Crypto Market Set for Liqudity Pump With Fed Rate Cut Expected This Week

Highlights

- The crypto market could be green all week as traders anticipate another 25bps Fed rate cut.

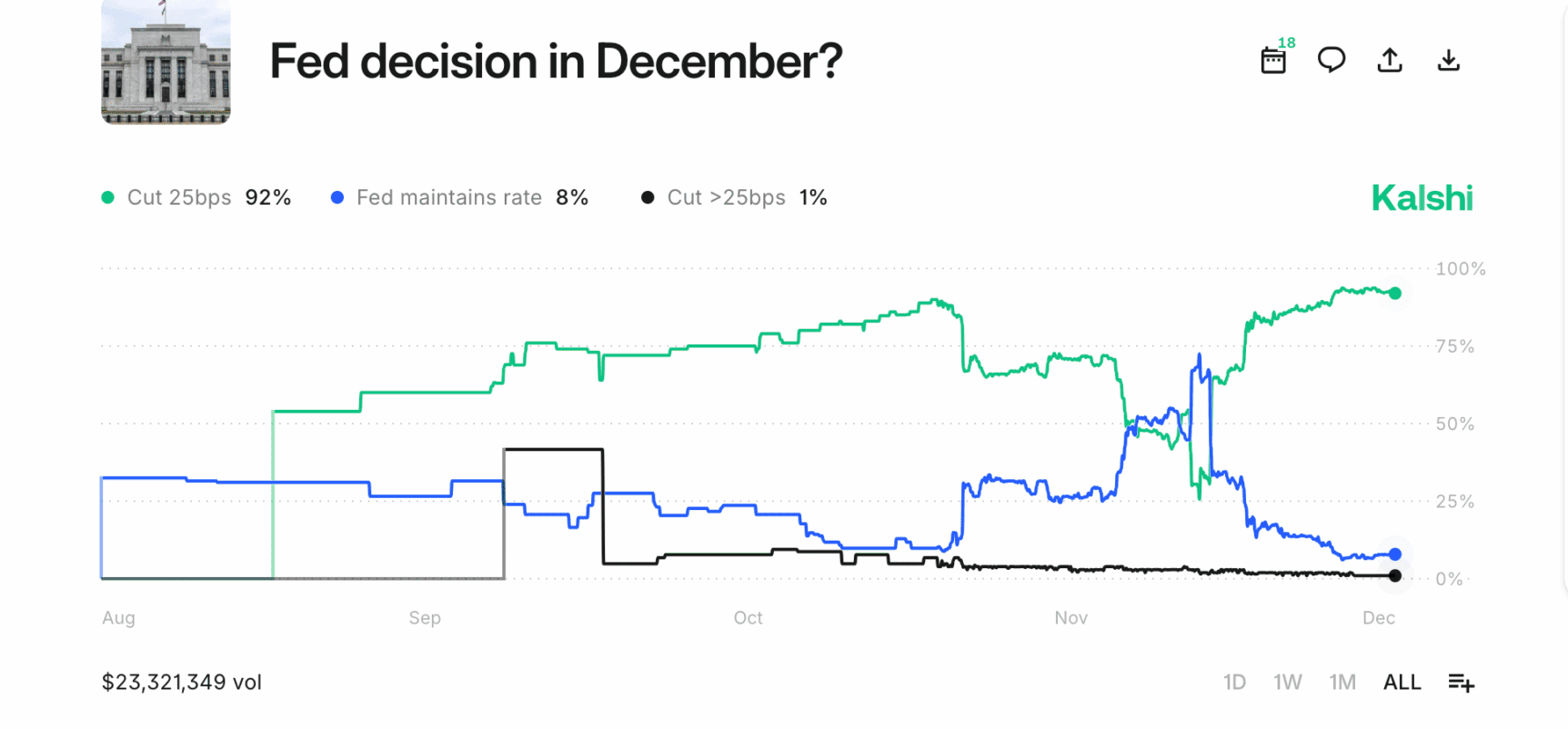

- CME FedWatch shows an 87% probability, while Kalshi puts it at 93%.

- Banmu Xia predict a broad rebound across crypto, U.S. equities, and commodities if the Fed cuts rates again.

The crypto market is poised for a huge week as traders prepare for another possible Fed rate cut. Experts and institutions are now calling for a 25-basis-point reduction this Wednesday.

Crypto Market Positioned for Rally Ahead of Expected Fed Rate Cut

Chinese market analyst Banmu Xia last month projected a rebound across financial markets after another Fed rate cut. This includes cryptocurrencies, U.S. equities, and commodities.

He thinks that easing measures and balance-sheet expansion by the U.S. central bank could improve liquidity conditions like those seen in late 2019. This could lead to strong performance in December.

Xia has noted a macro pattern and believes that the current situation is similar to when the Federal Reserve changed its approach in October 2019, continuing aggressive easing into the next year.

Forecasting platforms align on the likelihood of a rate cut by policymakers. The CME FedWatch tool now puts the probability of a 25-basis-point move at 87%, while the prediction platform Kalshi puts it higher, at 93%.

JPMorgan and Morgan Stanley also revised its earlier call and now expects an immediate Fed rate cut in December. According to the bank strategists, a 25-basis-point reduction is likely to be the most probable outcome.

The Federal Reserve made its second rate cut in October. After the move, many officials raised concerns about easing too quickly and making another one before the year ends.

Even with the hawkish pushback, analysts expect another move this week. Rate-cut cycles have been supportive of equities and digital assets in the past. Often, stock markets tend to climb between 5% and 15% in the six months after easing begins.

Which Other Factors Could Move the Crypto Market This Week?

This week has a number of events that can make the crypto market volatile even before the Fed makes its decision. According to The Kobeissi letter, the JOLTS job openings data will come out this Tuesday. This basically shows the labor demand in the market.

Notably, November’s U.S. jobs report came in above expectations with payrolls growing by 119,000 well above the 53,000 estimate. The uptick pushed Bitcoin higher as rising unemployment historically strengthens the case for a rate cut.

Fed Chair Jerome Powell will also hold a press conference on Wednesday. Markets will analyze Powell’s speech closely for any hints about the number and pace of future cuts.

Meanwhile, the Federal Reserve’s balance sheet has contracted to $6.53 trillion. This is its lowest level since April 2020, after a 3.5-year quantitative-tightening cycle. Treasury holdings fell to $4.19 trillion and mortgage-backed securities to $2.05 trillion.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Breaking: Ethereum Treasury BitMine Adds 50,928 ETH as Tom Lee Predicts March Bottom For Crypto Prices

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

Buy $GGs

Buy $GGs