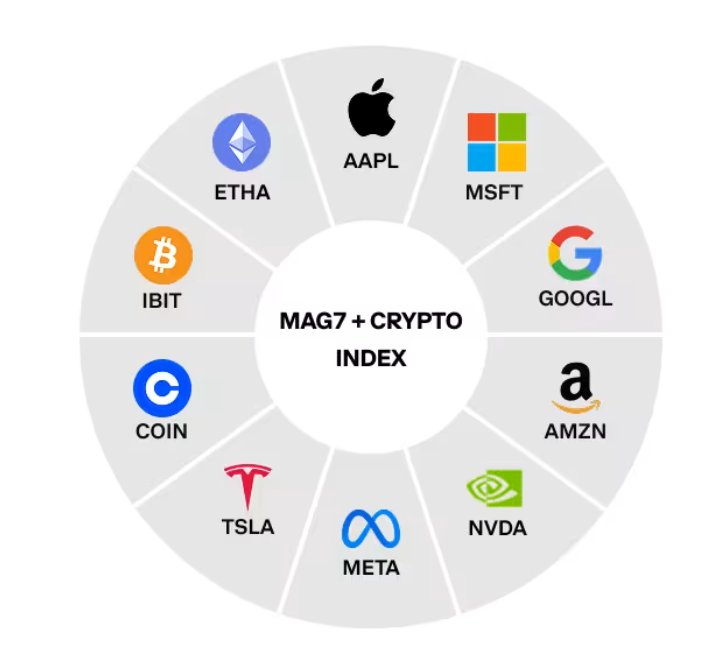

The Mag7 Crypto Equity Index will consist of both traditional equities and crypto assets. It will include Apple, Microsoft, Google, Amazon, NVIDIA, Meta, and Tesla stocks, which collectively make up the ‘Magnificent 7’ stocks.

Furthermore, the index will also include Coinbase stock (COIN) and BlackRock’s iShares Bitcoin ETF and iShares Ethereum ETF, which will provide exposure to the two largest crypto assets by market cap, BTC and ETH.

The crypto exchange stated that the index will follow an even-weighting methodology, with each asset accounting for 10% of the index. Coinbase plans to rebalance the index quarterly to reflect any market changes.

Meanwhile, the company noted that as component prices fluctuate, each asset’s weight may shift above or below 10%. However, the rebalancing will reset all components to equal weightings.

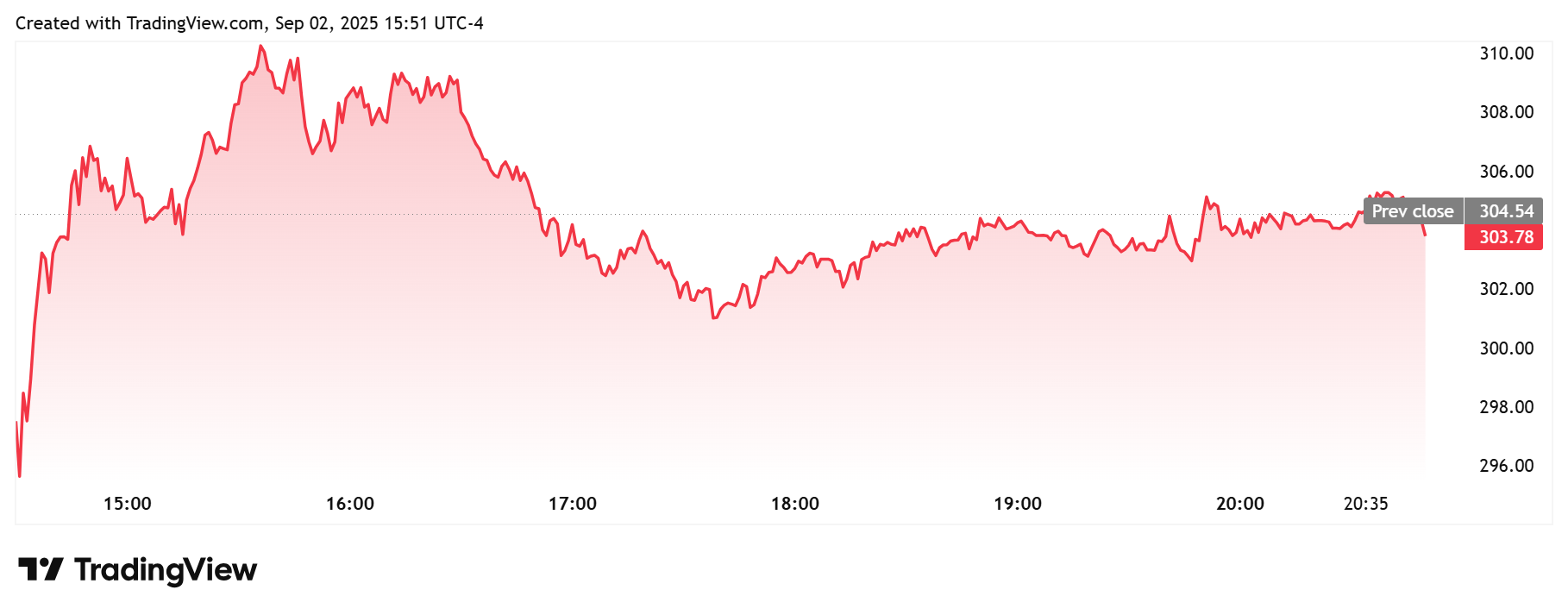

The COIN stock is trading flat amid this announcement. TradingView data shows that the stock is currently trading at around $304, with minimal gains recorded in today’s trading session.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

Buy $GGs

Buy $GGs