Crypto Exchange Probes Bitcoin Dip; Here’s The Best Level To Buy BTC Now

Highlights

- A crypto exchange investigates Bitcoin plunge amid unusual trading concerns.

- BTC price analysis identify a key range as an optimal level to buy Bitcoin.

- Bitcoin plunged to early 2020 low, prompting speculation on whale trading activity.

The digital currency ecosystem saw a sudden and sharp drop in the Bitcoin (BTC) price on the BitMEX Exchange, sending ripples of speculation across the market. As Bitcoin plummeted to $8,900 on BitMEX while maintaining a significantly higher value on other exchanges, concerns arose over the reasons behind this drastic discrepancy.

Notably, analysts pointed fingers at potential whale activity, prompting BitMEX to launch an investigation into the unusual trading behavior. Meanwhile, amid the downturn, recent data suggests the best range to buy Bitcoin now.

BitMEX Probes Recent Price Plunge

BitMEX, a prominent crypto exchange, found itself in the eye of a storm as the Bitcoin price nosedived on its platform, reaching a staggering low of $8,900, a level last seen in early 2020. Responding to the crisis, BitMEX initiated an investigation into what it termed as “unusual activity” within its BTC-USDT Spot Market.

Meanwhile, according to a Bloomberg report, the exchange assured its users that all systems were functioning normally, yet they detected aggressive selling patterns originating from a handful of accounts, surpassing typical market behavior. A spokesperson for BitMEX, addressing the incident, said:

“We identified aggressive selling behavior involving a very small number of accounts that exceeded expected market ranges.”

However, the exchange refrained from divulging specific details or actions taken against the accounts involved. Despite the turmoil, BitMEX assured its users of the platform’s operational integrity and the safety of their funds.

Also Read: Ethereum Price Risks $24M Collateral Liquidation If ETH Falls To This Level

Best Price To Buy Bitcoin Now

Following the sudden Bitcoin crash, the flagship crypto swiftly rebounded from its low, reminiscent of levels last observed in early 2020. However, the repercussions of this event rippled through the broader cryptocurrency market.

Meanwhile, the market pundits speculate on a flurry of factors precipitating the plunge, with a particular focus on whale activities and potential market manipulation. Notably, the incident, occurring amid Bitcoin’s staggering highs and increased institutional interest, highlights the persistent volatility and uncertainties inherent in the cryptocurrency sphere.

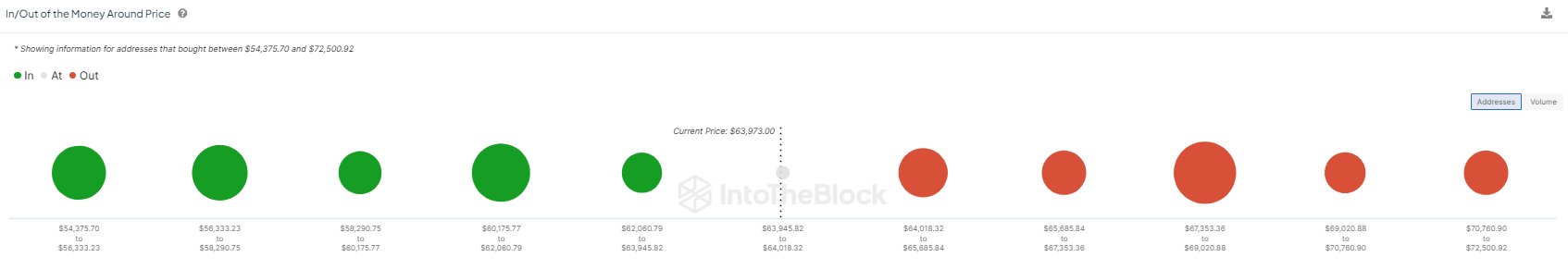

However, amid the uncertainties, IntoTheBlock data has suggested a key level to buy Bitcoin now. In other words, the BTC price range suggests strong support for Bitcoin price, as BTC is seeking stability amid a highly volatile market.

With attention turning to potential buying opportunities, the $61,000 range emerges as a critical area to monitor. Notably, data reveals a substantial accumulation of over 466,000 BTC by 805,000 addresses at this level, signaling robust investor interest and suggesting it may serve as a strategic entry point for those eyeing Bitcoin investments.

Meanwhile, as of writing, the Bitcoin price was down 7.32% to $63,127.80. However, despite the recent BTC crash, it has added over 20% in the last 30 days.

Also Read: Nvidia Unveils New AI Superchip Blackwell, NVDA Stock Price To Rally?

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs