With Growing Speculation Of 50bps Rate Hike, Is A Crypto Crash Incoming?

As a direct response to Fed Chair Powell’s speech on Tuesday, the U.S. stock market witnessed a significant decline, with key indexes including the S&P 500, Dow Jones, and Nasdaq 100 all trading in the red. The price of the largest crypto by market cap, Bitcoin, also decreased by 1.17% in the past hour, and is currently exchanging hands at $22,362. And not just BTC, but the whole crypto market has seen glaring price drops across major altcoins as well.

Speculation High On 50bps Hike

The cryptocurrency market and the U.S. stock market are both experiencing uncertainty at the moment. On the other hand, the value of the U.S. dollar Index (DXY) has skyrocketed and is now trading close to the 106 mark. This is usually seen during periods in which the Federal Reserve raises interest rates — and as a result of Powell’s hawkish comments — market participants are anticipating an even larger rate hike of 50 basis points (bps) for the month March. According to the CME FedWatch Tool, the likelihood of a rate hike of 50 basis points for March has grown to 46%, while the likelihood of a rate hike of 25 basis points remains at 54%.

Read More: Check Out The Top 10 DeFi Lending Platforms Of 2023

A higher U.S. Dollar also indicates less incentive to invest in riskier assets such as equities and cryptocurrencies. Therefore, there will be a bigger demand for the dollar if the real returns are higher. A higher DXY often translates to a weakening stock market and its ripple effect can be felt across other markets such as the crypto sector.

Is Crypto Crash On The Horizon?

The speech made by Federal Reserve Chair Jerome Powell also had a significant impact on the price of oil, as can be seen by the major decline recorded across indexes, including WTI and Brent Crude; where both have settled at 77.90 and 83.82 respectively. All of these variables — especially with the widespread fear prompted by the prospect of increasing interest rates — can eventually bring about a cataclysmic crash throughout markets, which could wipe out majority of the gains made in the past few weeks.

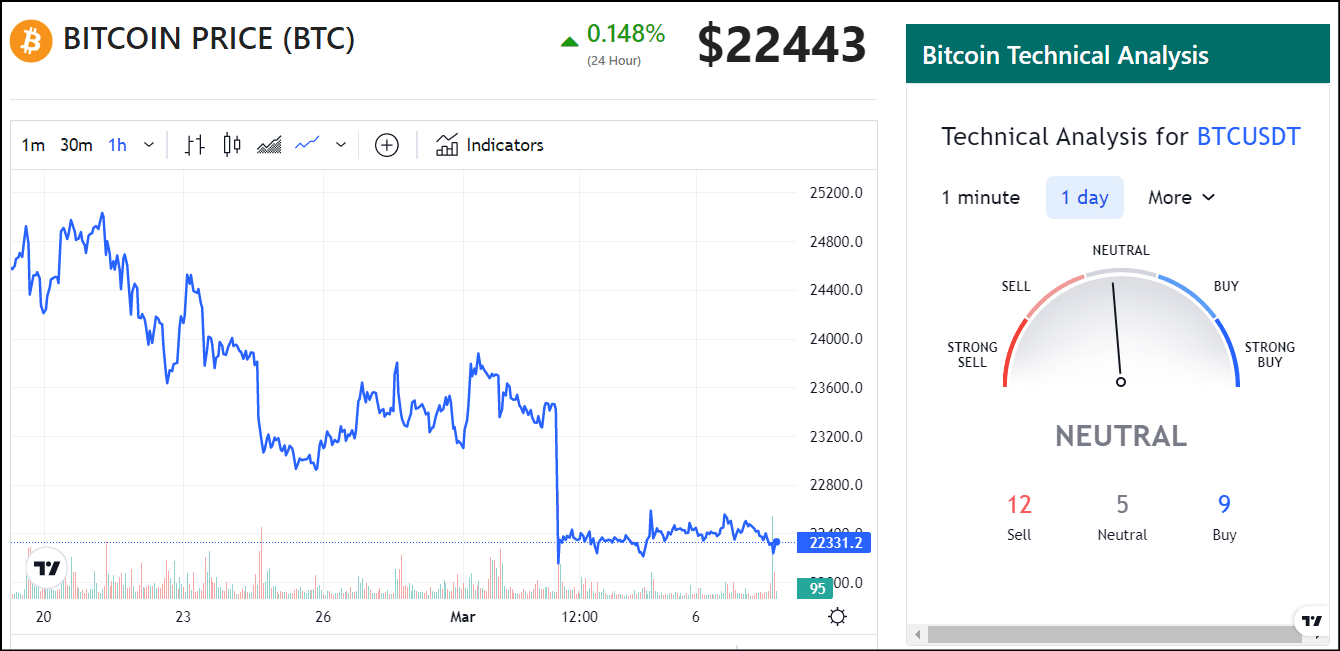

Additionally, it should be noted that BTC’s technical analysis (TA) indicators at CoinGape’s crypto market tracker recommend a “Neutral” position due to the ongoing uncertainty. Moreover, the moving averages suggest a “sell” at 12 and a “buy” at 9 at the time of writing. As things currently stand, the price of Bitcoin (BTC) is trading at $22,443 which represents a decrease of 1.12% over the past 24 hours, in contrast to a drop of 5.25% over the last seven days.

Also Read: U.S. SEC Continues Crypto Crack Down; Charges BKCoin For Running “Ponzi-like Scheme”

- Bitget Launches Gracy AI For Market Insights Amid Crypto Platforms Push For AI Integration

- BlackRock Signals $257M Bitcoin and Ethereum Sell-Off Ahead of Partial U.S. Government Shutdown

- XRP News: Jane Street Emerges Among Key Institutions Driving XRP ETF Inflows

- Bhutan Gov. Dumps More Bitcoin Amid $410M Institutional Sell-Off in BTC ETFs

- Crypto Market in Panic Mode Ahead of Bitcoin, ETH, XRP, SOL Options Expiry & US CPI Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15