Crypto Market Selloff: ETH, SOL, XRP, DOGE, & PEPE Price Plunge Amid Declining Sentiment

Highlights

- The recent crypto market selloff has sparked discussions in the crypto market.

- The altcoins were among the laggards, with ETH, SOL, PEPE, and others retreating.

- Investors seem to be taking the profit-booking strategy amid the recent surge in the crypto prices.

Crypto Market Selloff: The digital asset space witnessed a sharp decline today, with the majority of altcoins failing to maintain a positive momentum amid speculations of a possible sell-off. While Bitcoin price stayed near the bay, major altcoins and meme coins like Ethereum (ETH), Solana (SOL), XRP, Dogecoin (DOGE), Pepe Coin (PEPE), and others, have witnessed a selloff today. So, let’s take a look at the recent market developments and see the potential reasons behind the recent selloff.

Crypto Market Selloff: Why Are Altcoins Witnessing A Slump Today?

A flurry of reasons could be behind the recent plunge in the crypto market, especially among the altcoins. ETH, SOL, XRP, DOGE, and PEPE experienced a price dip of 0.5%-7% in the past 24 hours, turning heads across the market.

Here we explore some of the top reasons behind the recent selloff, which could be potentially driving the turbulent price movements.

Whales Booking Profit

The crypto market has witnessed robust gains over the past few days, with soaring anticipation over the Spot Ethereum ETF and other regulatory developments in the space. In addition, the pro-crypto sentiment amid the U.S. Presidential election buzz has also bolstered the sentiment of the market watchers.

Considering that, several investors seem to be shifting their focus towards the profit-booking strategy due to the recent surge. For context, a notable Ethereum whale transaction has raised eyebrows today.

According to the report, whale address 0xAeb…AED31 moved 4062 Ethereum from Lido to Binance, signaling a potential profit of $3.12 million upon sale. This move follows a trend where the whale previously shifted 18,446 ETH from Binance, ultimately selling a portion for a significant profit two months prior.

The transaction highlights whales potentially cashing out on substantial gains, contributing to market volatility. Such profit-taking activities by large holders often trigger selloffs among retail investors, underscoring the impact of whale movements on crypto markets.

Distinct Views Over Ethereum ETF

The Spot Ethereum ETF hype, especially after the regulatory nod by the SEC, has sent the Ethereum price higher over the past few weeks. However, despite the soaring optimism, several crypto market analysts have provided different outlook over the potential performance of the investment instrument.

While several market watchers are bullish on the Ethereum price following the start of the Ethereum ETF trading, some have argued a different picture. For context, some market pundits anticipate that the U.S. Spot Ethereum ETF will not get as much traction as the U.S. Bitcoin ETFs.

In addition, a recent report from the prominent research firm, Kaiko suggests that upon the Ether ETF launch, Ethereum may witness a $110 million outflow. Kaiko has suggested the scenario comparing it with the Bitcoin ETF trading, and due to significant outflow from GrayScale.

Also Read: Vanguard Receives Backlash Over Ethereum ETF Ban But There’s A Catch

Cautions In The Meme Coin Sector

According to recent reports, Ark Invest CEO Cathie Wood has provided a mixed outlook on the SEC’s stance on the ETF approval process. Cathie Wood suggests that the regulatory nod for the Ethereum ETF could be only due to the U.S. election issue.

In addition, she also said that although an ETF for Solana might get approved by the SEC, but meme coins ETF are unlikely to follow the same path. Amid this meme coins like Dogecoin, Shiba Inu, Pepe Coin, and others, have noted sharp declines today.

On the other hand, the recent surge in meme coins has also provided a profit-booking opportunity for the crypto market participants. According to a recent report by Lookonchain data, a whale has deposited 660.7 billion of Pepe Coin, worth $9.52 million, to Binance today.

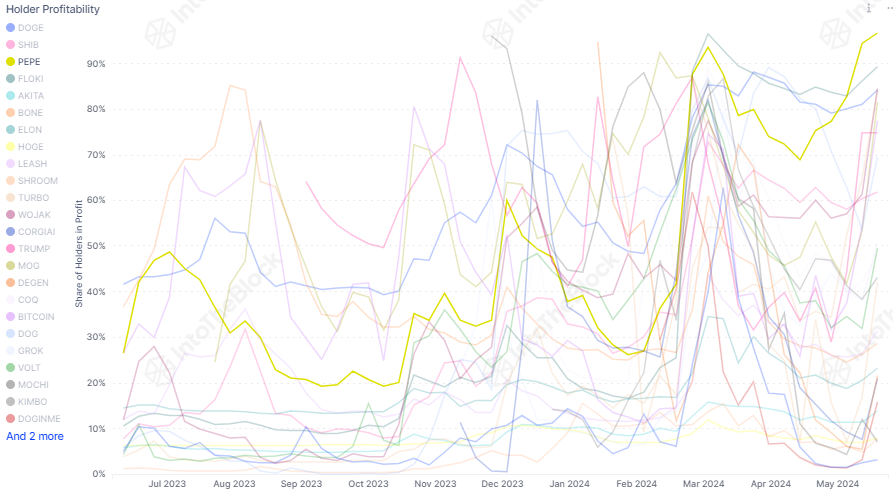

Notably, Pepe Coin has reached a new high recently, and it allowed the whale to book a profit of $4.95 million with his recent selling, with an ROI of 52%. According to IntoTheBlock data, 90% of the PEPE holders are now in profit, making it one of the most “profitable among major meme coins”.

Crypto Market Performance

The crypto market has been volatile lately, with investors seeking more clarity on the sector. In addition, the recent surge in crypto prices, especially meme coins, has provided an opportunity to liquidate the holdings to book substantial profit for the investors.

As of writing, the global crypto market cap was down about 2% to $2.51 trillion, after reaching $2.57 trillion over the last 24 hours. Talking about the individual cryptos, Ethereum price was down 2.51% to $3,716.64, while Solana price witnessed a slump of 2.37% to $165.12.

According to CoinGlass data, 72,546 traders were liquidated in the last 24 hours, with the total liquidation amount totaling $155.26 million. Over the last 24 hours, Ethereum has noted a liquidation of $26.82 million, with long-liquidation at $18.60 million, and short liquidation at $8.22 million.

Also Read: XRP Is Primed For A Breakout, Ex-Ripple Director Predicts

- CLARITY Act: Banks and Crypto Make Progress Following “Constructive” Dialogue at White House Meeting

- Expert Warns Bitcoin Bear Market Just In ‘Phase 1’ as Glassnode Flags BTC Demand Exhaustion

- SEC Chair Reveals Regulatory Roadmap for Crypto Securities Amid Wait for CLARITY Act

- ProShares Launches First GENIUS Act Focused Money Market ETF, Targeting Ripple, Tether, Circle

- BTC Price Falls as Initial Jobless Claims Come In Below Expectations

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?