Crypto Market Crash: Here’s Why $2B in Bitcoin, ETH, XRP, SOL, HYPE & Top Altcoins Got Liquidated

Highlights

- Crypto market crash and wipes out over $240 billion, with $2 billion liquidated in top crypto assets.

- Bitcoin falls to $81,087 lows and ETH price fell 8% to $2,689 today.

- Multiple factors including Iran-US tensions and Trump likely naming Kevin Warsh as Fed chair crash markets.

- Bitcoin ETFs saw a net outflow of $817.8 million as traders brace for options expiry.

The crypto market crash wipes out over $240 billion, with the total market cap tumbling from $3.04 trillion to $2.80 trillion. Massive liquidations across Bitcoin (BTC), Ethereum (ETH), XRP, BNB, Solana (SOL), HYPE, and other altcoins, including GOLD and SILVER perpetuals erase all recent gains.

Bitcoin price breaks multiple key support levels and plunges more than 7% to $81,087 lows today. On the other hand, ETH price fell 8% to a 24-hour low of $2,689. The Crypto Fear & Greed Index hit “extreme fear” levels of 16, echoing past deleveraging events.

Meanwhile, top altcoins XRP, BNB, SOL, DOGE, Cardano (ADA), and HYPE fell 6-10% over the past 24 hours. AI coins led the crash, with Worldcoin (WLD) price tanking more than 13%.

Reasons Behind Bitcoin, Gold, Crypto Market Crash

Earlier this week, CoinGape alerted about Bitcoin price crash to $81k. Multiple factors, including falling stablecoin liquidity, US Fed hawkish outlook, macro stress, geopolitical tensions, spot ETF outflows, and crypto options expiry, have resulted in a massive market crash.

However, this isn’t isolated to the crypto market and appears to be a broader global market crash, with assets like stocks, gold, and silver, as well as leveraged positions, getting hit hard.

BREAKING: Gold futures fall -$300/oz in 2 hours and officially drop back below $5,200/oz.

Volatility in gold markets is at 2008 levels. pic.twitter.com/vK48mGChmR

— The Kobeissi Letter (@KobeissiLetter) January 30, 2026

Gold, silver, copper, and other metals all fell sharply as investors locked in profits after a strong rally to record highs. The geopolitical tensions related to Iran become intense as reports claim President Donald Trump is weighing new military options for Iran, including raids inside the country.

President Donald Trump said on Thursday he planned nuclear talks with Iran, even as the U.S. dispatched another warship to the Middle East. Meanwhile, Iranian authorities say they are preparing for a war amid the US pressures.

Trump to Nominate Kevin Warsh as US Fed Chair

Moreover, investors are likely disappointed as Trump prepares to nominate former Fed Governor Kevin Warsh as the next Federal Reserve chair, Bloomberg reported on January 30.

Earlier, President Trump said he would announce the new Federal Reserve Chair “tomorrow morning.” Odds for Bitcoin-friendly Kevin Warsh becoming the next Fed chair spiked to 88% on Polymarket.

However, some have criticized Trump’s pick as Walsh urged for short-term rate cuts but tighter liquidity. This is bad for crypto that rises on Fed expansion, causing a crypto market crash.

Massive Liquidations Ahead of $10 Billion in Bitcoin and ETH Options Expiry

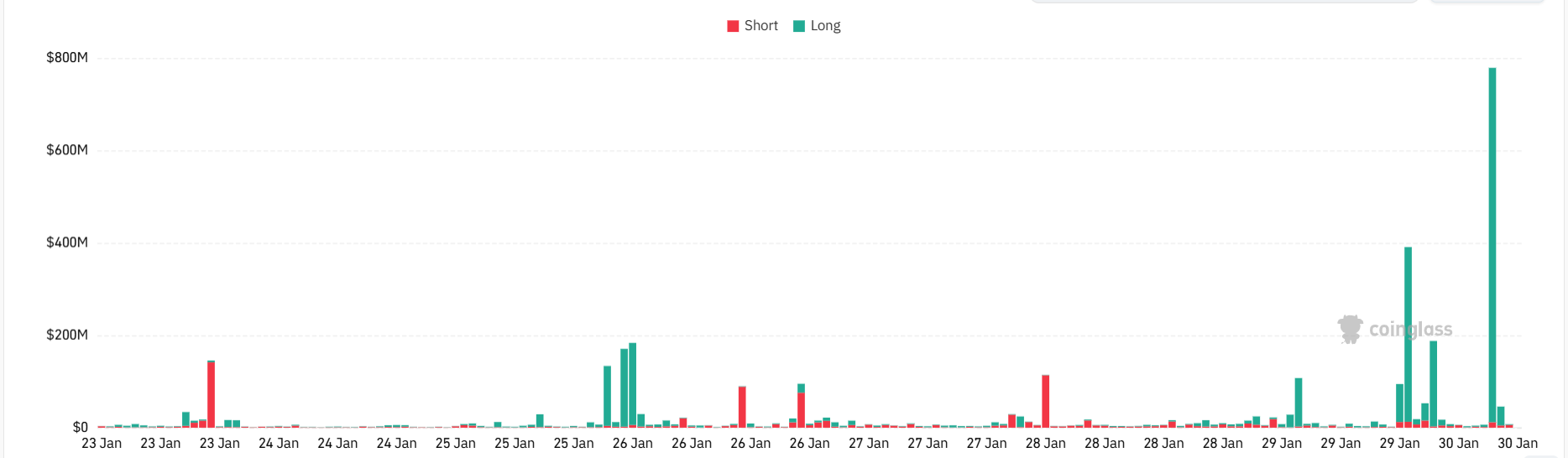

CoinGlass data shows almost $2 billion liquidated from leading crypto assets in 2 days. More than 267K traders were liquidated in the last 24 hours, with the largest single liquidation order of BTC-USDT of $80.57 million happening on HTX.

In the past 24 hours, almost $1.7 billion in long and more than $200 million in short positions were liquidated. Notably, $766 million in long positions were liquidated in just an hour, turning the market sentiment bearish.

BTC, ETH, XRP, SOL, XYZ: SILVER, XYZ: GOLD perpetual, HYPE, XAU, DOGE, SUI, ZEC, and ADA were the most liquidated in the past 24 hours.

As CoinGape reported, crypto market selloffs have deepened BTC is consolidating with muted trading volumes and options traders leaning bearish. Notably, long-term Bitcoin holders and whales continue to liquidate their holdings.

BTC options with a notional value of $7.5 billion to expire today, with a put-call ratio of 0.50. The max pain price is at $90,000, with many options traders having already liquidated their positions.

Moreover, ETH options worth $1.2 billion to expire on Deribit, with a put-call ratio of 0.70. The max pain price is at $3,000, with traders adjusting their positions as per current market conditions.

Spot Bitcoin ETF Outflows Signal Deeper Crypto Crash

Outflows from spot Bitcoin ETFs continue after the FED held interest rates unchanged and turned hawkish. In the last 9 trading days, spot BTC ETFs have recorded more than $2.5 billion in net outflows. The massive money outflows have triggered a crypto market crash.

Bitcoin ETFs saw a net outflow of $817.8 million on Thursday. BlackRock Bitcoin ETF (IBIT) led with $317.8 million in outflows. Spot Bitcoin ETFs by Fidelity, Bitwise, Ark 21Shares, and Grayscale also recorded outflows.

Meanwhile, analyst Ali Martinez has predicted $75,804 as the next level to watch as institutional investors continue to sell BTC. Bitcoin has just lost the 2-year moving average for the first time since 2022. “We’ve also lost the November 2025 lows, and are 7% away from losing the 2025 yearly low,” said analyst Joe Consorti.

- Breaking: CME Group To Launch 24/7 BTC, ETH, XRP, SOL Futures Trading On May 29

- White House to Hold CLARITY Act Meeting With Ripple, Coinbase, Banks Today

- Senator Warren Warns Fed Against Bitcoin Crash Rescue Amid Liquidity Pump Claims

- Top 5 Reasons Ethereum Price Is Down Today

- Crypto Market Slides as Hawkish FOMC Minutes Trigger BTC, ETH, XRP Sell-Off

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum