Crypto Market Crash: Why Is Bitcoin, Ethereum, Solana, Dogecoin & XRP Price Dropping?

Highlights

- A crypto market crash has occured, with Bitcoin, Ethereum, Solana, and Dogecoin suffering price declines.

- This comes amid market uncertainty sparked by several factors.

- Developments in the market has also sparked a bearish sentiment.

Another crypto market crash is happening, with Bitcoin, Ethereum, Solana, and the Dogecoin price witnessing significant declines. This development comes amid the uncertainty in the market, which is sparking a bearish sentiment among investors.

Crypto Market Crash: Why BTC, ETH, SOL, DOGE & XRP Are Down

CoinMarketCap data shows that a crypto market crash has occurred, with the Bitcoin price sharply dropping below the psychological $95,000 level. The flagship crypto has also dragged altcoins along as they have suffered significant declines. Ethereum, Solana, and Dogecoin are down over 7%, 12%, and 11% respectively. Meanwhile, the XRP price is down over 9% in the last 24 hours.

This crash has occurred amid market uncertainty, with investors currently choosing to stay on the sidelines. Several developments have sparked this market uncertainty, including Donald Trump’s proposed tariffs on several countries. Today, the US president reaffirmed that he will move forward with the proposed tariffs on Mexico and Canada.

Another macro factor is the Federal Reserve’s quantitative tightening (QT) policies, which suggest that the US Central Bank is unlikely to cut interest rates anytime soon. Amid these developments, it remains uncertain when or if Donald Trump and his administration will implement the Strategic Bitcoin Reserve, which could provide a huge boost to the Bitcoin price.

It is also worth mentioning that the crash in the US stock market could have also contributed to the crypto market crash, as the Bitcoin price is known to correlate to these US stocks at times. The S&P 500 declined by almost 2% last week on Friday, which was the worst day in two months.

Developments In The Market

Developments in the market have also sparked this bearish sentiment among investors and contributed to the price crash across the board. One is the Bybit hack, which has raised concerns among crypto community members and also highlighted the security issues that persist in the industry.

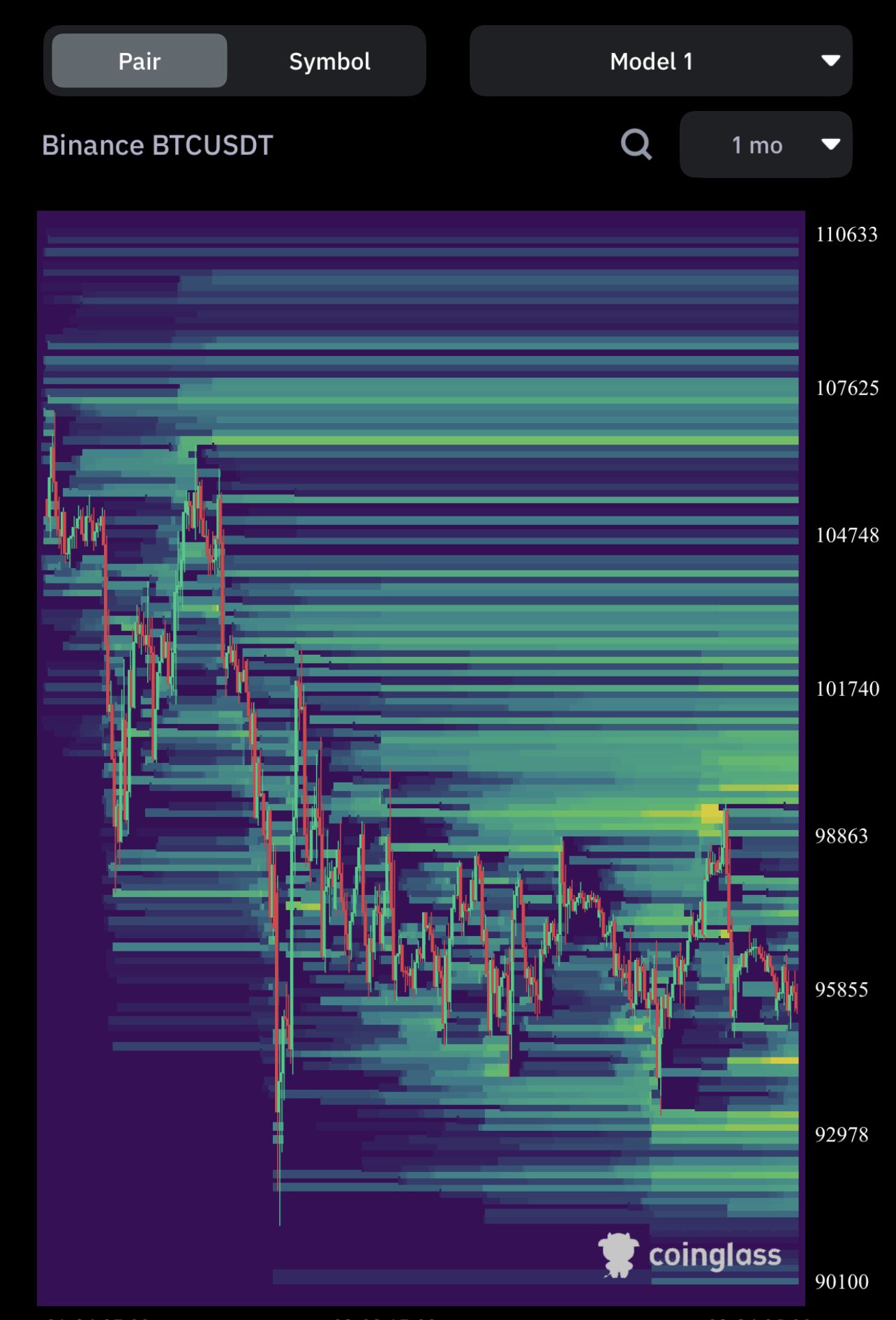

Furthermore, the market looks to be overleveraged at the moment, which could also be contributing to the crypto market crash. Crypto analyst Kevin Capital recently highlighted the liquidity heatmap in the derivatives market and noted that there are a “ton of longs the built up below” is down to $91,000.

The analyst remarked that BTC can head higher after liquidating these positions. He added that the flagship crypto needs more time to reset the 3-day MACD, which is already happening.

The Solana price has suffered one of the biggest declines amid this market crash. This is due to the token unlock of 11.2 million SOL, around $1.78 billion, which will happen on March 1. Some of these coins belong to institutional investors like Galaxy Digital, who bought these coins as part of the auction of FTX’s estate for a discounted price.

As such, SOL could face significant selling pressure as these investors move to secure profits. Ahead of the token unlock, Solana whales already look to be offloading their coins. As CoinGape reported, Binance dumped 100,000 SOL through market maker Wintermute, further sparking this bearish outlook for Solana.

Coinglass data shows that $1.2 billion has been wiped out from the crypto market in the last 24 hours. Long positions have taken the most hit, with $1.14 billion liquidated.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Ethereum Treasury BitMine Adds 50,928 ETH as Tom Lee Predicts March Bottom For Crypto Prices

- Bitget Champions Women’s Role in Crypto as Part of International Women’s Day Campaign

- Breaking: Michael Saylor’s Strategy Adds 3,015 BTC as Bitcoin Holds Steady Despite U.S.-Iran War

- BitMine’s Tom Lee Bets on ‘March Turnaround’ to Spark Crypto Market Recovery

- Bitget Unveils MotoGP-Inspired ‘Smarter Speed Challenge’ for Crypto, Stocks, and Gold Trading in Latest UEX Push

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

Buy $GGs

Buy $GGs