Crypto Market Selloff: $330M Liquidated As Bitcoin Price Fell Under $62K, Here’s Why

Highlights

- Bitcoin price extends decline to 6% in last 24 hours as indicators point to more fall.

- Pre-halving Bitcoin price correction and macro factors continue to push market under selling pressure.

- US 10-year Treasury yield jumped to a high of 4.663% today.

- Federal Reserve Chair Jerome Powell and Vice Chair Philip Jefferson believe rates will remain higher for longer.

Crypto market saw another sudden market-wide selloff in the early US hours, with more than $30 million liquidated in an hour. Bitcoin price slipped from $63,340 to a low of $61,600, extending the intraday drop to 6%.

Ethereum price also briefly fell below $3,000 amid numerous liquidation orders, triggered by weak sentiment ahead of Bitcoin halving. Other top altcoins including BNB, SOL, XRP, DOGE, TON, ADA, and SHIB witnessed a 2-3% fall in prices within an hour. Solana and Toncoin prices have tumbled 14% and 15% in the last 24 hours.

Why Bitcoin Price Fell Suddenly

The pre-halving correction in Bitcoin price coupled with macro and geopolitical factors pulls down BTC price, with no major buying from whales and large investors.

Coinglass data shows more than $330 million were liquidated across the crypto market amid this strong correction. Of these, $260 million long positions were liquidated and nearly $70 million short positions were liquidated on Tuesday.

Over 109K traders were liquidated and the largest single liquidation order happened on crypto exchange OKX as someone swapped ETH to USD valued at $5.97 million.

Bollinger bands (blue) indicator reveals BTC price is in a downside trend, failing to break above the 20-simple moving average (orange). Ichimoku Cloud shows price continue to move under support and the selling pressure is rising as trend reversed, with the cloud widening.

Also Read: BlackRock Co-founder Predicts Market Comeback

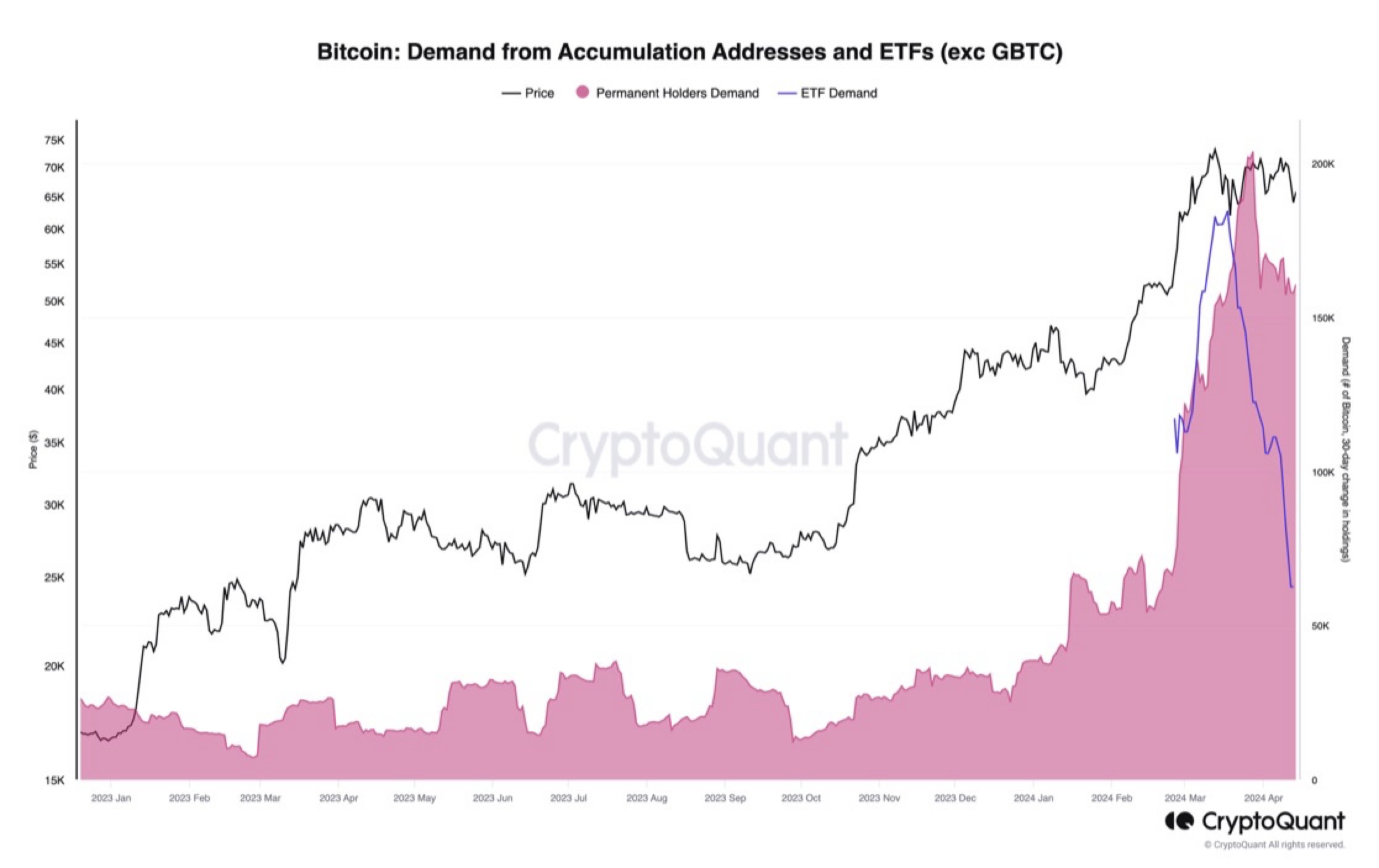

CryptoQuant head of research Julio Moreno joined other experts such as analyst Markus Thielen to express bearish sentiment developing on BTC. “Bitcoin demand growth has slowed down significantly, both from ETFs and other permanent holders,” said Moreno. Bitcoin demand from accumulation addresses and ETFs has faded ahead halving.

Analyst Predicts A Fall to $55K

Popular analyst Michael van de Poppe predicts a $55K level is likely as BTC price holds up on support after a lower timeframe rejection. However, he believes Bitcoin will hold near current levels and start a slow upward momentum. The bearish divergence stays valid as consolidation for the post-halving rally builds up.

The global macroeconomic events caused US dollar index (DXY) to climb above 106.23, continuing to rise higher. Whereas, the US 10-year Treasury yield jumped to a high of 4.663% today on open. As Bitcoin moves opposite to DXY and Treasury yields, a rise in both DXY and 10-yr treasury yield has caused a sudden fall in Bitcoin price below $62k, triggering a crypto market selloff.

Meanwhile, Federal Reserve Chair Jerome Powell and Vice Chair Philip Jefferson will make public comments today, which are likely to be their last before the U.S. central bank’s next meeting. Interest rates could be high for longer as inflation remains high, both reaffirmed earlier.

Also Read: Ripple Vs SEC Lawsuit — Settlement Debates & XRP Price Fall Concerns

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs