Crypto Slowly Losing Edge Over US Equities Amid Bitcoin Price Retreat

Bitcoin and the broader cryptocurrency market continue to face selling pressure with the BTC price dropping 2.3% in the last 24 hours and moving closer to $29,000. While the Bitcoin performance in the month of July remains subdued, Nasdaq 100 made over 5% gains.

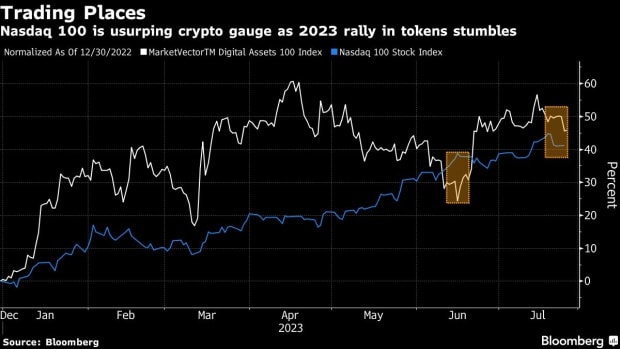

This shows that the top US equity indices have been closing the gap with the 2023 gains in the crypto market. The rise in the value of the top 100 digital tokens has slowed down to 46% so far this year, which is not much higher than the 41% increase in the Nasdaq 100 Index of technology stocks. The tech stock index received a boost from the excitement around artificial intelligence products, briefly surpassing the MVIS CryptoCompare Digital Assets 100 Index in June.

Chart Patterns Flag Caution for Bitcoin

Some chart patterns are indicating that investors should be careful. The Bollinger bandwidth for Bitcoin’s 20-week period has become the narrowest it has been in seven years. This means that the movements of Bitcoin could become more intense, especially if certain important levels are broken. The Bollinger study helps us understand how much the price of Bitcoin is changing over time.

Furthermore, the BTC price has given a breakdown under the consolidating range of $29,500-$30,200. Analysts are also having mixed views over the further price action in Bitcoin. Bitcoin’s drop “should extend toward $26,000/$25,000 before finding support,” Tony Sycamore, a market analyst at IG Australia Pty wrote.

Speaking to Bloomberg, Caroline Mauron, co-founder of digital-asset derivatives liquidity provider OrBit Markets said:

“The rally has lost momentum following the initial excitement sparked by the ETF news, and there are no other visible catalysts on the horizon”.But downside risk “should be limited as the Fed is near the end of the current rate hiking cycle, which should support risk assets including crypto.”

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?