Crypto Market Crash: $700M Liquidated in Bitcoin, ETH, XRP, SOL, DOGE, XPL

Highlights

- Bitcoin, ETH, XRP, SOL, DOGE and XPL led $700 billion liquidations in the crypto market crash today.

- Crypto market crash amid massive profit booking by short-term holders, leveraged traders, and whales.

- US dollar hits 2-month high and 10-year treasury yield holds near 4.13% ahead of FOMC Minutes release.

Crypto market crash on Wednesday saw the market cap tumbling back to $4.1 trillion, down more than 2.50% over the last 24 hours. Moreover, the Crypto Market Fear & Greed Index recorded a sharp drop in the sentiment from 70 (greed) to 60 (greed) in just a day.

Bitcoin (BTC) loses strength amid massive profit booking and plunges more than 4% to $121,257 from $126,200 ATH. Ethereum (ETH) reverses 7% to $4,436, witnessing exceedingly higher liquidations than BTC in the last 24 hours. This is a hallmark of Euphoria phases, where widespread profitability often fuels accelerated profit-taking and rising market risk.

Top altcoins XRP, Solana (SOL), Cardano (ADA), and Hyperliquid (HYPE) fell 5-10% over the last 24 hours. Meme coins Dogecoin (DOGE) and Pepe Coin (PEPE) tumbled over 7%, with Shiba Inu (SHIB) trying to defend levels after 5% fall. DoubleZero (2Z) and Plasma (XPL) are down nearly 19% and 13%, respectively.

Profit Booking Driven Crypto Market Crash

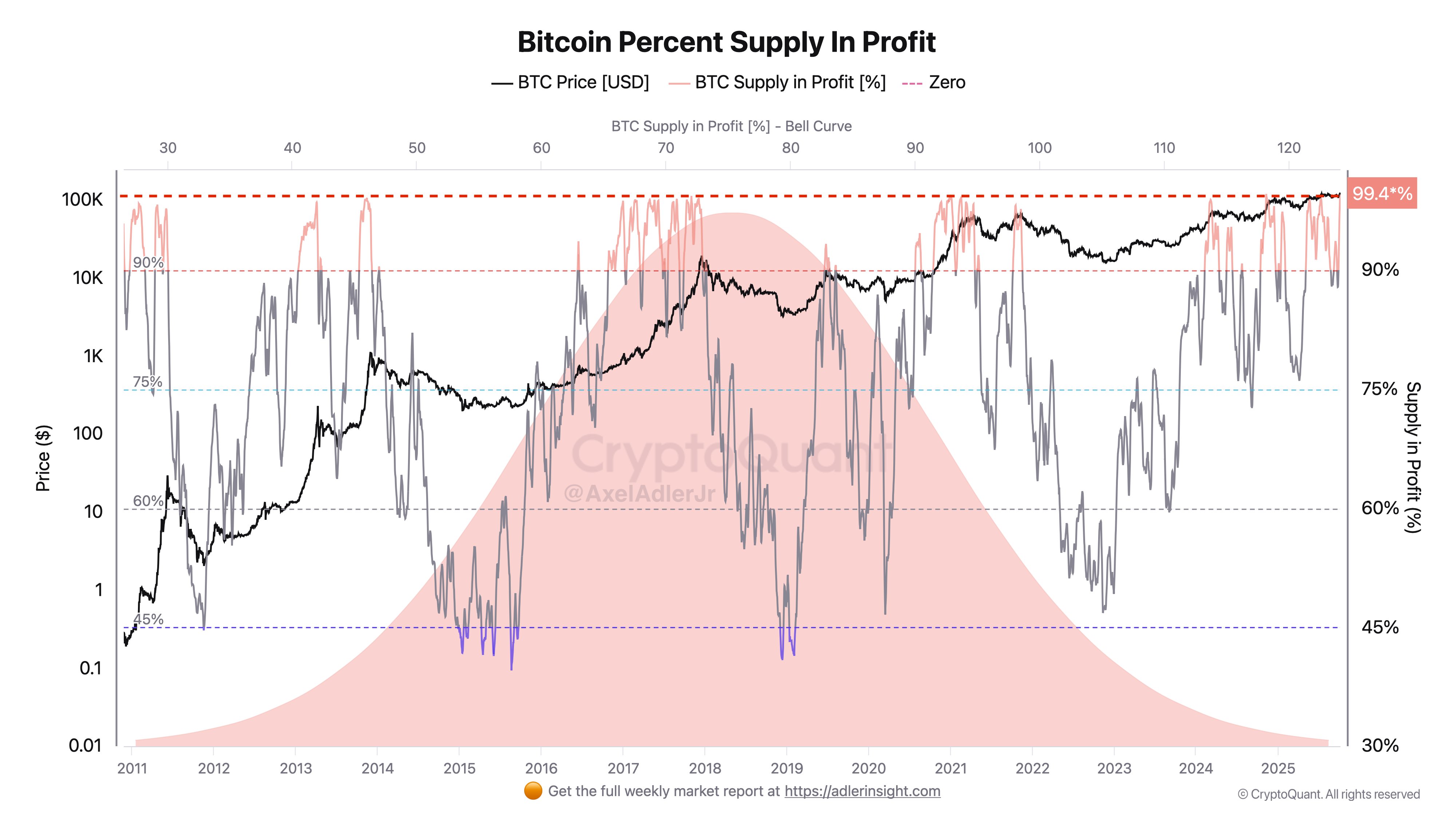

Widespread profit-taking by high-leverage traders caused the crypto market crash. Strong ETF inflows, renewed spot & derivatives demand, and rising on-chain activity led to holders sitting at 99.5% profit. Moreover, short-term holders’ unrealized profit rose to 10%, which typically follows massive dumping.

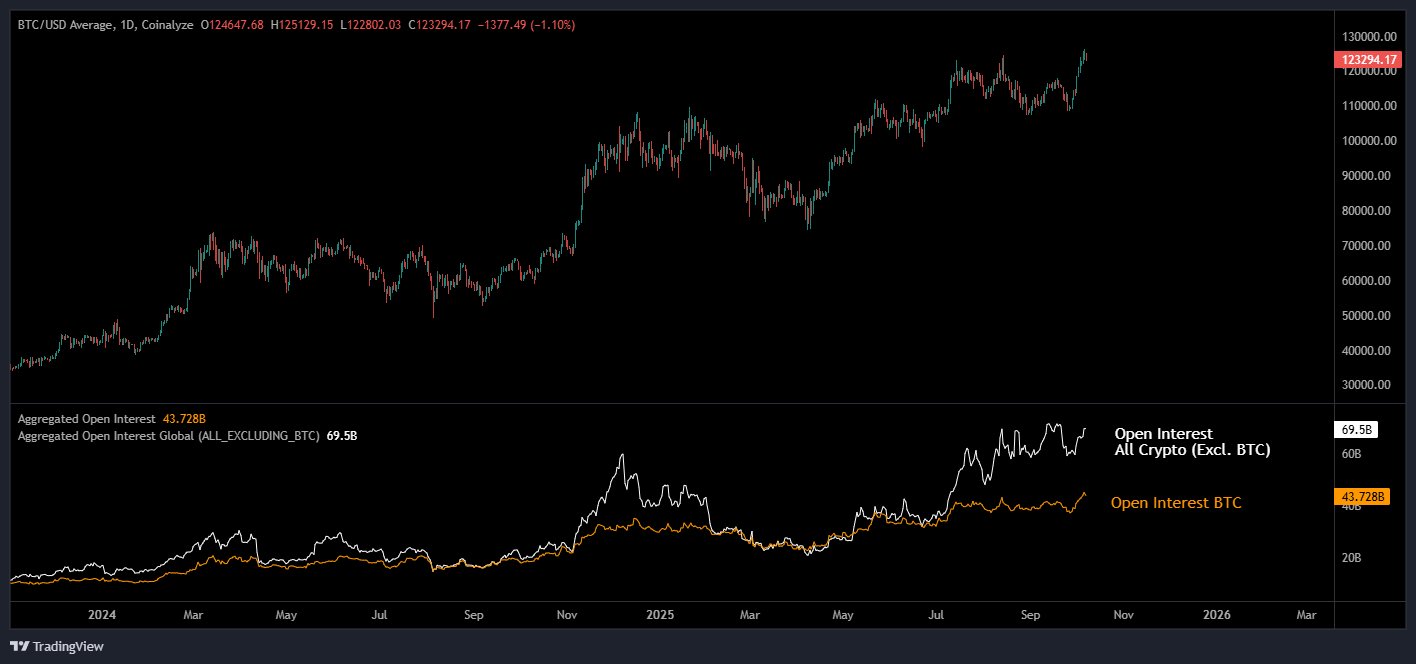

Bitcoin and Ethereum open interests hit a new high during the latest crypto market rally. The setup last witnessed in December led to months of sideways moves followed by a 30% broader crypto market crash, as per on-chain analyst Maartunn.

Long-term holders and whales are also selling. According to Onchain Lens data, a Bitcoin OG deposited 3,000 BTC into Hyperliquid and started selling it for USDC. The whale has sold 960.57 BTC for $116 million until now and holds 46,765 BTC worth $5.7 billion.

The current pullback is testing the market outlook, helping to reset leverage. It will be crucial to see where buyers step in and whether support levels attract renewed demand, as experts predicted a new ATH of $135K for Bitcoin.

Massive Bitcoin, ETH, XRP, SOL, DOGE, XPL Crypto Liquidations

The crypto market saw a massive $700 million in liquidations, according to Coinglass data. Notably, nearly $550 million in long positions and $150 million in short positions were liquidated over the last 24 hours.

This is turning into a bigger crypto market liquidation amid no signs of buy-the-dip, with over $150 million in long positions as the largest liquidation in an hour.

More than 180K traders were liquidated in the last 24 hours, with the largest single liquidation order of BTC-USDT swap worth $8.74 million on crypto exchange OKX. As per data, ETH, BTC, SOL, XRP, DOGE, XPL, WLFI, ASTER, BNB, AVAX, and HYPE recorded the largest liquidations, causing a broader crypto market crash.

Crypto Market Crash Ahead of FOMC Minutes Release

The 10-year US Treasury yield holds around 4.13% after slipping in the previous sessions ahead of the FOMC Minutes release and comments from Fed officials, including Jerome Powell. The market expects another 25 bps Fed rate cut this month.

Also, the U.S. Dollar Index (DXY) is moving towards 99 today, hitting a 2-month high after recent declines that fueled market recovery. This happens amid concerns regarding the ongoing US government shutdown and global uncertainties have lifted demand toward safe-haven assets.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs