Coinbase Ventures Buys 4.7 Million Tokens Of This Project: Nansen

Highlights

- Coinbase Ventures continues to purchase Aerodrome Finance (AERO) tokens through different wallet address.

- Nansen data revealed that Coinbase Ventures accumulated more than 4.7 million AERO tokens worth $2.7 million.

- Aerodrome Finance (AERO) price gained over 15% in a week.

Coinbase Ventures, the investment arm of crypto exchange Coinbase, has continued to purchase massive amounts of Aerodrome Finance (AERO) tokens since Aerodrome revealed that the investment firm bought AERO tokens on the market, as per Nansen.

Coinbase Ventures Continues to Accumulate AERO Tokens

Crypto analytics platform Nansen disclosed that Coinbase Ventures hasn’t stopped buying Aerodrome Finance (AERO) tokens. The company has accumulated more than 4.7 million AERO tokens worth $2.7 million, as per on-chain data of transfers from the Coinbase Venture address.

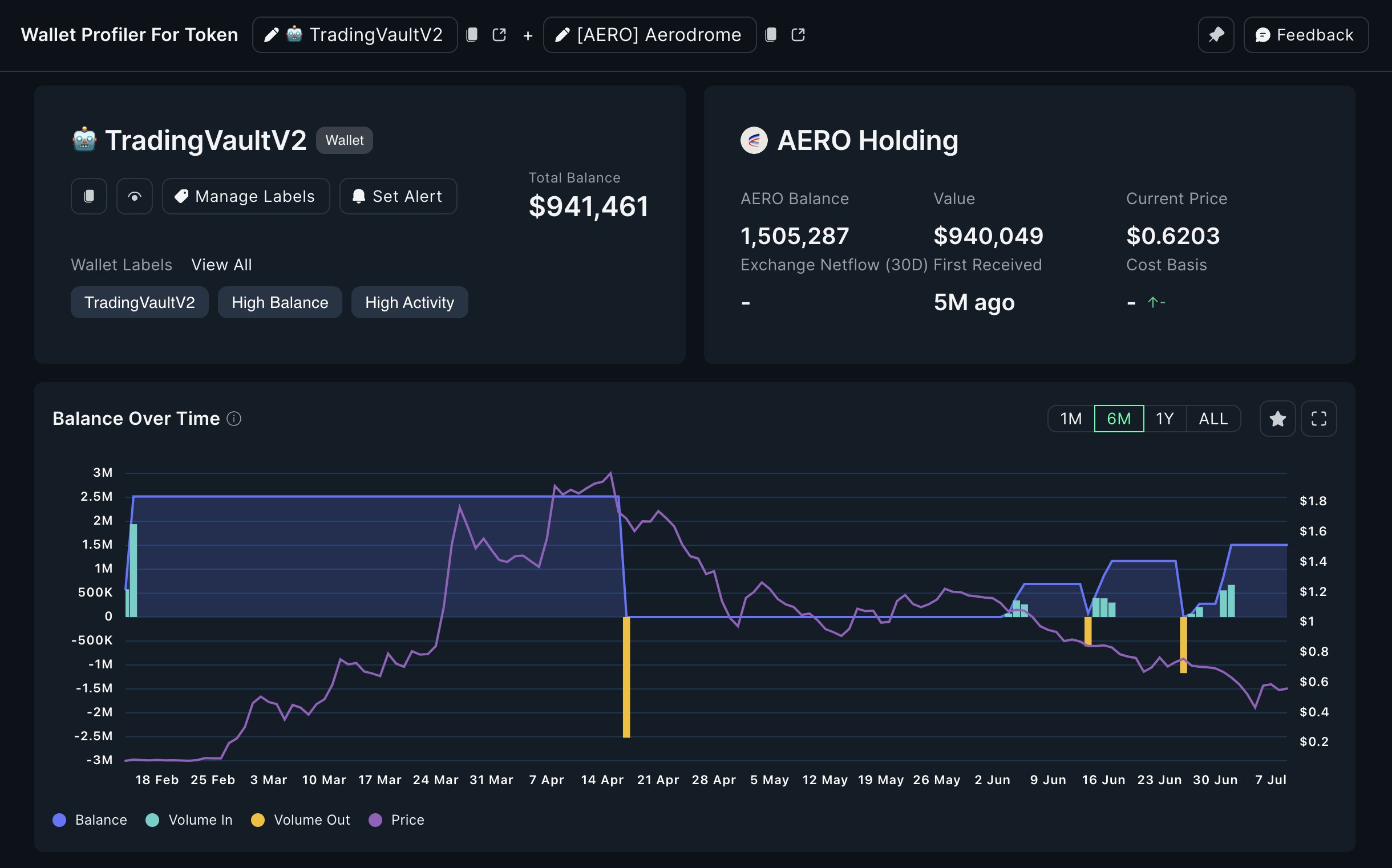

Large entities like crypto firms use individual TradingVaults to build positions in tokens. In July start, Coinbase Ventures also used TradingVault to further add 1.5 million AERO tokens to its holding. “All the tokens Coinbase Ventures have acquired are locked up within the wider Aerodrome Finance ecosystem, said Nansen.

Aerodrome previously revealed that the Base Ecosystem Fund led by Coinbase Ventures market acquired AERO tokens. The fund invests in the next generation of on-chain projects built on the Base chain.

Also Read: Fed Rate Cuts — Gov Lisa Cook Eyes Soft Landing, Bitcoin To Rally After CPI Today?

AERO Price Performance

Aerodrome recently reported that it hit $1 billion in cumulative volume within 7 months and skyrocketed to $15 billion in three months after Slipstream pools were deployed.

Aerodrome Finance (AERO) price gained over 500% after Coinbase Ventures acquired AERO tokens. In the last 24 hours, the price has dropped 1% after a 15% rally in a week. The 24-hour low and high are $0.603 and $0.631, respectively.

Furthermore, trading volume has also dropped by 12% in the past 24 hours, indicating a decline in interest among traders. A breakout above the $0.65 resistance level to likely trigger a further rally.

Also Read:

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Analyst Predicts Bitcoin Price Dip to $55K as ETFs See Outflows Amid Middle East Tensions

- Ethereum Co-founder Sparks $157M Sell-Off Fears as ETH Struggles Below $2k

- Analyst Predicts XRP Price Could Fall to $1 as XRP ETFs Record Net Weekly Outflows

- U.S.-Iran War: Trump Threatens to Hit Iran ‘Very Hard’ Today as Bitcoin Faces New Selling Pressure

- Crypto Market Weekly Recap: US-Iran War Steer Crypto Prices, Kraken Gets Fed Master Account, Tokenization Push March 2-6

- Dogecoin, Pepe coin, and Shiba Inu Price Prediction As BTC Crashes Below $70k

- Here’s Why Cardano Price Has Not Reclaimed $0.30

- Will XRP Price Crash as U.S. Nonfarm Payrolls Fell by 92,000 in February?

- Pi Network Price Eyes a 40% Surge as Pi Day Looms on March 14

- Top Reasons Why Circle Stock Price is Surging

- Gold Price Prediction as US-Iran War Hits the Second Week

Buy $GGs

Buy $GGs