Crypto Market Crash: BTC, ETH, XRP, SOL Trading Activity Drops

Highlights

- The crypto market is down, with old Bitcoin whales moving over $8 billion BTC today.

- Trump's trade deadline is also causing uncertainty in the market.

- Expectations for a July rate cut have dropped.

The crypto market liquidations have soared to $210 million in last 24 hours as top crypto assets like Bitcoin, Ethereum, XRP, and Solana, continue to face selling pressure, reversing gains from the earlier week. The latest market crash coincides with growing concerns that long-dormant Bitcoin whales may be offloading their holdings, with over $8 billion worth of BTC moved earlier today.

Why The Crypto Market Is Down Today

TradingView data shows that the total crypto market cap is down almost 2% today, dropping to $3.28 trillion. This drop has occurred following significant declines in the prices of major assets like BTC, ETH, XRP, SOL, and BNB.

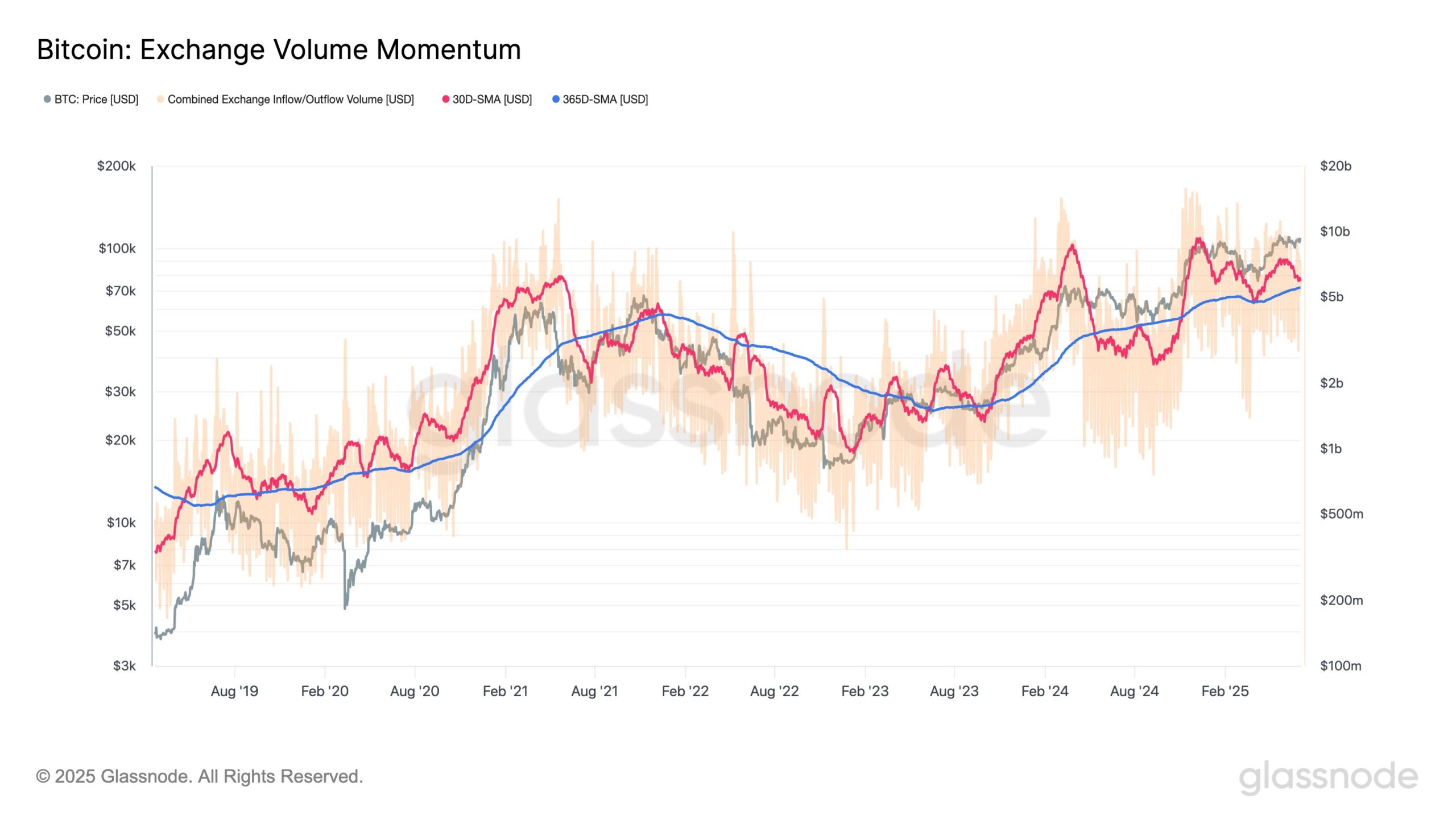

The Bitcoin price had dropped to as low as $107,600 today, recording a loss of over 2%. ETH is also down over 3% while XRP, SOL, and DOGE are down 2.67%, 2.70%, and 4.70% respectively. Additionally, on-chain data shows that the investor sentiment is weakening as of now. Blockchain analytics platform Glassnode noted:

“The momentum of (Bitcoin) exchange volume has declined since early June, with the monthly average falling to $5.9B, about 7% above the yearly average of $5.5B. This modest premium suggests weakening investor interest and slowing network activity despite price consolidation”.

Old BTC Whales Look To Be Selling

One reason the crypto market is crashing is the panic among investors that Bitcoin whales may be selling their holdings. As CoinGape reported earlier today, a Satoshi Era whale moved $2.14 billion BTC after 14 years of inactivity. Such movement typically raises concerns as it suggests that the investor is looking to offload their coins.

A sale of such magnitude can also massively impact the market, especially if it goes through exchanges rather than over-the-counter. This panic has further increased as more dormant wallets have coins worth over billions of dollars today.

Onchain analytics platform Lookonchain indicated that all these dormant wallets might be linked to a single entity. This old BTC whale has now transferred over 80,000 BTC ($8.69 billion) today and might be looking to offload them.

Currently, all 8 wallets woke up after 14 years of dormancy and transferred out 80,009 $BTC($8.69B).https://t.co/5FjcAQxb89 pic.twitter.com/HuoQT5hjFF

— Lookonchain (@lookonchain) July 4, 2025

Trade Deadline Sparks Concerns

The Trump tariffs deadline, which comes up on July 9, has also contributed to the crypto market crash. The US has yet to strike deals with economic powerhouses like India, Canada, and the EU.

Donald Trump has also dismissed rumors that he plans to extend the tariff deadline. Bitcoin and other crypto assets risk another decline if the US fails to strike these trade deals, since the reciprocal tariffs will then come into force.

According to a Bloomberg report, Trump plans to start notifying countries of US tariffs up to 70% from today. The president remarked that by July 9, they will be done informing these countries of the import duties placed on them, which will take effect from August.

Rate Cut Hopes Diminish

The crypto market has also crashed as hopes of a July Fed rate cut fade. As CoinGape reported, the odds for Powell and the FOMC to keep rates unchanged following the July meeting have surged above 90%.

This came following strong US job data, which suggests that the labor market is solid and that there is no need for the Fed to hurry and cut rates. Thanks to this development, traders are now betting on just two 25-basis-point (bps) rate cuts later in the year, according to CME data.

#FedWatch: Calls for three cuts in 2025 fade.

After today’s jobs report, markets are now pricing in two rate cuts in 2025 (year-end target range of 375-400 bps) as the most likely scenario. pic.twitter.com/M5ADG0d1by

— CME Group Interest Rates (@Interest_Rates) July 3, 2025

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs