Crypto Market Selloff: Why Bitcoin, ETH, DOGE, SHIB Prices Are Falling Today?

Highlights

- The global crypto market cap fell nearly 3% today, sparking market discussions.

- Major cryptos like BTC, ETH, BNB, DOGE, and SHIB, among others, have noted sharp declines.

- The global crypto market witnessed a liquidation of over $123 million in the last 24 hours.

Crypto Market Selloff: The digital asset sector has noted a sharp decline today, with the overall market retreating nearly 3% today in the last 24 hours. Meanwhile, the recent slump in the major cryptos like Bitcoin, Ethereum, DOGE, BNB, LINK, and others, has sparked discussions in the market over the potential reasons.

So, let’s take a look at the possible reasons that have fueled the recent crypto market selloff.

Potential Reasons Behind The Recent Crypto Market Selloff

A series of factors could have triggered the recent crypto market selloff today. Here we explore the top reasons that might have impacted the sentiment of the broader crypto market.

Bitcoin ETF Outflow Fuels Concern

The U.S. Spot Bitcoin ETF has reversed its track after noting inflows for five straight days through July 1. Over the last five days, the U.S. Bitcoin ETF has recorded the highest influx of $129.5 million on July 1. This move has fueled the market sentiment over regaining the confidence of the institutional interests towards the flagship crypto.

However, the overall scenario took a different turn on July 2, with U.S. Spot Bitcoin ETFs recording an outflow of $13.7 million. Despite inflows of $14.1 million and $5.4 million from BlackRock IBIT and Fidelity’s FBTC, the outflux of $32.4 million from GrayScale has allayed the gains.

This move might have once again weighed on the investors’ sentiment, who are still seeking clarity on the market momentum. The recent outflux after a five-day winning streak also indicates that the institutions are taking a pause before making further bets in the sector.

Friday Options Expiry

The Bitcoin ETF outflow has triggered volatility in BTC, potentially impacting the broader crypto market. Apart from that, the massive upcoming options expiry also seems to have impacted the risk-bet appetite of the investors.

Notably, the recent crypto market selloff could be primarily attributed to the upcoming expiration of significant BTC and ETH options. Data from Deribit reveals that BTC options with a notional value exceeding $1.04 billion and a put/call ratio of 0.80 are set to expire on Friday, July 5, with a maximum pain price of $63,000.

Similarly, ETH options worth $479.30 million, with a put/call ratio of 0.38 and a max pain price of $3,450, will also expire. The impending expiries are creating uncertainty and influencing market behavior, as traders adjust their positions ahead of the deadline.

Also Read: Ripple and Coinbase Use Binance Win to Contest SEC Claims

Ethereum ETF Launch Delay

The crypto market was highly anticipating the Spot Ethereum ETF approval by the U.S. SEC this week. However, a potential delay might have sparked concerns among the investors.

Meanwhile, looking at the latest market trends, ETF Store president Nate Geraci said that the U.S. Spot Ethereum ETF might launch on July 15. Besides, Bloomberg also hinted at a mid-July launch for the Ether ETF to go live in the U.S.

Crypto Market Faces Over $120M Liquidation

The recent selloff in the crypto market has caused a liquidation of $123.62 million over the last 24 hours, CoinGlass data showed. In the same timeframe, around 45,000 traders were liquidated with the largest single liquidation taking place on OKX – ETH-USDT-SWAP worth $3.36 million.

Bitcoin faces liquidation of $34.74 million, while Ethereum’s liquidation stood at $32.87 million. However, despite the recent crypto market selloff, some analysts are still optimistic about the future performance of the market. Given the declining value and anticipation over Ethereum ETF approval this month, the crypto market might witness robust gains in the coming days.

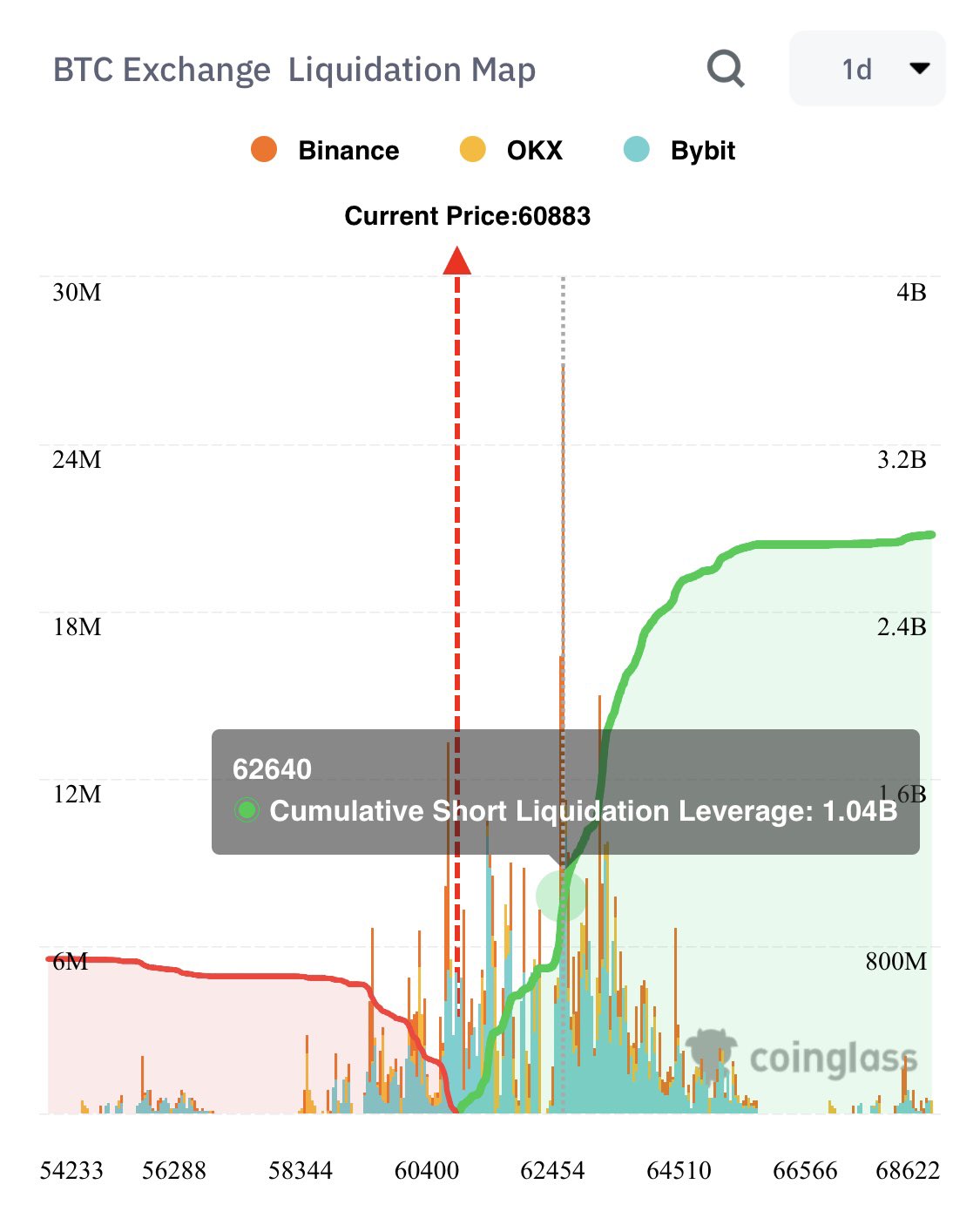

However, with Bitcoin price currently crossing the brief $61,000 mark, the risk still prevails in the market. In a recent analysis, popular crypto market expert Ali Martinez warned of over $1 billion liquidation if BTC hits the $62,600 mark.

As of writing, Ethereum price dropped nearly 3% in the last 24 hours, while Dogecoin price fell 1.3%. Simultaneously, the BNB price noted a slump of 2.5% to $566.23, and Shiba Inu price slipped 1.34% to $0.00001695.

Also, CoinGlass data showed that Bitcoin Futures Open Interest (OI) fell about 4% from yesterday, while Ethereum OI slipped about 1.4%. This data also highlights the gloomy sentiment dominating the crypto market.

Also Read: Genesis Digital Is Considering Going Public Via IPO In US

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin Price Still Risks Decline If Iran War Mirrors Ukraine War Market Reaction, JPMorgan Warns

- Bitget Unveils Upgrade For Stock, Gold Trading Alongside Crypto As Part Of Universal Exchange Push

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- $3B Western Union Expands Into Crypto With USDPT Stablecoin Launch on Solana

- XRP News: Key Ripple Whale Indicator Turns Bullish After Months, Price Rally Ahead?

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

Buy $GGs

Buy $GGs