Crypto Market Tumbles as Jerome Powell Says December Rate Cut ‘Far From Certain’

Highlights

- Powell signals no December rate cut, ending Fed’s balance sheet runoff.

- Bitcoin and Ethereum slide after Fed hints at pause in easing.

- Earlier 25 bps rate cut by the Fed could now be the last for the year

The crypto market turned sharply lower on Tuesday after Federal Reserve Chair Jerome Powell said another interest rate cut in December is “far from certain.” His comments dampened investor optimism that the Fed would continue easing monetary policy to support slowing growth.

Powell Ends Quantitative Tightening, Hints At No Rate Cut in December

Speaking after the October Federal Open Market Committee (FOMC) meeting, Powell admitted that the U.S. labor market is weakening while inflation remains “somewhat elevated.” He added that recent data show the overall economic outlook has not changed significantly despite earlier signs of softening. Powell warned that higher tariffs are adding pressure on prices, creating a difficult balance for the central bank.

The comments come as the Fed reduced rate by 25 basis point, which was the same it did last month. It was done to boosting the slowdown in the growth of the economy and the continued rise in borrowing costs.

He also revealed that Fed officials hold “strongly different views” about whether another cut should come in December. “A further reduction in the policy rate at the December meeting is not a foregone conclusion. Far from it,” Powell said.

The Fed decided to end its balance-sheet runoff starting December 1, saying reserves have reached levels consistent with ample liquidity. Powell stated that this step had to be taken as repo rates and funding costs have been up lately. His statement suggests that the Fed has ended quantitative tightening, but it is likely not to make any further reductions in rates.

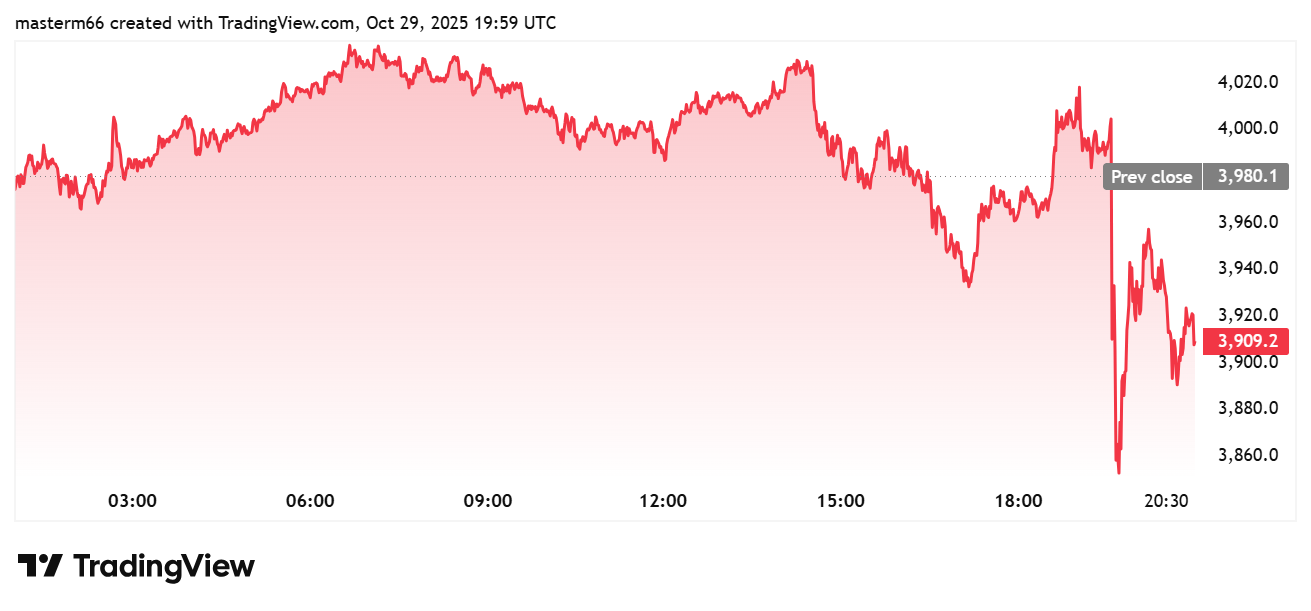

Bitcoin, Ethereum Slide as Powell’s Remarks Trigger Market Selloff

Markets reacted quickly to the mixed signals. BTC price fell 1.49% to $111,237, while Ethereum dropped 1.07% to $3,937, according to TradingView data. Both assets slid immediately after Powell’s remarks, erasing earlier gains.

As part of a recurring post-FOMC trend by Bitcoin, its price could still rise again. It may even reach a new all-time high before next month’s Fed meeting.

Traders understood Powell’s statement to be a caution that the rate cuts won’t happen again this year, making risk assets like cryptocurrencies less attractive. The drop mirrored declines across broader financial markets, as U.S. Treasury yields moved higher and the dollar strengthened.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Breaking: Ethereum Treasury BitMine Adds 50,928 ETH as Tom Lee Predicts March Bottom For Crypto Prices

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

Buy $GGs

Buy $GGs