Crypto Market Crash Deepens as $1 Billion in Bitcoin, ETH, XRP, Altcoins Liquidated

Highlights

- Crypto market crash as Bitcoin breaks below $90K and ETH, XRP, BNB, Solana and other top altcoins falls deeper.

- Bitcoin and top altcoins saw over $1 billion in crypto liquidations over the last 24 hours.

- Institutional interest wipes out as outflows from spot Bitcoin Ethereum ETFs continue.

Crypto market crash deepens amid massive liquidations across Bitcoin, Ethereum, XRP, BNB, Solana, Cardano and other top altcoins. This happens as BTC price slumps below $90,000 in Asia hours on Tuesday, crashing by more than 28% in a month.

The crypto market has now lost over $1.20 trillion in just over a month, with the global market cap currently at $3.08 trillion. The Crypto Market Fear & Greed Index indicates bearish sentiment among investors as the index slipped further into the extreme fear zone to 11 today.

Crypto Market Crash as Bitcoin Tumbles to $89K

BTC price tumbles 6% on Tuesday to hit the key support around $90K. If the historical pattern repeats, similar to the bull market peak pattern, BTC could drop to its realized price at $55K.

The selling pressure in BTC has caused a broader crypto market crash. Meanwhile, ETH price has slumped more than 16% in a week to make a 5-month low of $2,948 today.

Altcoins XRP, Binance Coin (BNB), Solana (SOL), Dogecoin (DOGE), Cardano (ADA) fell 5-9% over the past 24 hours. Notably, trending altcoins Zcash (ZEC) and Telcoin (TEL) dropped 11% and 12%, respectively.

XRP price dropped more than 5%, with the price currently trading at $2.13. The 24-hour low and high are $2.12 and $2.29, respectively.

As CoinGape reported last weekend, long-term holders (LTH) and whales continued selling based on historical BTC bull market peak patterns. Moreover, buyers who once supported every dip are no longer present amid weakening odds of a Fed rate cut in December.

