Crypto Market Faces New Macro Jitters Ahead of Nvidia Earnings, FOMC Minutes, NFP Jobs Data

Highlights

- Crypto market braces for Yen carry trades unwind as Japan's long-term bond yield hits new high.

- Bitcoin, Ethereum, XRP and other altcoins pare gains ahead of Nvidia earnings, FOMC minutes, NFP jobs data.

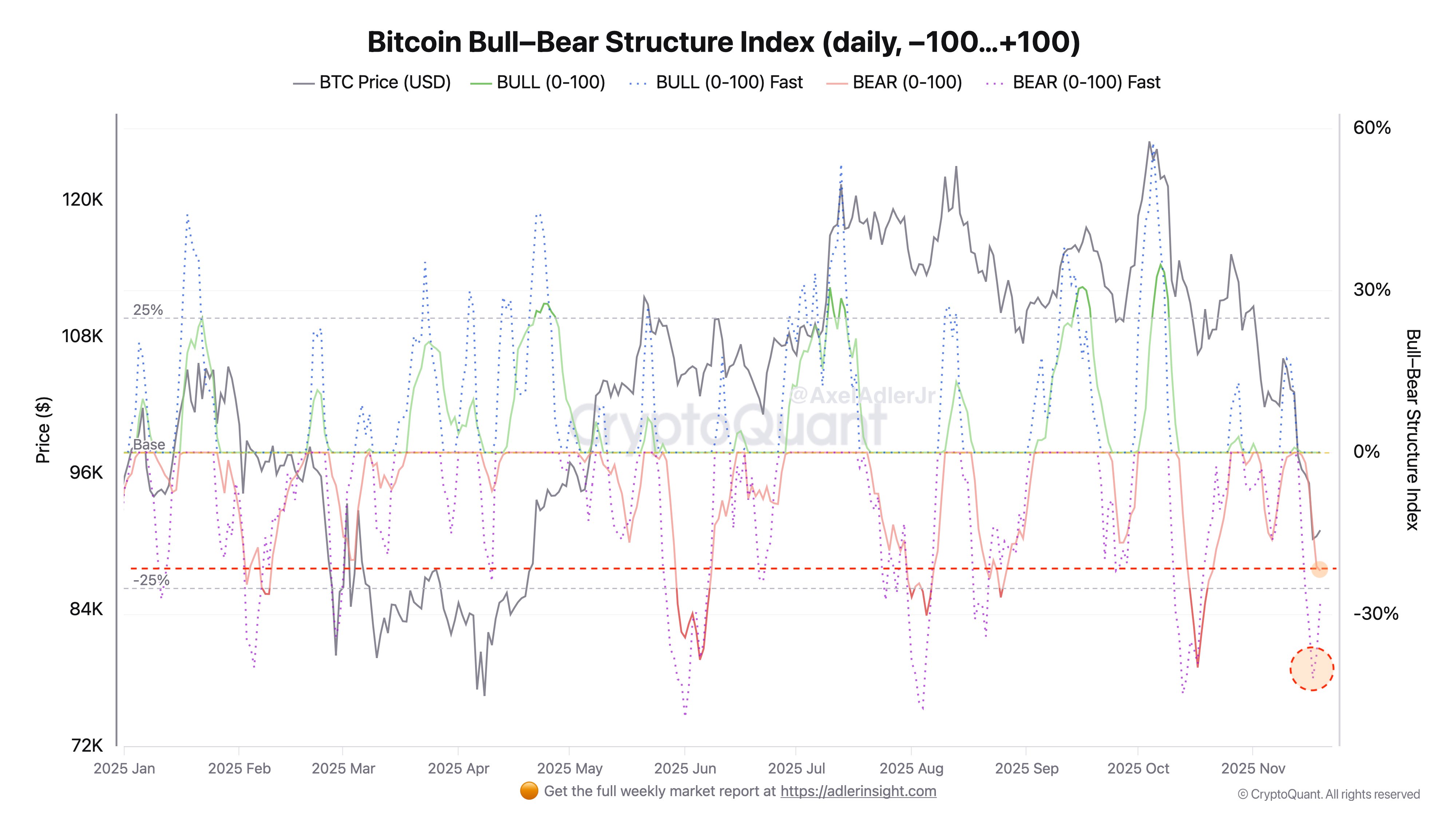

- Bull-Bear Structure Index signals continued dominance of bearish factors.

Bitcoin, Ethereum, XRP and other altcoins pare gains as the crypto market braces for another potential selloff. New macro jitters are unlocking ahead of key events such as Nvidia earnings, FOMC minutes release, and Nonfarm payroll jobs data this week.

Bitcoin, Crypto Market Falter as Japan’s Bond Yields Hit New High

Japan’s long-term government bond yields surge to record highs for the first time in history amid economic concerns. This has caused Bitcoin and the broader crypto market to drop amid signals of global liquidity tightening and potential unwinding of the Yen carry trades.

Today, Japan’s 40Y Government Bond Yield surged to its highest level in history at 3.697%, as markets prepare for Prime Minister Sanae Takaichi’s stimulus plan.

BREAKING: Japan's 40Y Government Bond Yield surges to 3.697%, its highest level in history, as markets prepare for more stimulus. pic.twitter.com/NgyJKRdDva

— The Kobeissi Letter (@KobeissiLetter) November 19, 2025

The macro jitters sparked reactions across the crypto market. Bitwise Invest CIO Jeff Park said “Japan’s 30Y bond yield has never been higher in history than it is now. The global carry machine is on life support.”

Meanwhile, Bank of Japan (BOJ) Governor Kazuo Ueda told Prime Minister Takaichi that the central bank will hike rates to curb inflation in line with its 2% target.

However, a further rise in bond yields could trigger unwinding of Yen carry trades. Global yen carry trade exposure accounts for $20 trillion, which can shake markets, including Bitcoin, as seen during an earlier crypto market crashes.

Crypto Market Braces for Nvidia and FOMC Meeting

Bitcoin, Ethereum, XRP and the broader crypto market rebounded after the latest data showed a rise in jobless claims in the United States. The weakening labor market fueled December’s Fed rate cut odds.

However, BTC price has again dropped below $90K after rebounding above $93K, signaling uncertainty rising ahead of key events such as Nvidia earnings and FOMC minutes release today.

Nvidia to report its Q3 earnings after market hours on Wednesday, amid AI bubble fears. Nvidia earnings will determine the sustainability of Wall Street’s massive AI-driven investments. NDVA stock closed 2.81% lower at $181.36 on Tuesday, extending the fall to 7.26% in a week.

The crypto market participants face the FOMC minutes release later today. Markets trimmed bets on a Fed rate cut in December amid hawkish outlook. The CME FedWatch tool now shows below 49% odds of another 25 bps Fed rate cut as the Fed officials remain divided.

Meanwhile, US President Donald Trump aims to replace Fed Chair before Christmas as Jerome Powell sticks to his hawkish stance. Fed concerns could raise short-term crash concerns in the global markets.

Key Jobs Data to Watch

Thursday’s Nonfarm payroll and unemployment rate data for September is key due to first jobs data release post government shutdown. Moreover, the White House confirmed that no October CPI and jobs data will be released.

At the time of writing, ETH price wavers above $3,000 after a major crash, with trading volume dropping 30% over the past 24 hours.

Meanwhile, XRP price holds near $2.15, but analysts see whale distributions in this early bear market could result in an additional price drop.

The Bull-Bear Structure Index signals the continued dominance of bearish factors. These include negative taker flow, persistent derivatives pressure, and ongoing ETF outflows.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Prices Today: BTC, ETH, XRP Prices Surge Despite Iran’s Strait of Hormuz Closure

- Nasdaq Brings Prediction Markets to Wall Street with New SEC Filing

- Is the Bitcoin Price Correction Really Over or Is This a Bear Market Trap?

- ‘Gambling Is Not Investing’: New Group Pushes Crackdown on Prediction Markets

- XRP News: Ripple Prime to Move Post-Trade Activity to XRPL via NSCC Link

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs