Will Crypto Face Another Crash Due To Massive Sell Pressure? Data Suggests So

After the dreadful 2018 crypto winter, the year 2022 marked the start of a new bear trend which was distinguished by the failure of prominent crypto businesses across the board. It was further accompanied by the precipitous decrease in the value of cryptocurrencies and the larger global market meltdown. This has now led to the dilemma of the crypto market’s direction for the coming year 2023.

Crypto To Face Another Crash?

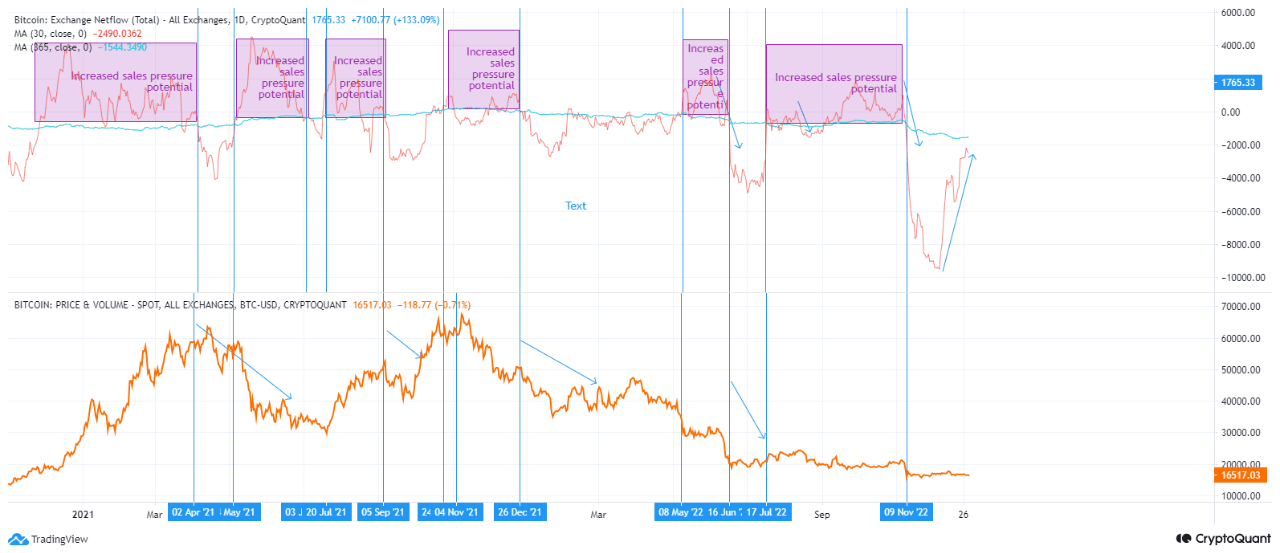

After conducting extensive research into crypto exchange’s netflow and historical indicators, a number of prominent hypotheses have been established by leading crypto analysts in the industry.

According to the data, the netflow will eventually become positive once it advances closer and closer to zero. This results in a lower number of buyers and a greater number of sellers. It is likely that at the same time that it turns positive, a local peak will be observed, followed by an increase in the amount of selling pressure on the future market. This can lead to a continuation of the downward trend and the loss of support that is currently in place.

The “exchange netflow” is an indicator that gauges the total net amount of cryptocurrency that is moving into or out of the wallets of all centralized exchanges. This metric can be positive or negative and the value is determined by subtracting the total amount of funds that were brought into the exchange from the total amount that was taken out.

Read More: MicroStrategy Sells 704 Bitcoins (BTC) For First Time Due To This Reason

Has Bitcoin Price Bottomed?

As reported earlier by CoinGape, the price of Bitcoin (BTC) is likely to drop much further given that the top cryptocurrency is not yet undervalued nor has it reached its bottom.

Furthermore, the degree of volatility seen in stablecoin inflows traded on spot exchanges has reached an all-time high. This suggests that Bitcoin might either begin a bull run or collapse to a new bottom in the near future.

As things stand, the price of Bitcoin is presently being traded at $16,532. This represents a decrease of 0.61% on the day, with a further decline of 1.85% during the week as per crypto market tracker CoinMarketCap.

Also Read: Shiba Inu (SHIB) Price To Surge After Reaching This New Milestone?

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- U.S House Introduces Bipartisan Crypto Bill To Protect Crypto Developers Amid DeFi Push Under CLARITY Act

- XRP News: Ripple Unveils Funding Hub To Support Innovation On XRPL

- ZachXBT Names Axiom Exchange in Alleged Employee Crypto Insider Trading Investigation

- Bitcoin Falls as U.S. Jobless Claims Signal Labor Market Rebound

- Bitcoin News: CitiBank to Launch BTC Services in 2026

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

Buy $GGs

Buy $GGs