Crypto Market Crash: BTC, ETH, XRP, DOGE At Risk Following Weak PMI, JOLTS Data

Highlights

- A crypto market crash has occured with Bitcoin, Ethereum, XRP, and DOGE suffering sharp declines.

- This occured following the release of the PMI and JOLTS data, which were below expectations.

- Crypto analysts have suggested that the bull run is still far from over.

A crypto market crash looks imminent, with Bitcoin, Ethereum, XRP, and Dogecoin witnessing notable declines. This price crash happened following the release of weak manufacturing PMI and JOLTS data, which provides a bearish outlook for the market.

Crypto Market Crash: BTC, ETH, XRP, & DOGE Decline

CoinMarketCap data shows that a crypto market crash could be on the horizon, with the Bitcoin price sharply dropping below $83,000 from a daily high of around $84,400. Altcoins such as Ethereum, XRP, and DOGE also witnessed sharp declines.

This market crash occurred following the release of weak ISM manufacturing PMI and JOLTS data. The March PMI data dropped to 49, below expectations of 49.5 and lower than the 50 recorded in February.

The US JOLTS job openings for February came in at 7.568 million, below the expected 7.690 million and lower than the 7.762 million recorded in January. These data add to several macro fundamentals that paint a bearish outlook for the market.

This crypto market crash could persist, with China, Japan, and South Korea agreeing to respond to Donald Trump’s proposed tariffs. Trump is set to announce a number of reciprocal tariffs tomorrow, which could significantly harm the market as it sets off a trade war between the US and other nations.

Meanwhile, the US Federal Reserve also continues to hold out on cutting interest rates, which is another macro fundamental that continues to spark a bearish sentiment among investors. Although the Fed announced plans to slow balance sheet runoff starting April 1, Trump’s tariffs have overshadowed this move.

Bull Run Still Far From Over

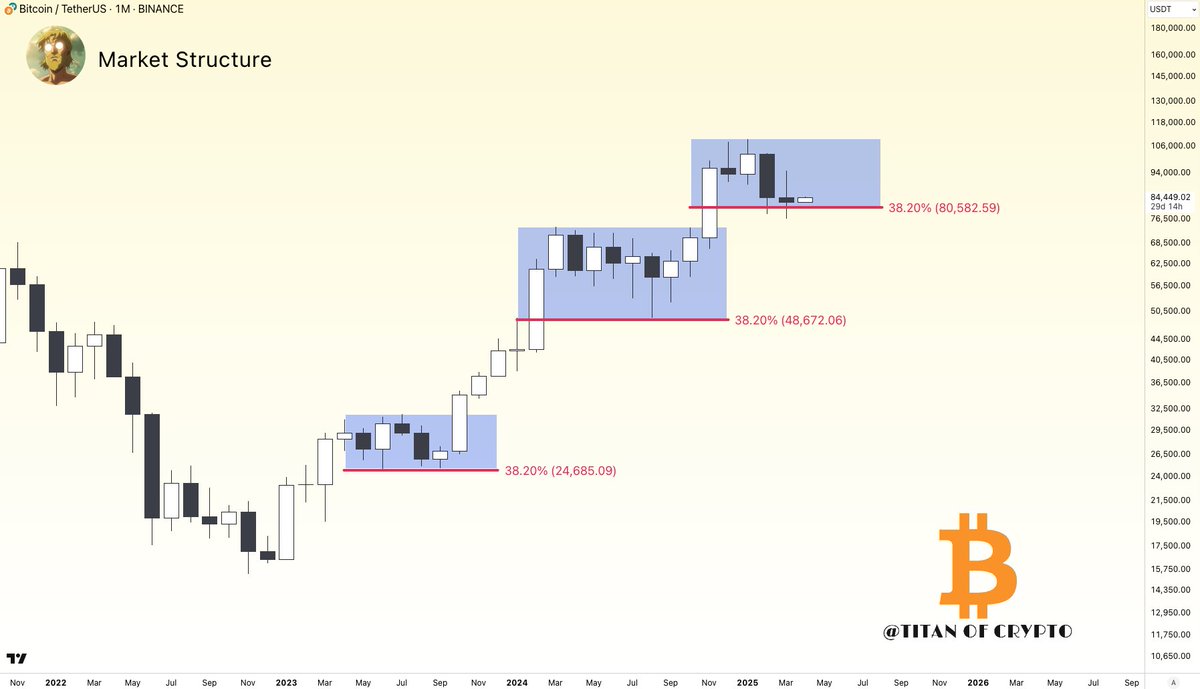

Despite the potential crypto market crash and declining prices, crypto analysts like Titan of Crypto have suggested that the bull run is far from over. The analyst noted that the Bitcoin price closed March just above the 38.2% Fibonacci retracement level. He remarked that this keeps the bullish scenario alive for now, while all eyes will be on what April has in store.

Crypto analyst Kevin Capital also mentioned that BTC is simply in a correction phase, which will end soon. He stated that what is important is what the flagship crypto does after, whether it reaches new highs or only creates higher lows.

Despite BTC’s erratic price action, whales such as MicroStrategy continue to actively accumulate more coins. Saylor’s company recently announced the purchase of 22,048 Bitcoins for $1.92 billion.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs