What’s Making The Crypto Market Fall Today?

After the SEC accused California-based Kraken crypto exchange of offering an unregistered crypto staking program, calling it as a violation of the U.S. securities law — panic spread across the broader cryptocurrency market. Market participants and crypto enthusiasts are right now unaware of whether or not staking would be completely eradicated by the country’s financial watchdog.

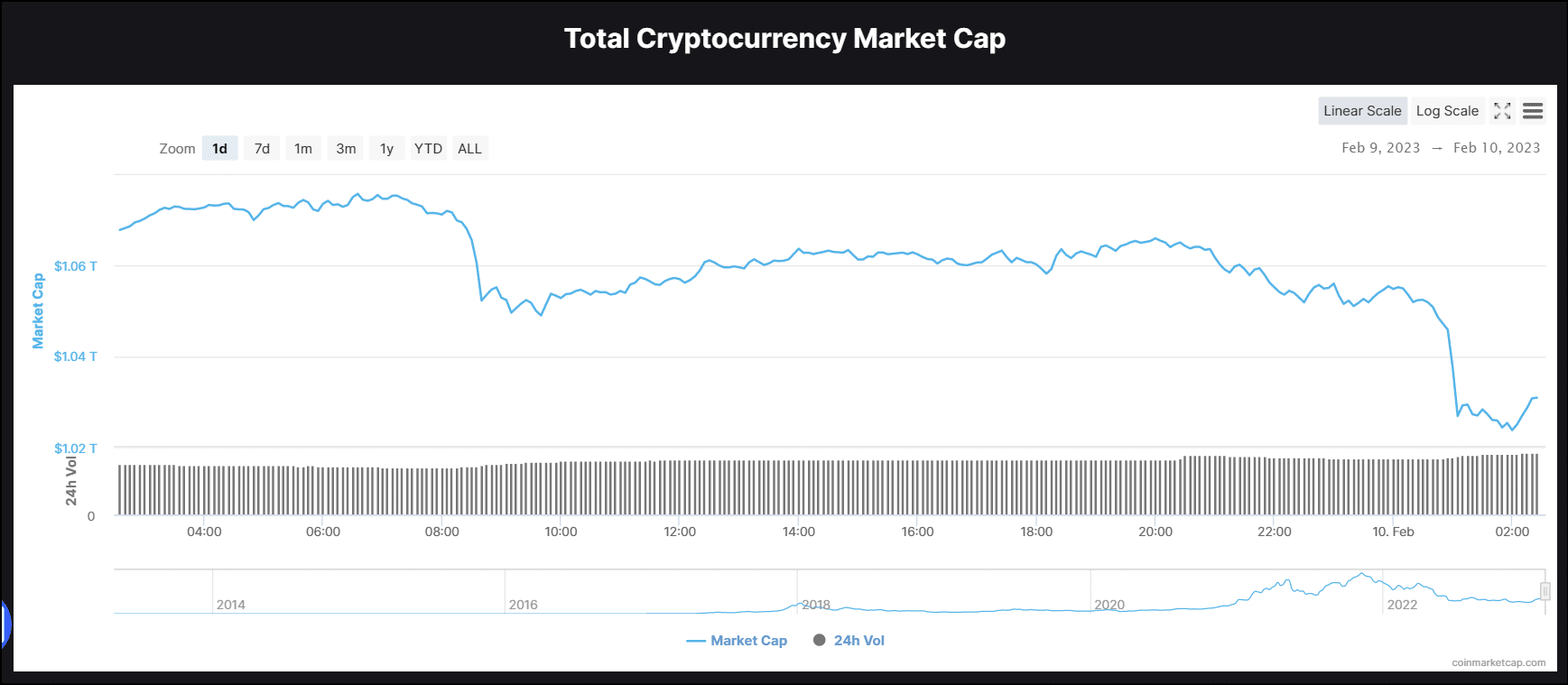

Crypto Market Tumbles

In spite of the fact that a similar rumor had been tweeted by Coinbase CEO Brian Armstrong earlier today, the SEC’s direct action sent shockwaves in the crypto market. This caused the price of Bitcoin (BTC) to drop by approximately 4% in the last hour, bringing it back down to the level of $21k. After hearing that the exchange would be disabling its staking feature, a total of around $30 billion in funds exited the cryptocurrency market.

Read More: Check Out The Top 10 DeFi Lending Platforms Of 2023

Moreover, after trading above $23,000 earlier this week, Bitcoin went down to almost $21,500 as of 3:30 p.m. in New York. Altcoin supremo, Ethereum, also fell more than 5%, while other tokens like Avalanche (AVAX) and Dogecoin (DOGE) experienced declines of above 8%.

SEC Chair Gary Gensler said in a statement that:

Today’s action should make clear to the marketplace that staking-as-a-service providers must register and provide full, fair, and truthful disclosure and investor protection.

Looming Fear For DeFi Grows

On several blockchains, including Ethereum, the proof-of-stake (PoS) method is used to order transactions by using collections of cryptocurrencies. According to Kraken and Staked’s quarterly report, the value of staked coins reached $42 billion at the end of last year. The report claims that 23% of the market capitalization of all cryptocurrencies is held by blockchains that use staking. Last September, Ethereum switched to proof of stake and among the top five staked ether depositors in the world, Kraken ranks 4th.

On the other hand, U.S. stocks were also trading lower on Thursday, with the S&P 500 on track for its third decline this week. The S&P500 closed at a negative 0.85%, Nasdaq at -1.05% while Dow ended at a -0.70% loss for the day. However, industry experts predict that cryptocurrency prices will continue to fall in the near future. DeFi-specific tokens are predicted to be struck the hardest, as crypto staking is essentially a vital by-product of the larger DeFi ecosystem.

Also Read: Are These Tokens The Future of Crypto Gaming In 2023?

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Fed Rate Cut Odds Drop as Inflation Fears Rise Due To U.S. Iran Conflict

- Here’s Why Tether Gold (XAUt) Price Is Falling Even With Growing Gold Demand

- XRP News: Ripple Expands Payments Platform To Unify Fiat and Stablecoins Globally

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs