Crypto Market Selloff: Bitcoin, ETH, SOL, XRP Risks Falling Amid High Funding Rates

The crypto market witnessed a broader selloff suddenly in Asia hours on Tuesday, causing the global crypto market cap to fall another 1% to $1.65 trillion.

Bitcoin price slips 2% within hours from $43,400 to $42,500, making a 24-hour fall to almost 3%. Top altcoins ETH, SOL, BNB, XRP, and others also witnessed a 2-4% drop within hours.

Here’s Why Crypto Market Is Falling Suddenly

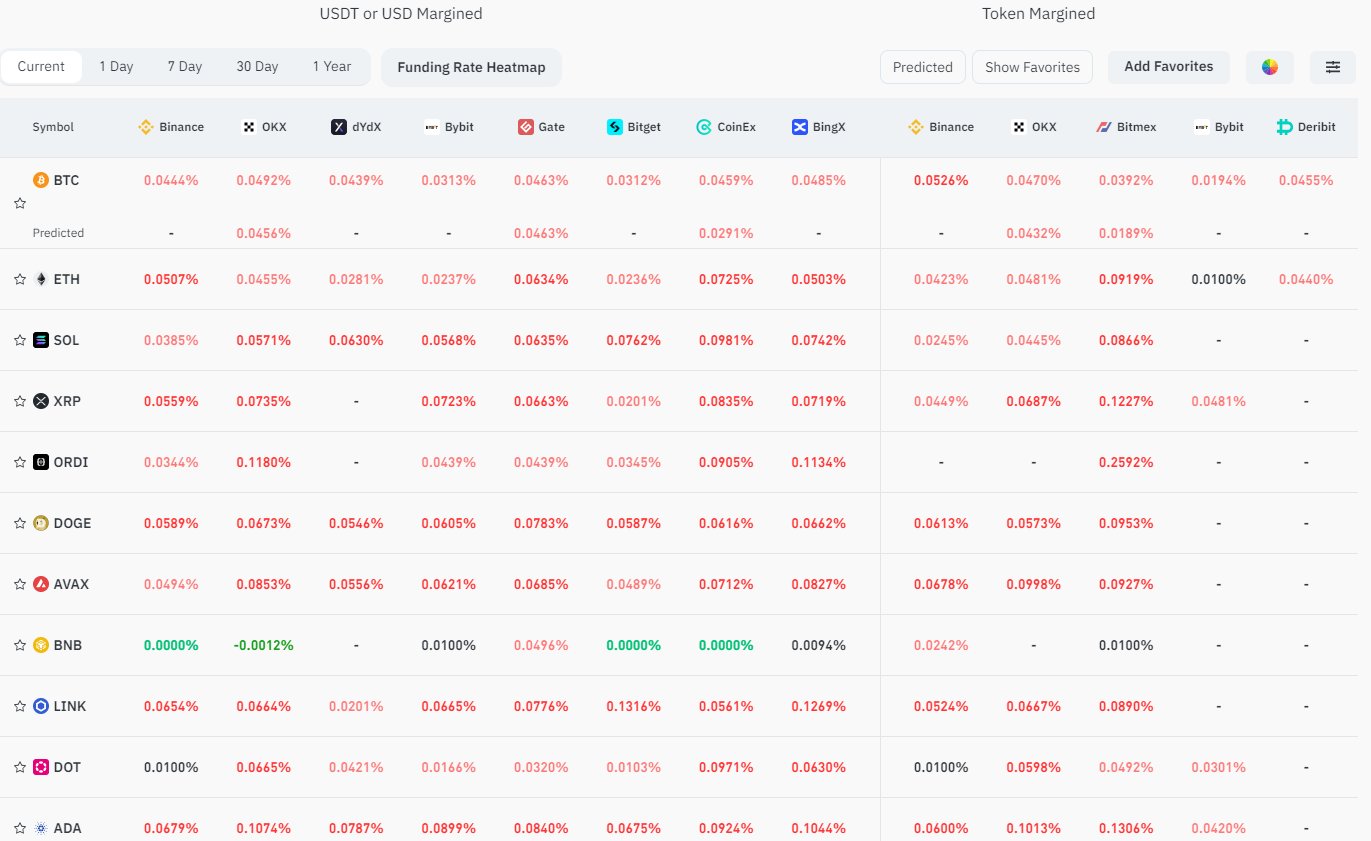

Investors expected a Santa Claus rally, but the high funding rates are causing panic among traders. The market needs to cool down in order to continue moving upwards. Coinglass derivatives exchange data platform reported that “Funding Rates going crazy. Expect huge volatility.”

This caused traders to move away from their long positions, causing a broader crypto market selloff. The crypto market saw $40 million longs liquidated just in an hour. In the past 24 hours, 92k traders were liquidated and the total liquidations is at $210 million. Among this, over $157 million of longs and $53 million of shorts were liquidated.

BTC, ETH, SOL, ORDI, XRP, SATS, AXS, and 1000SATS are the most liquidated crypto in the last 24 hours, with ETH leading the liquidation in the last 1 hour.

Meanwhile, Mt. Gox creditors have reportedly started receiving their Bitcoin payments. It will cause some to sell their Bitcoin gains, with miners looking closely at the event.

Also Read: Analysts Predict BTC Rally To Continue As Bitcoin Funding Rates Reset

BTC, ETH, And Other Crypto Prices Tumble

CoinGape reported that the coming Friday’s annual options delivery will be a key event, with nearly half of Bitcoin and Ethereum options positions facing delivery. With high funding rates, traders could be looking to shift their positions, considering various factors including an anticipated spot Bitcoin ETF approval, Bitcoin halving, and technical charts.

BTC price fell from a 24-hour high of $43,765, with the price currently trading at $42,759. Moreover, trading volume has increased by 26% in the past 24 hours, indicating interest from traders. It happens as BTC OI-weighted funding rate jumps significantly higher.

ETH price trades at $2231, down over 2% in the past 24 hours. The trading volume has increased slightly in the past 24 hours.

Also Read: Bitcoin, Ethereum, Solana Saw $98 Mln Inflows As Spot Bitcoin ETF Deadline Looms

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Breaking: U.S. Supreme Court Strikes Down Trump Tariffs, BTC Price Rises

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?