Crypto ETF News: Bitcoin, Ethereum Funds See $1B in Outflows as Bullish Sentiment Fades

Highlights

- Bitcoin and Ethereum ETFs recorded nearly $1 billion in outflows in a single day.

- This marks one of the worst combined sessions of 2026.

- Arthur Hayes attributed Bitcoin’s price drop to shrinking U.S. dollar liquidity.

U.S.-listed spot Bitcoin and Ethereum ETFs just saw one of their worst combined days of outflows in 2026. Current falling prices and escalating volatility have compelled institutions to cut their investment in crypto ETFs.

Crypto ETFs Lose $1 Billion as Institutions Cut Losses

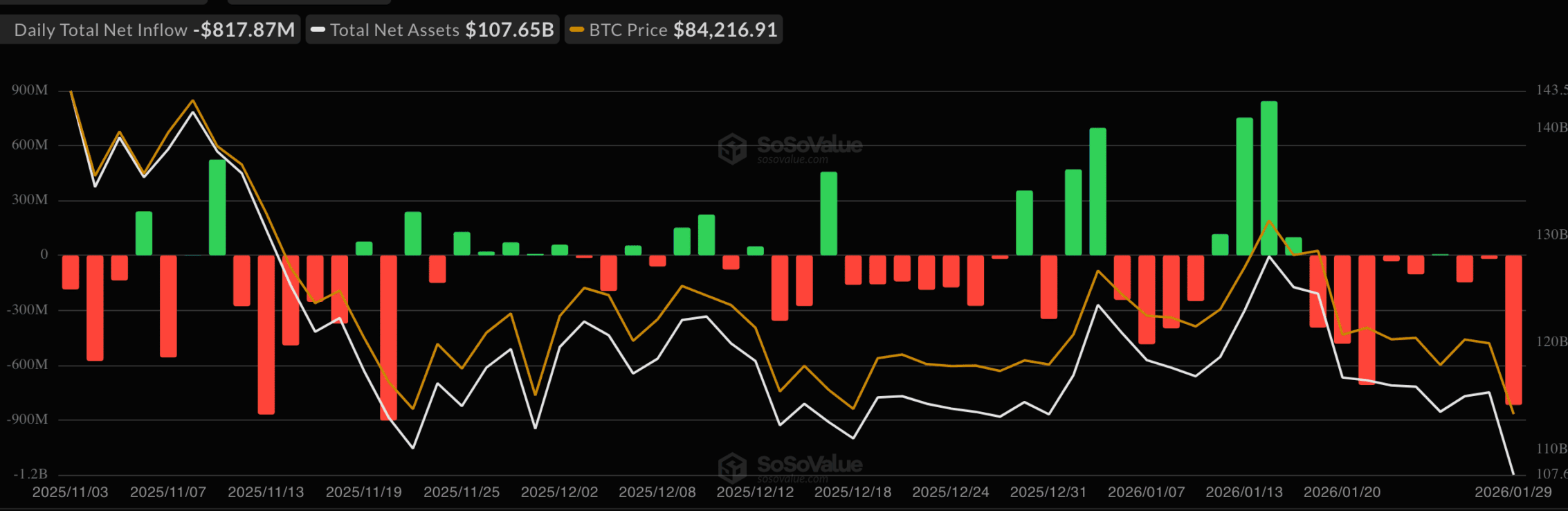

Outflows from Bitcoin and Ethereum exchange-traded funds soared on Thursday, with nearly $1 billion pulled out in a single session. According to data from SoSoValue, investors pulled $817.9 million from BTC ETFs on January 29. This is the biggest outflow it has seen since November 20. ETH ETFs also lost $155.6 million.

The sell-off came as the crypto market crashed earlier today. The BTC price fell below $85,000 and then fell to $81,000. The market recovered to $83,000 in the early morning hours of Friday. ETH also dipped by 6% in a day.

Notably, other spot crypto ETF funds saw outflows as well. The XRP ETFs recorded a substantial outflow of funds worth $92.92 million. On the other hand, the Solana funds did not see as high an outflow from institutional investors as $2.22 million.

The recent sale of Bitcoin and Ethereum ETFs shows that institutional investors are withdrawing from their broad investments in cryptocurrencies and not just rotating between different assets.

The largest loser was BlackRock’s IBIT with an outflow of $317.8 million, while Fidelity’s fund, FBTC, lost $168 million. BlackRock’s fund, ETHA, which tracks Ethereum ETFs, lost $54.9 million. Also, Fidelity’s FETH had an outflow of $59.2 million. This is different from early January, when there were consistent inflows into crypto ETFs.

Arthur Hayes Ties Bitcoin Price Dip to US Treasury Liquidity Drain

The BitMEX CEO Arthur Hayes said that the decline in the price of Bitcoin is due to a decrease in the amount of liquidity in US dollars. According to him, this is being driven by cash reserves, specifically those being held by governments.

Roughly $300bn fall in $ liq over past few weeks driven mostly by $200bn rise in TGA, gov could be raising cash balances to fund spending in case of shutdown. $BTC falling not a surprise given the fall in $ liquidity. pic.twitter.com/ctPjWd8188

— Arthur Hayes (@CryptoHayes) January 30, 2026

Hayes noted that about $300 billion in dollar liquidity has been removed from the markets in recent weeks. The major contributor was an increase of $200 billion in the US Treasury General Account (TGA), the government’s cash reserves held at the Federal Reserve.

He even went to the extent of suggesting that the Treasury may be holding cash reserves, awaiting a possible government shutdown in the U.S. This would ensure that the government has a spending budget in case negotiations fail. The founder had initially projected that the Bitcoin bull run would occur despite the crypto ETFs outflows.

He projected a rally would commence this year if the Fed intervenes in the crashing Japanese yen. However, the market has only gotten worse since the projection.

- ProShares Launches First GENIUS Act Focused Money Market ETF, Targeting Ripple, Tether, Circle

- BTC Price Falls as Initial Jobless Claims Come In Below Expectations

- Breaking: CME Group To Launch 24/7 BTC, ETH, XRP, SOL Futures Trading On May 29

- White House to Hold CLARITY Act Meeting With Ripple, Coinbase, Banks Today

- Senator Warren Warns Fed Against Bitcoin Crash Rescue Amid Liquidity Pump Claims

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?