Crypto Market Rally: Will Bitcoin Catch Up With S&P 500 Gains After Fed Rate Cut?

Highlights

- Fed rate cut announcement triggers crypto market rally with altcoins like BNB, SOL, ADA, DOGE, and XRP gaining 3–5%.

- Market liquidations totaled $415 million while open interest in ETH, XRP, and BNB rose signalling bullish sentiment.

- Analysts note Bitcoin’s strong correlation with the S&P 500, which historically rallies 14–15% in the year following rate cuts.

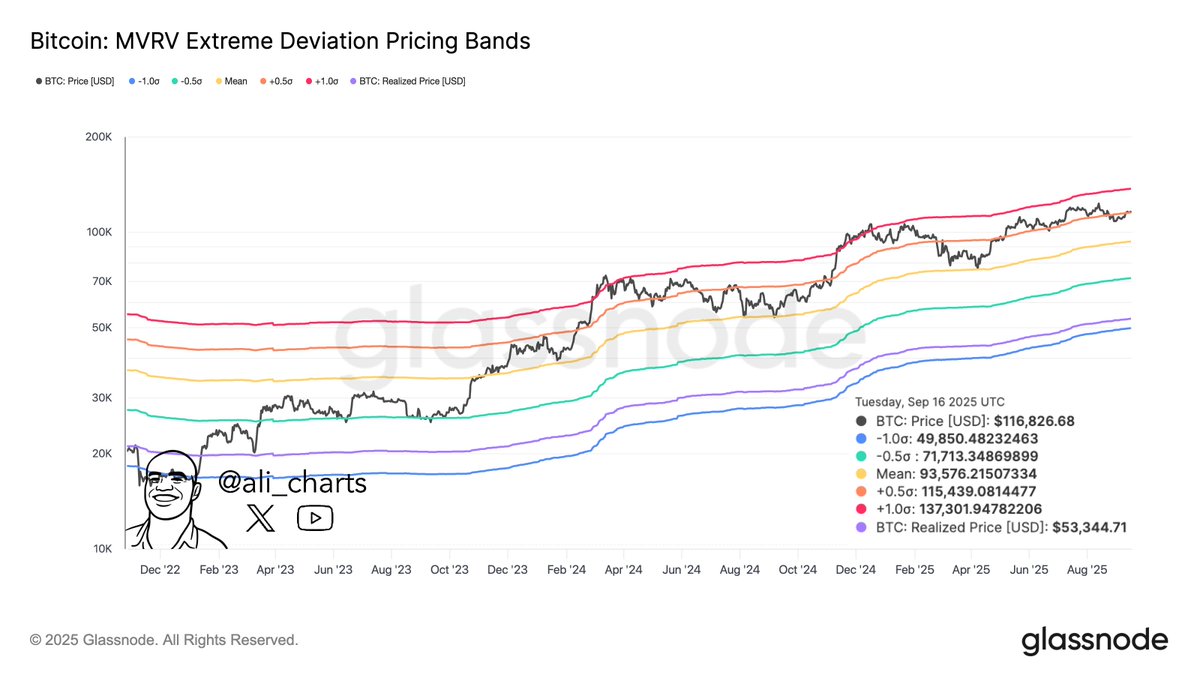

- BTC’s key support seen at $115,440 with potential upside toward $137,300.

Jerome Powell’s announcement of 25 bps Fed rate cut at the September 17 FOMC, has triggered a strong crypto market rally with Bitcoin (BTC) and altcoins seeing strong gains. The overall market liquidations have surged to $415 million, of which $232 million is in short liquidation. Historical trends suggest that in the year after rate cuts, S&P 500 rallies an average of 15%. Considering BTC’s strong correlation with the US index, analysts are predicting what happens next.

BTC, SOL, BNB, DOGE Lead Crypto Market Rally on Fed Rate Cuts

During yesterday’s FOMC meeting, Federal Reserve Chairman Jerome Powell announced the much-awaited 25 bps interest rate cuts, the first in 2025. Investors have reacted positively, with the broader crypto market rallying today, as top digital assets like Ethereum (ETH), Binance Coin (BNB), Solana (SOL), Dogecoin (DOGE) and Cardano (ADA), gained between 3-5%.

The BTC daily trading volume has surged 41% to more than $67 billion, highlighting bullish sentiment among traders. On hopes of a fresh liquidity influx following rate cuts, altcoins are showing even greater strength. Ripple’s XRP is up by 3% today, while BNB Coin (BNB) hits new all-time highs, eyeing a $1000 breakout amid rumors of CZ’s return to Binance.

On the other hand, the US SEC has allowed a proposed rule change to adopt generic listing standards for crypto ETFs. This could usher in a new wave of approval for ETFs around SOL, ADA, DOGE, etc. In the last 24 hours, each of these three altcoins gained more than 5%.

Blockchain analytics firm Glassnode reported that open interest (OI) in Ethereum (ETH), Ripple (XRP), and Binance Coin (BNB) has been climbing. This indicates renewed leveraged activity and increasing demand for directional exposure in these altcoins.

Will Bitcoin Catch Up With the S&P 500 Rally?

While the S&P 500 has continued to inch higher to all-time highs above 6,600, Bitcoin rally has stalled in the last few weeks, and BTC price continues to flirt with the $112,000-$115,000 range. Market researchers at The Kobeisse Letter noted:

“Rate cuts have begun at record highs. When the Fed cuts rates within 2% of all time highs, the S&P 500 has risen an average of +14% in 12 months”.

As of now, the Bitcoin price is trading 1% up at $117,531 amid the broader crypto market rally. A daily close above $17,200 could lead to further gains to $120K. Investors are still in a wait-and-watch mode as BTC volatility subsides.

Crypto analyst Ali Martinez highlighted $115,440 as the key support level for Bitcoin (BTC) based on Pricing Bands. He noted that holding this level could set the stage for a move toward $137,300, while a breakdown below it may open the downside to $93,600.

- Harvard Management Co (HMC) Cuts BlackRock Bitcoin ETF Exposure by 21%, Rotates to Ethereum

- Morgan Stanley, Other TradFi Load Up SOL as Solana RWA Tokenized Value Hits $1.66B ATH

- Trump’s WLFI Slides 8% as Senators Tell Bessent To Review World Liberty’s UAE Stake

- XRP Price Slides Under $1.5 Amid $50M Market Dump on Upbit

- Is Bitcoin Bottom Still Far Away as Matrixport Says More Bear Market Signals Are Emerging?

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today