Crypto Investments Rise By 19900% YoY in India To Cross $40 Billion

- India has witnessed massive growth in cryptocurrency investments in the last year

- The country has seen a rise from $200 million to over $40 billion worth of investments in digital currency

- Bitcoin (BTC) holdings are being viewed as digital gold by the citizens

India’s Cryptocurrency Investment Surge

Despite strict regulatory measures looming over the digital currency adoption in India, investors have managed to escalate holdings in the crypto market by leaps and bounds.

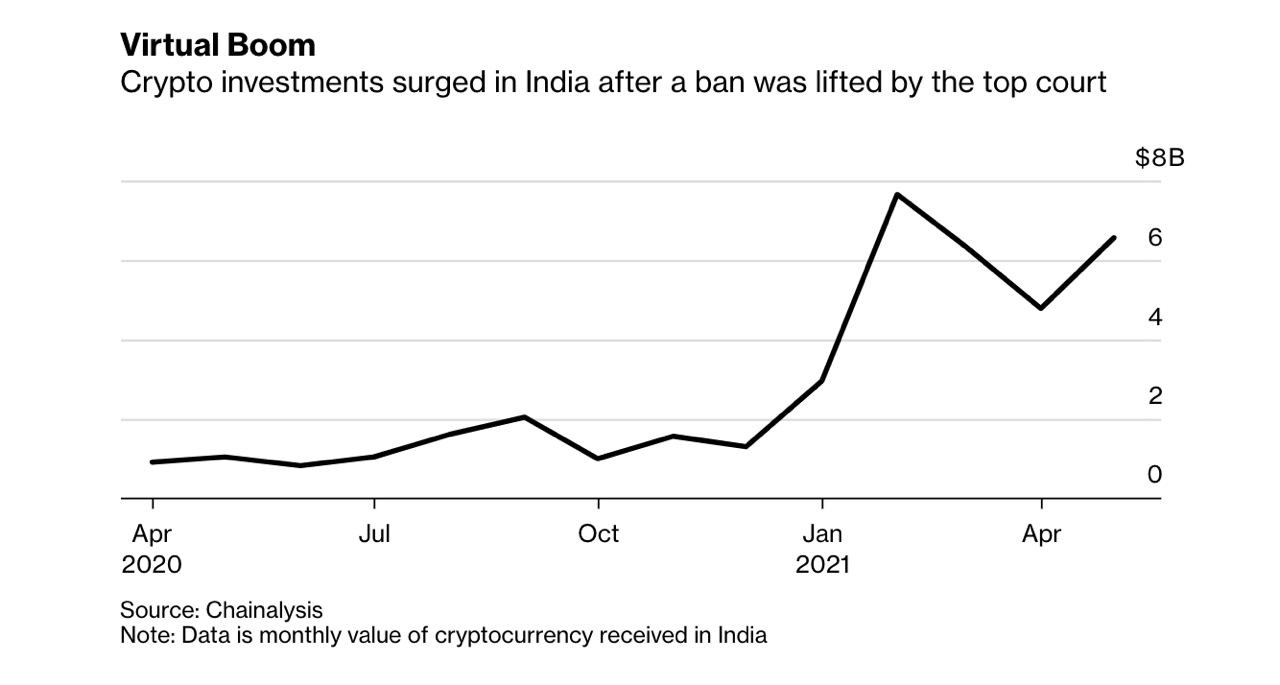

As per a report published by Chainalysis, Indian investors have driven a 19,900% increase in cryptocurrency investments, taking the total holdings from somewhere around $200 million to over $40 billion in the last year.

This development has taken place amidst strong opposition from the central bank over the introduction of digital currency in India’s financial market. Along with this, a proposed ban on trading cryptocurrency is also a threat to investors in the nation.

The market trend in crypto investments took an upturn during the middle of 2020, before advancing into a parabolic curve. The latter was a consequence of new heights reached in terms of ATHs (All Time High’s) by various prominent digital coins by the end of the fourth quarter. The shift in the market trends correlated with India’s Supreme Court ruling to end the prohibition on working relationships between the banking sector and digital currency platforms in March 2020.

Cryptocurrency : The Digital Gold

According to Sandeep Goenka, the founder of crypto exchange platform Zebpay, increased interest in Bitcoin and Altcoins has been shown by individuals between the ages of 18 to 35. Additionally, a preference toward digital currency over gold was also strongly observed.

This inclination toward investing in digital coins can be attributed to the highly simple process of going online and purchasing crypto, without having to verify. It is also fairly transparent, and the possibility of higher returns within shorter periods of time is a definite factor in attracting investors. On the other hand, the procedure of buying and investing in gold is a more complicated one.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- Ripple Prime Adds Support For Bitcoin, Ethereum, XRP, Solana Derivatives on Coinbase

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs