Crypto Market Rebounds As Donald Trump Exempts Tech From Tariffs On China

Highlights

- The crypto market has rebounded following Trump's decision to exempt phones, computers and chips from tariffs on China.

- The Bitcoin price surged past $85,000 following this announcement.

- Trump's decision has reduced the severity of the tariffs he imposed earlier this month.

The crypto market, led by Bitcoin, has rebounded following Donald Trump’s decision to exempt tech products from tariffs he has imposed on China and other countries. Market participants see this as a positive amid the ongoing trade war between the US and China.

Crypto Market Rebounds As Donald Trump Exempts Tech Products From Tariffs

The crypto market has surged following Donald Trump’s move to exempt tech products from reciprocal tariffs imposed on China and other countries. According to a CNBC report, the US president has exempted phones, computers, and chips from the new tariffs.

The Bitcoin price surged past the $85,000 market following this report, with other altcoins also recording significant gains. This development is undoubtedly bullish for the market as it reduces the severity of the tariffs that Trump imposed on almost all countries earlier this month.

Moreover, this represents a big win for the stock market, with companies like Apple the biggest beneficiaries of this exemption. As such, it is normal for the crypto market to rebound alongside, given Bitcoin’s correlation with stocks.

Meanwhile, this move could also mark the beginning of the end of the ongoing trade war between the US and China. As CoinGape reported, China yesterday announced a 125% tariff on US imports following the latter’s decision to impose 145% tariffs on Chinese goods.

Trump already mentioned that he is looking forward to making a deal with China, which is also positive for the market. Bitcoin and altcoins could witness another massive rally once that happens.

Correctional Phase Could Soon Be Over

In a recent X post, crypto analyst Kevin Capital suggested that the correctional phase could soon be over for the crypto market. He noted that this phase has so far gone according to plan. However, he warned that there is still a lot of work to be done.

The analyst believes it is important for the Bitcoin price to clear the $89,000 level before market participants start feeling good. He added that the macro side also needs to line up for things to start looking really good for the market.

The macro side looks to be progressing well as the Federal Reserve recently revealed plans to provide liquidity if necessary. Meanwhile, the latest CPI and PPI inflation data came in lower than expectations, which could also motivate the Fed to start easing monetary policies.

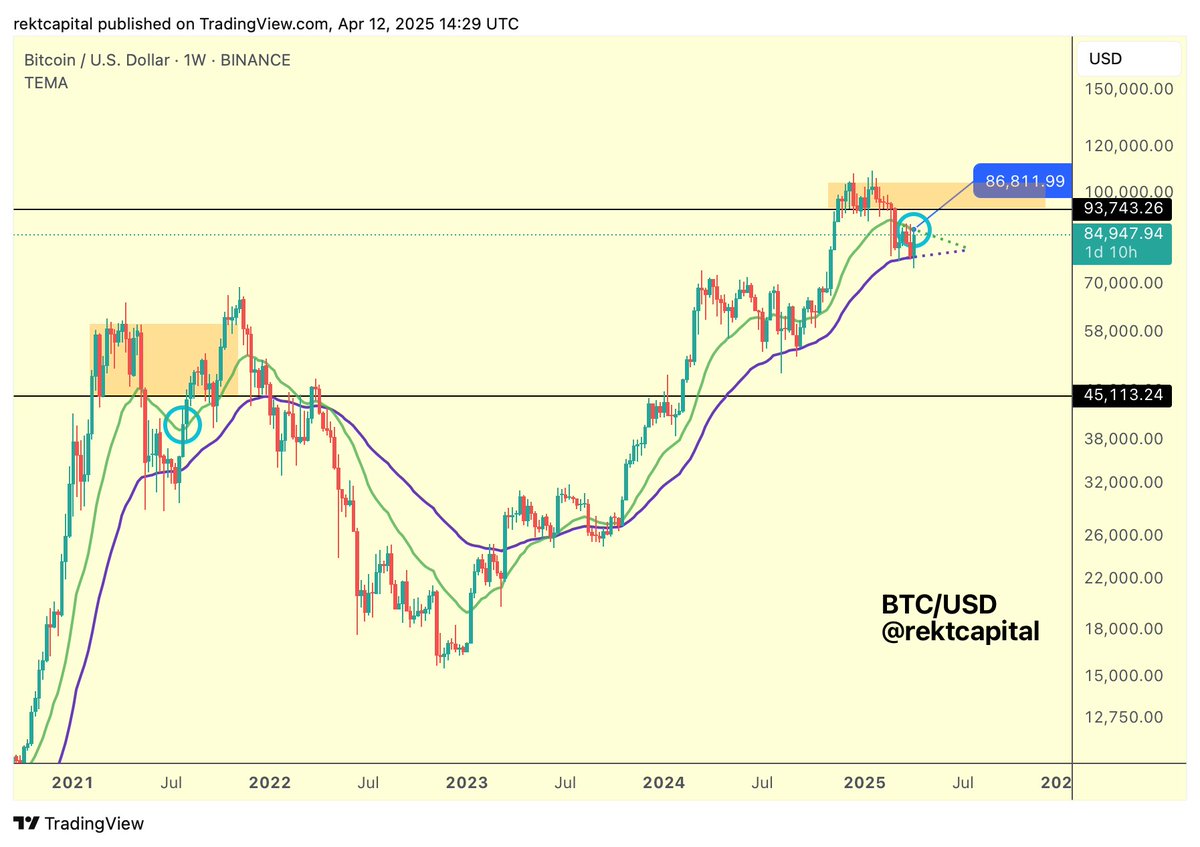

Crypto analyst Rekt Capital warned that Bitcoin isn’t there yet. He stated that it would be momentous to weekly close above $86,000, as this would potentially set BTC up for a repeat of a mid-2021 breakout. However, the flagship crypto is still away from the bullish weekly close of $86,811.

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Trump Tariffs: U.S. Raises Global Tariff Rate To 15% Following Supreme Court Ruling

- Bitwise CIO Names BTC, ETH, SOL, and LINK as ‘Mount Rushmore’ of Crypto Amid Market Weakness

- Prediction Market News: Kalshi Faces New Lawsuit Amid State Regulatory Crackdown

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise