Compound [COMP] Pumps Another 80% from Value Injection and Short Liquidity

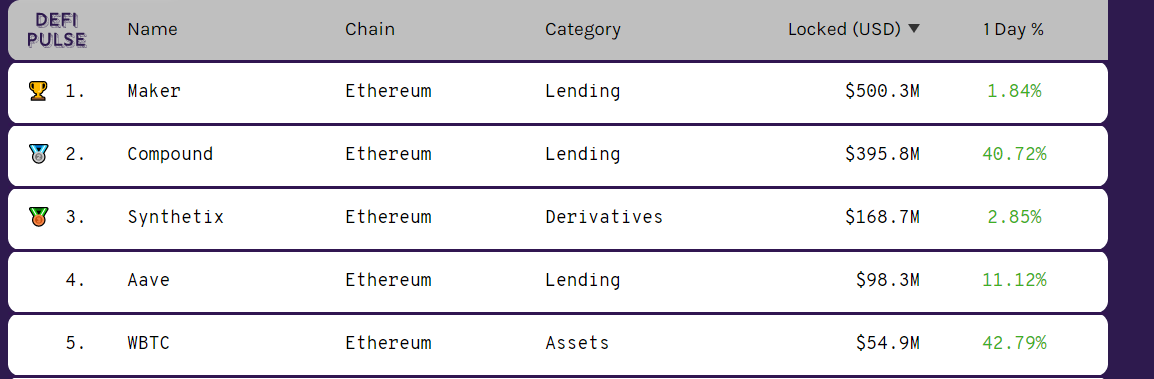

The crypto markets witnessed a classic exaggerated pump of the COMP token as its price skyrocket over 300% since the launch on Monday. The most surprising part is that its market capitalization is now 4 times that of Maker, defying all expectation of the market; since the total value locked in the Compound DeFi is still less than MakerDAO.

Nexofinance Investment

Nexo finance, an Instant Crypto Credit Lines provider has provided the fresh liquidity for the pump of the coin early Friday. Arthur, an independent researcher of DeFi projects tweeted,

Nexo pumped in another $28.4m to Compound 30 mins. This farm is so harvested… They have deployed 59.5m to farm $COMP so far.

Nexo is necessarily a centralized Financial Services firm that seems to be benefiting from the Compound pump. In parts, it is similar to the injection in the global economy by the Feds.

Nevertheless, there is a flip side to it as well. Kyle Samani, Managing Partner at MultiCoinCap tweeted,

CeFi companies are using customer deposits to milk liquidity mining. If anything goes wrong, these CeFi companies are going to implode.

Apart from the $60 million from Nexo finance, about $240 million has poured in from other sources as well.

Short Side Liquidity Adding to Euphoria

FTX launched futures trading of COMP to dive into volatility around the COMP token. However, the price of the cryptocurrency jumped another 80% after its launch.

The marked area in the hourly chart above marks the time of the COMP futures launch on FTX.

COMP futures are live on FTX!https://t.co/1ZyPXqUued

As are cUSDT futures: https://t.co/a382kKQyrm@compoundfinance

— SBF (@SBF_Alameda) June 19, 2020

FTX also launched trading of the underlying stablecoin ‘cUSDC’ provides the interests on the lending platform. He tweeted,

So cUSDC is basically just an every-increasing number of USDC, growing at the interest rate on Compound. I’ts kinda like a coin that can only go up! (Unless there is a liquidation failure/hack/etc. on the platform, in which case it can go down.)

The rise of the Compound DeFi seems to be fueled by the expectations of growth around the lending markets and an increase in interest earnings. Nevertheless, the sudden rise in the project raises liquidity risks of the platform as well.

DeFi Growth

The dominance of Maker which was above 50% last week has fallen to 37% as well. Moreover, increasing attention towards DeFi is also propelling the growth of Aave and WBTC.

As for COMP token, there is massive volatility in the price. It has fallen from highs above $240 to $190 in less than three hours as the euphoria seems to have reached its zenith point.

Do you think that growth in Compounds’ price is sustainable? Please share your views with us.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs