Crypto Market Rally: Here’s Why BTC, ETH, SOL, XRP, And Others Are Up Today

The global crypto market cap increased more than 6% to $1.75 today, reaching the May 2022 level, backed by a 30% rise in total crypto market volume in the last 24 hours. Bitcoin dominance rises again to 50.94% after a splendid 8% rally over the last day. On the other hand, Ethereum (ETH) price soars 7% to a hit of $2,428 and gaining in momentum towards 3,000.

The broader crypto market rally began on New Year’s Day as positive sentiment rose ahead of a plausible spot Bitcoin ETF approval by the U.S. Securities and Exchange Commission (SEC) near January 10, 2024.

Why Bitcoin and Crypto Market Are Rallying?

As predicted by CoinGape on Dec 30, the crypto market started 2024 with a bullish rally despite concerns over Bitcoin and Ethereum open interests (OI) getting wiped out completely during an $11 billion annual expiry last week. Bitcoin and Ethereum futures and options OI started rising gradually.

The crypto market saw over $160 million in liquidation in the last 24 hours. Coinglass data indicate massive shorts liquidation of over $130 million today. More than 46k traders were liquidated in the last 24 hours, with the largest single liquidation order on Binance’s BTCUSDT worth $10.16 million. As a result of over $200 million of shorts liquidation, the broader crypto market is “green” today.

In addition, the total Bitcoin futures OI on all exchanges skyrockets almost 10% to $20 billion. BTC OI on CME and Binance jumped 7.76% and 14.20%, respectively. Also, BTC options data saw 70% of calls, with the most volume in the last 24 hours.

The total Ethereum futures OI is $$8.24 billion, up 9% in the last 24 hours. ETH OI on the top three futures crypto exchanges Binance, Bybit, and OKX rose 9-11%. Also, ETH options data saw 75% of calls in the last 24 hours.

CoinGape also reported Bitcoin funding rate reached a staggering 66%, which shows that the bulls are willing to hold their positions. Matrixport reported that Bitcoin mining companies are showing a trend of limiting supply around the upcoming halving cycles, anticipated for April 2024.

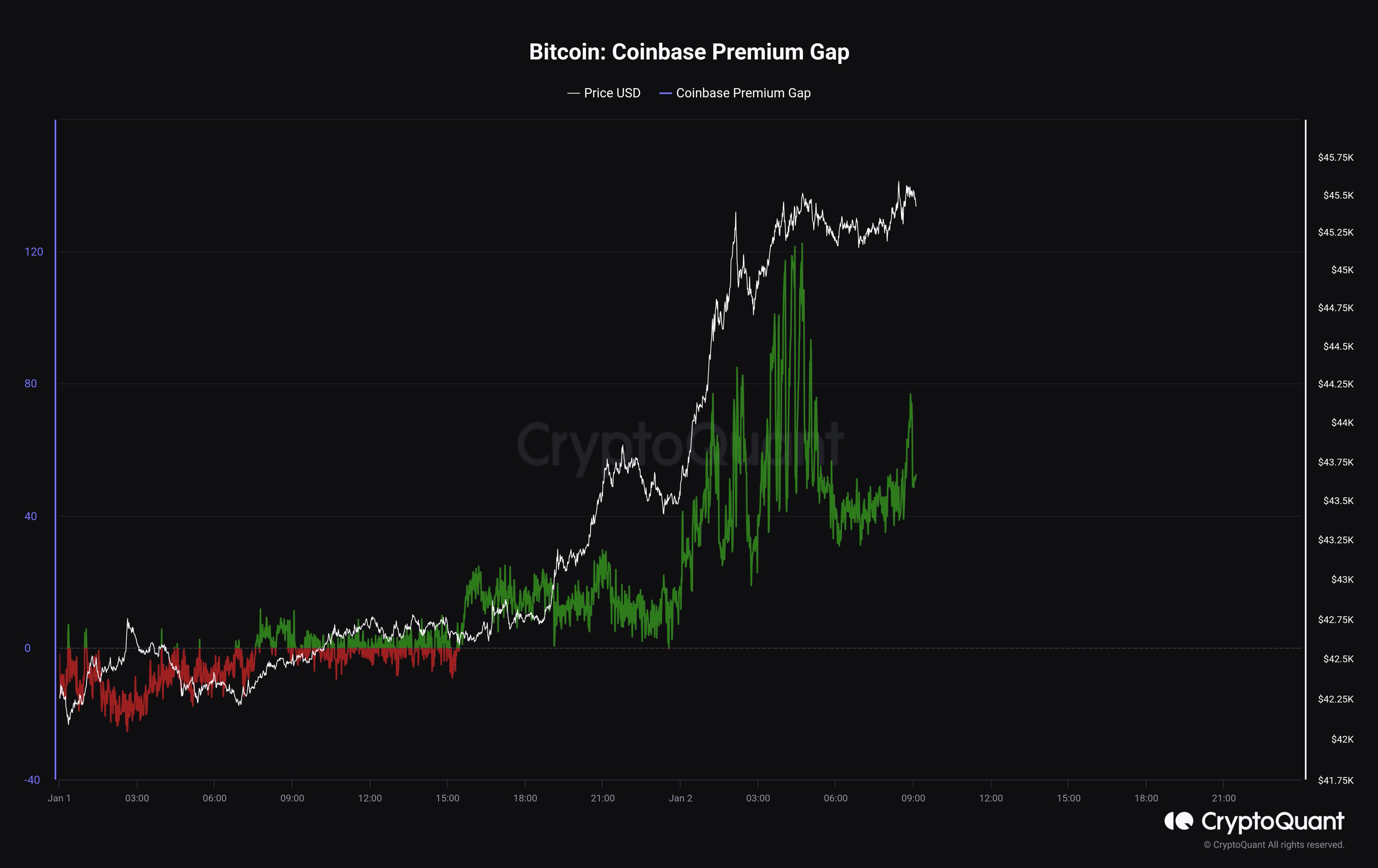

Coinbase Premium Gap started to increase again on Jan 2, suggesting strong Bitcoin buying pressure on Coinbase. BTC price started to move suddenly as traders and investors made new bets.

Also Read: Solana Labs Co-Founder Addresses Community Concerns Over Ecosystem Security

Crypto Market Rally: Bitcoin and Altcoins Prices

BTC price jumped 8% in the past 24 hours, with the price currently trading at $45,765. The 24-hour low and high are $42,547 and $45,899, respectively. Furthermore, the trading volume has increased by 92% in the last 24 hours, indicating a rise in interest among traders.

Ethereum climbed 7% and SOL skyrocketed 12% amid rising activity on the chain. Whereas, other altcoins XRP, ADA, AVAX, DOGE, DOT, and MATIC pumped 3-7% in the last 24 hours amid a broader recovery.

Also Read: Binance Burns 5.57 Billion Terra Luna Classic, LUNC And USTC Prices Rise Over 7%

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Crypto Market Update: Top 3 Reasons Why BTC, ETH, XRP and ADA is Up

- Crypto News: Bitcoin Sell-Off Fears Rise as War Threatens Iran’s BTC Mining Operations

- U.S.–Iran War: Monday Crypto Crash Odds Rise As Pundits Predict Oil Price Spike

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

Buy $GGs

Buy $GGs