Crypto Crash: XRP, Ethereum Leads Sell Off As Crypto Market Bleeds

Crypto Crash: The global cryptocurrency market printed red indexes as selling pressure among traders increased. The cumulative digital asset market cap dropped by a massive 4% over the past day to stand at around $1.02 trillion. This comes in when the Federal Reserve pauses rate hikes for the first time in the last 15 months.

Also Read: US SEC Refuses To Commit Deadline in Coinbase Crypto Clarity Case

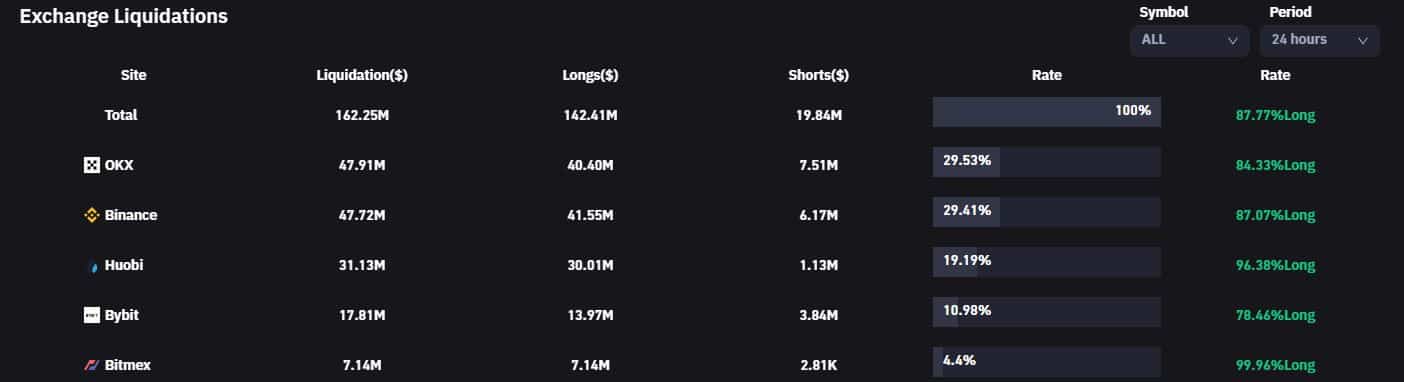

Crypto Liquidation Breaches $162 Mln

Coinglass data depicts that more than 46K traders were liquidated in the last 24 hours, while, the total liquidations recorded stands at around $162.2 million. However, the single largest liquidations order of ETHUSDT valued at $11.57 million was registered on the Binance crypto exchange.

It is important to note that $142.4 million, 87% of the total liquidation over the last 24 hours turned out to be long positions set by the traders. This suggests that the traders were betting on an upward movement in the crypto market. However, Ethereum (ETH) recorded the most of the liquidation (approx worth $60.5 million). Read More Crypto Crash News Here…

Cardano, Solana Drops By Over 20%

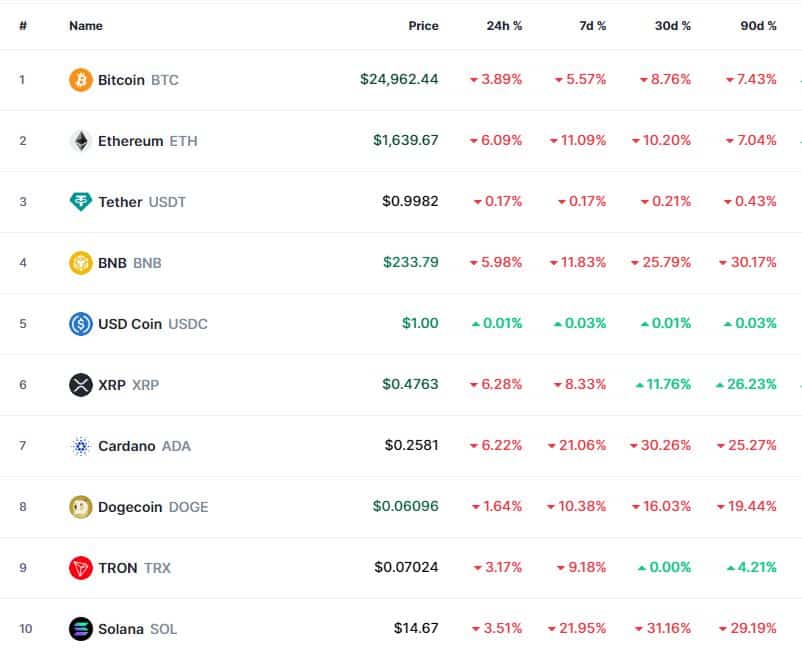

Bitcoin (BTC) price declined by more than 4% in the last 24 hours as the biggest crypto dropped below the crucial $25K level. Bitcoin is trading at an average price of $24,856, at the press time. BTC dominance decreased to stand around 47.57%. However, a further decline can also be expected ahead.

Ethereum (ETH) and Ripple’s native crypto, XRP turned out to be one of the biggest losers in the ongoing sell-off. ETH and XRP price have dropped more than 6% in the last 24 hours.

Cardano (ADA) and Solana (SOL) emerged as the biggest losers in the last 7 days. ADA and SOL prices declined by 21% and 23%, respectively. This major decline comes in after U.S. Securities and Exchange Commission (SEC) alleged Binance and Coinbase of multiple charges. However, it also listed ADA, SOL, Sandbox (SAND), Filecoin (FIL), Axie Infinity (AXS), Chiliz (CHZ), Flow (FLOW), Internet Computer (ICP), and Other cryptos as securities.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Gold vs. Bitcoin: Can Gold Outperform BTC Amid US–Iran Conflict?

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs