Crypto Market Crash: Why Is Bitcoin, Ethereum, Solana & XRP Price Dropping?

Highlights

- Bitcoin has dropped below the $95,000 support level, while ETH, SOL, and the XRP price have also declined.

- This crypto market crash has occurred to due a lot of uncertainty on the macro side.

- There has also been decline in inflows into the Bitcoin and Ethereum ecosystem, leading to the market crash.

Another crypto market crash is occurring, with the Bitcoin price dropping below the crucial $95,000 support level, dragging altcoins like Ethereum, Solana, and the XRP price along with it. This price crash has occurred mainly due to the bearish sentiment in the market, thanks to several factors.

Crypto Market Crash: Why BTC, ETH, SOL & XRP Are Down

CoinMarketCap data shows that a crypto market crash is occurring again, with the Bitcoin price dropping below the psychological $95,000 level. Altcoins like Ethereum, Solana, Dogecoin, and the XRP price have also significantly declined.

This price crash has occurred due to several factors, including global economic uncertainty. For one, US President Donald Trump continues to threaten to impose tariffs on other countries. Yesterday, the president announced that he has decided that for the purposes of fairness, he will charge reciprocal tariffs on countries that charge the US.

This continues to raise concerns about trade wars, which is bearish for the crypto market. Meanwhile, the bearish sentiment in the market is also due to the US Federal Reserve’s quantitative tightening policy, with no hopes of monetary easing policies anytime soon. Traders predict that there will be only one Fed rate cut this year, which is unlikely to come until the second half of the year.

These developments sparked a bearish sentiment among investors, ultimately leading to this crypto market crash. The Bitcoin price has struggled to reclaim $100,000 for a while now and now even looks more likely to touch $90,000.

Bearish Factors In The Market

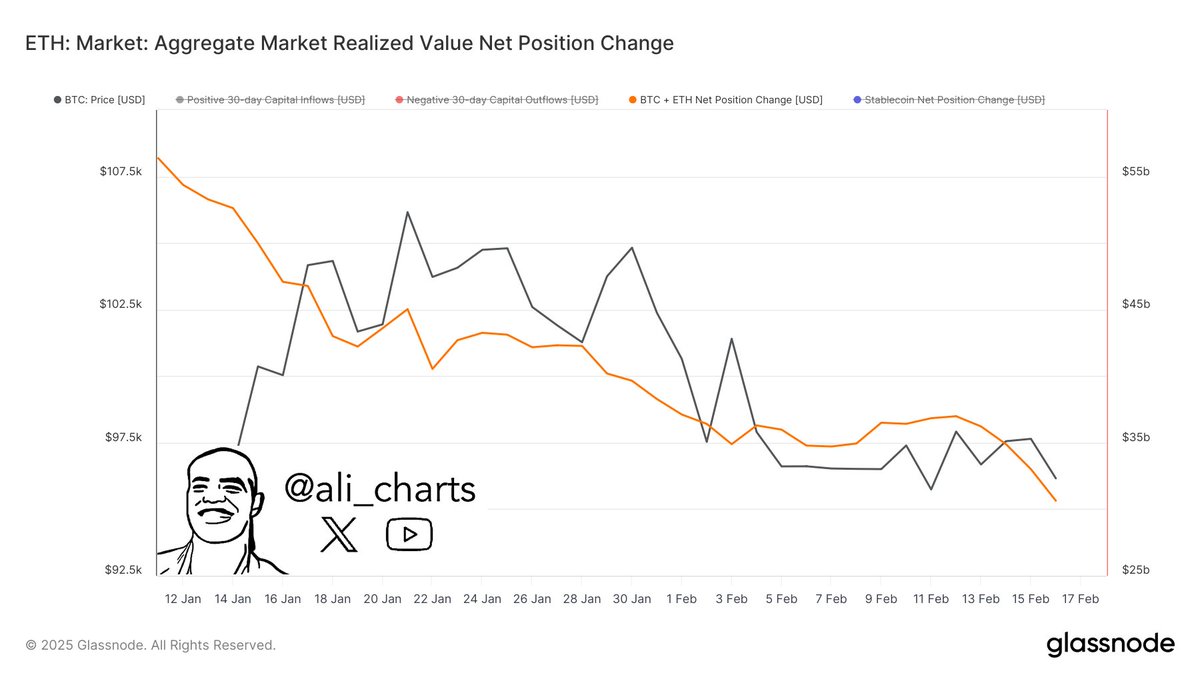

Besides the uncertainty on the macro side, other developments have led to the crypto market crash. Crypto analyst Ali Martinez recently revealed that the capital inflows into Bitcoin and Ethereum have declined by over 30% in the past month, dropping from $45 billion to $30 billion.

This indicates that there is a lack of liquidity in the market to sustain higher prices. Investors look to be holding off on allocating more capital to the market due to the bearish sentiment. Instead, more investors look to offloading their coins as the market likely priced in to Donald Trump’s administration even before he took office.

Moreover, some community members believe that Trump’s administration has fallen short of its promises to the crypto industry, considering that the Strategic Bitcoin Reserve initiative hasn’t yet happened.

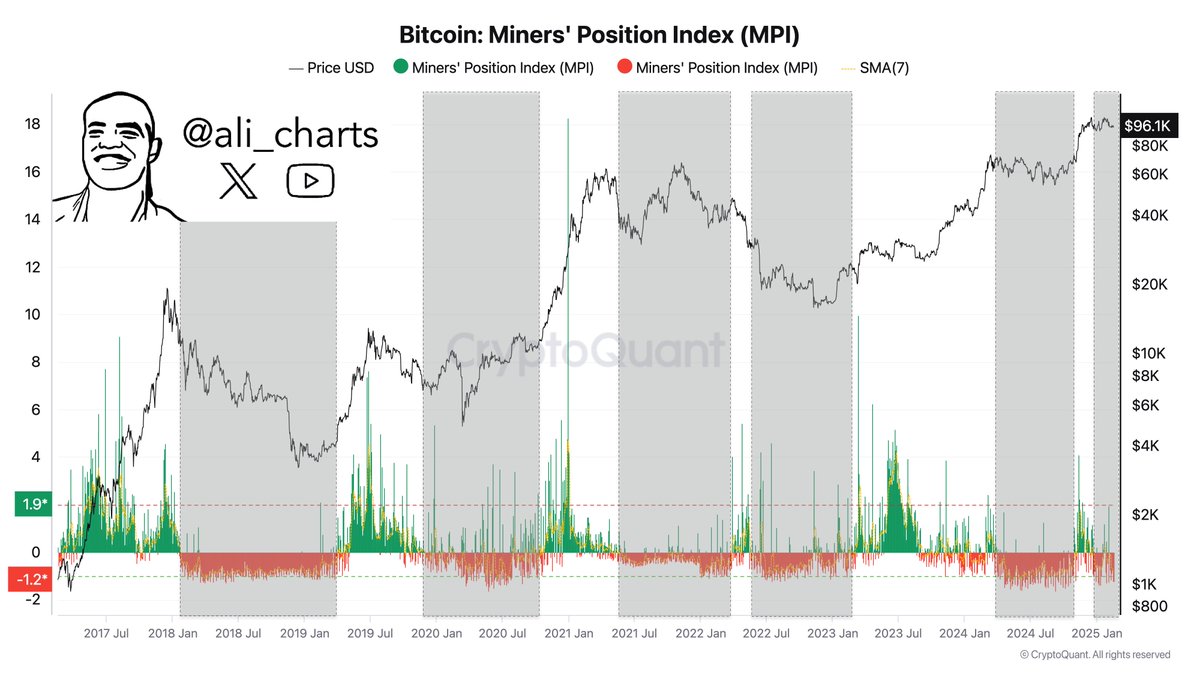

Amid this crypto market crash, Martinez has also suggested that the market could witness lower prices, as he revealed that prolonged price corrections have historically followed a decline in Bitcoin mining activity.

Away from the Bitcoin ecosystem, the bearish sentiment in the Solana sentiment also looks to be at an all-time high (ATH) following the LIBRA meme coin rug pull. Traders allegedly lost over $286 million to the rug pull, which has further sucked liquidity out of the crypto market.

This development has further dampened investors’ confidence, especially considering Argentina’s President Javier Milei promoted this meme coin on his X account. This saga has raised the ghosts of the TRUMP and Melania meme coins, which sucked liquidity from the market just before Donald Trump took office.

Coinglass data shows that over $300 million has been liquidated from the crypto market in the last 24 hours. Long positions took the most hit, with over $279 million in liquidations, while short positions have seen just over $55 million in liquidations.

- Top 8 Companies Leading the Tech and Compliance for RWA Tokenization

- US PCE Inflation Estimates by JPMorgan, BofA, & Other Wall Street Banks

- CLARITY Act: Banks and Crypto Make Progress Following “Constructive” Dialogue at White House Meeting

- Expert Warns Bitcoin Bear Market Just In ‘Phase 1’ as Glassnode Flags BTC Demand Exhaustion

- SEC Chair Reveals Regulatory Roadmap for Crypto Securities Amid Wait for CLARITY Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?