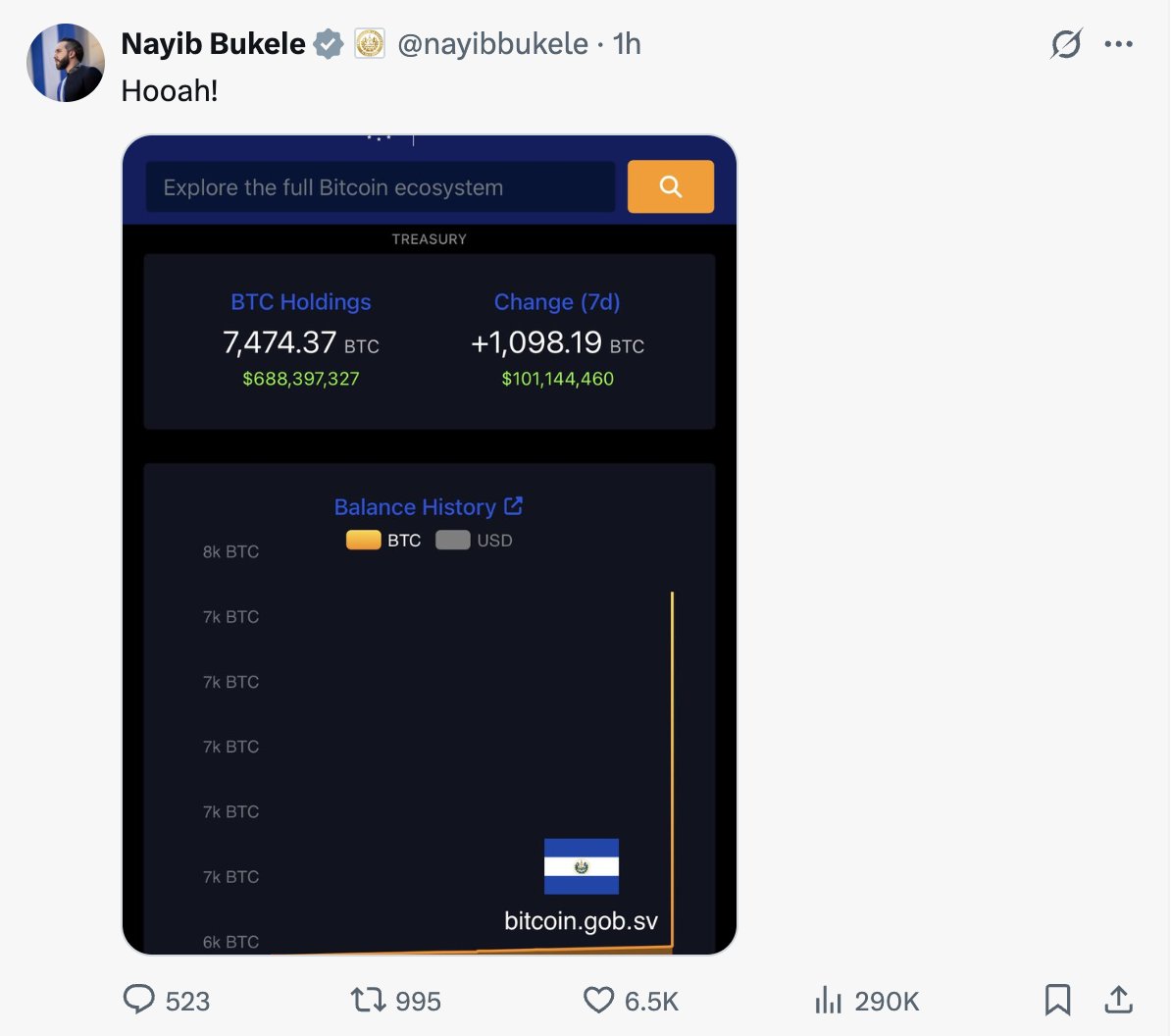

However, some are buying the dip, such as the El Salvador government, which purchased 1,090 BTC worth $101 million. Gemini co-founder Cameron Winklevoss said, “This is the last time you’ll ever be able to buy Bitcoin below $90K.”

Another Over $1 Billion in Bitcoin, ETH, XRP & Top Altcoins

Investors have lost more than $160 billion in today’s crypto market crash as the global market cap tumbled from $3.24 trillion to $3.08 trillion.

BTC and top altcoins saw over $1 billion in crypto liquidations over the last 24 hours, according to Coinglass data. Over 180K traders are liquidated, with the largest single liquidation order of BTCUSD valued at $96.51 happening on Hyperliquid.

Notably, over $720 million long and $280 million short positions were liquidated. BTC, ETH, SOL, XRP, ZEC, DOGE, BNB, ADA, and LTC are among the most liquidated crypto assets in today’s crypto market crash.

Bitcoin and Ethereum ETFs Outflow Continues

Spot Bitcoin ETFs and Ethereum ETFs continue to witness outflows, with no signs of buying yet. As per Farside Investors data, Bitcoin ETFs recorded a net outflow of $254.6 million on Monday. BlackRock’s IBIT and Grayscale Bitcoin Mini Trust ETF saw $145.6 million and $34.5 million in outflows amid bearish sentiment.

CoinShares crypto funds flow data revealed outflows from BTC, ETH, XRP and SOL. This comes despite inflows into Solana ETFs, with Fidelity Solana ETF (FSOL) to launch today.

Meanwhile, spot Ethereum ETFs saw $182.7 million in net outflows, the 5th consecutive day of outflows. BlackRock’s ETHA and Fidelity’s FETH recorded $109 million and $3 million in outflows.

Notably, Grayscale’s ETHE and ETH saw $2.5 and $10.8 million in inflows. It indicates buying the dip sentiment among investors after a 39% drop in ETH price from ATH.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs