Crypto Market Update: Fed Budget Data, Shutdown End, OPEC Report Set to Drive Price Swings This Week

Highlights

- The crypto market prepares for a volatile week following major U.S. economic events.

- Events include the Fed budget data release, OPEC’s monthly report, and others.

- The government shudown could also end this week due to positive developments.

There could be price swings in the crypto market this week amid a list of economic events happening in the U.S. These include the Fed budget data release, OPEC’s monthly report, and an end to the government shutdown.

Crypto Market Braces Up For Key Week

Events set to happen this week, which might essentially affect financial markets, were highlighted in the Kobeissi letter featured in a recent X post.

Markets opened the week with strong reactions to Donald Trump’s surprise announcement of a $2,000 “tariff dividend” for most American adults. It will be paid for with revenue from tariffs and record foreign investment inflows into U.S. manufacturing.

Trump countered that the initiative is a reflection of the nation’s solid fiscal position. He emphasized that “we are taking in trillions of dollars and will soon begin paying down our enormous $37 trillion debt.” He made clear that payments would not include high-income earners while calling his critics “fools.”

Fed Budget Data, OPEC Report, and Policy Signals Ahead

The Feds are expected to release the Federal Budget Balance data on Thursday. This would provide insight into the government’s revenue and spending patterns. Analysts will be paying close attention for signs of expanding deficits. This could impact Treasury yields and by extension lead to capital flow into risk assets like crypto.

Meanwhile, Wednesday’s OPEC Monthly Report is expected to shed light on global oil supply-demand dynamics and price stability. Energy costs usually act as a driver for inflation. It might influence future Fed rate cuts.

Besides, the NFIB Small Business Optimism Index is also due on Tuesday. It will provide a snapshot of U.S. business confidence. This is particularly for smaller firms that often feel the early effects of monetary tightening.

Fed Speeches and Shutdown Developments

The Federal Reserve calendar is full this week, with nine scheduled appearances, including remarks from Governor Michael Barr and Governor Stephen Miran. They would give their views, thus providing an indication of the Fed’s stance ahead of December’s policy meeting.

Adding to the week’s momentum, the U.S. government shutdown looks set to end after a breakthrough vote in the Senate on ending the shutdown. The lawmakers reached a bipartisan deal.

They passed a measure reopening key agencies with a 60–40 majority. The deal follows weeks of deadlock in negotiations. This is considered a major step towards restoring economic stability before year-end.

Market Initial Reaction Before the Events

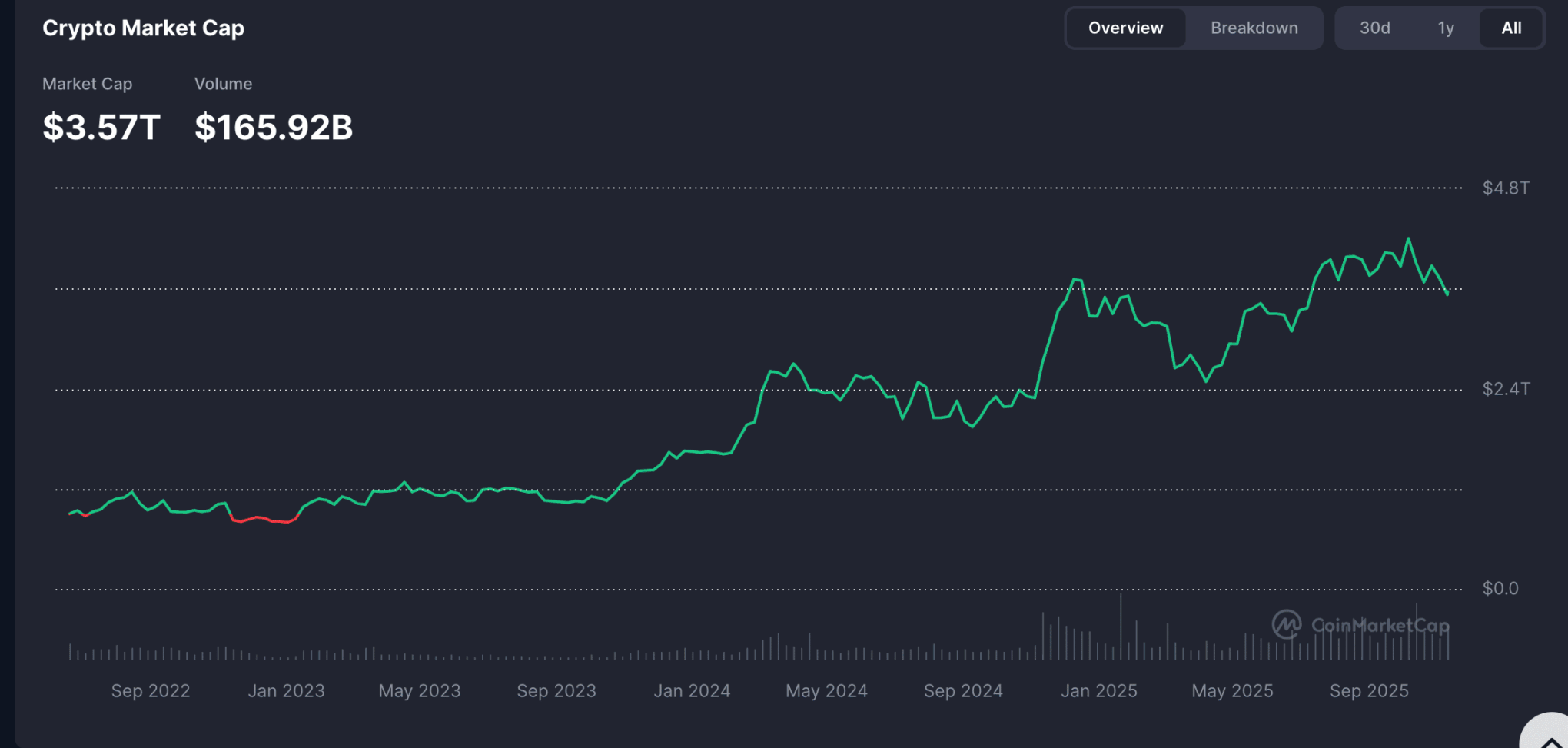

Over the last 24 hours, the crypto market has undergone some changes. The Crypto Fear and Greed Index has gained from “Extreme Fear” to “Fear” at 29. This shows a slight improvement in sentiment. Total crypto market cap added 4% now at $3.57 trillion. Bitcoin and Ethereum are up about 4 and 5%, respectively.

Data also points to further growth. Open interest in crypto derivatives has surged 4.8% in the past 24 hours to $146 billion. Also, spot market trading volumes reached $268 billion.

- Michael Saylor Hints at Another Strategy BTC Buy as Bitcoin Drops Below $68K

- Expert Says Bitcoin Now in ‘Stage 4’ Bear Market Phase, Warns BTC May Hit 35K to 45K Zone

- Bitcoin Price Today As Bulls Defend $65K–$66K Zone Amid Geopolitics and Tariffs Tensions

- XRP Realized Losses Spike to Highest Level Since 2022, Will Price Rally Again?

- Crypto Market Rises as U.S. and Iran Reach Key Agreement On Nuclear Talks

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?

- XRP Price Prediction As SBI Introduces Tokenized Bonds With Crypto Rewards

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?