Crypto Traders Reduce Fed Rate Cut Expectations Even as Expert Calls Fed Chair Nominee Kevin Warsh ‘Dovish’

Highlights

- Crypto traders cut Fed rate cut expectations after Warsh’s nomination raises uncertainty over policy direction.

- Polymarket data shows traders now expect two Fed rate cuts as against three rate cuts prior to Warsh's nomination.

- Analysts are split on Warsh as dovish views emerge despite his crisis-era caution on inflation.

Crypto traders have reduced expectations for a Fed rate cut this year as betting markets recalibrate following President Donald Trump’s nomination of Kevin Warsh as Federal Reserve chair. The shift reflects uncertainty over future monetary policy and debate over whether Warsh would support rate cuts or maintain a restrictive stance. This is significant as more rate cuts could boost the crypto market, just like it did last year when BTC rose to new all-time highs (ATHs).

Fed Rate Cut Bets Shift After Warsh Nomination

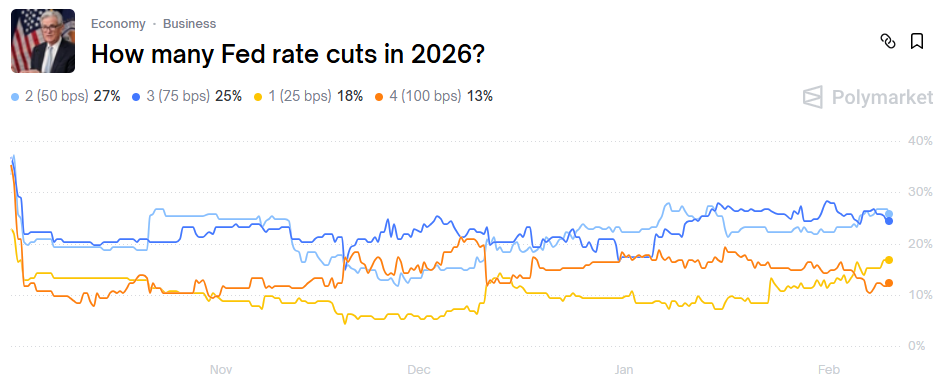

Polymarket data show that traders now give a 27% chance of two Fed rate cuts this year. Meanwhile, there is a 25%, 18%, and 13% chance of three, one, and four rate cuts, respectively. This marks a turnaround since when Trump nominated Kevin Warsh as the next Fed chair, despite the U.S. president signaling that Warsh would lower rates.

Prior to Warsh’s nomination, crypto traders were betting on three Fed rate cuts this year, with a 27% chance at the time. However, with concerns that Warsh may be hawkish, these traders are now reducing their expectations. The BTC price is also notably down from a high above $80,000 since Warsh’s nomination.

In an X post, Milk Road Macro noted significant confusion about whether Warsh is hawkish or dovish. This story is based largely on his five years as a governor of the Federal Reserve from 2006 to 2011, he said.

Milk Road Macro stated that during the global financial crisis, Warsh was reluctant to cut rates due to concerns about inflation. It added that those views haven’t stood the test of time and argued that he has evolved his thinking, citing structural shifts such as artificial intelligence and productivity gains.

Warsh had previously sounded the alarm over inflation risks, even when economic conditions were deteriorating. In April 2009, when core PCE inflation was running at 0.8%, and unemployment was around 9%, he said he was more concerned about upside inflation risks.

He has spent years since leaving the Fed in 2011 as a colleague of the investor Stanley Druckenmiller. On the day of the nomination, Druckenmiller told the Financial Times that pigeonholing Warsh as being permanently hawkish was unfair. The analyst said, Warsh believes growth can occur without inflation.

Trump Expects Cuts as Analysts Split on Warsh Outlook

President Donald Trump has repeatedly called for more Fed rate cuts. It has been a policy priority since he began his second term. The president recently reiterated that he believes Warsh would cut rates and that he wouldn’t have nominated him if he believed otherwise.

In an X post, Anthony Pompliano wrote that Warsh is likely to cut interest rates aggressively. They added that there is a mistaken belief that the economy needs tight policy. Pompliano cautioned traders to get ready for what he called a historic rotation.

Sam Badawi offered a cautionary take in an X post. He said Warsh is frequently depicted as hawkish, “but his call for a new Fed–Treasury accord suggests something more nuanced.”

Such an arrangement could further bind monetary policy to government financing requirements, Badawi said. He added that the rates and bond purchases might have incurred debt-service costs and had inflationary effects, which could influence perceptions of Fed independence.

Amid discussions on whether Warsh will be open to more Fed rate cuts, it is worth noting that the FOMC is again likely to hold rates steady at the March meeting. The odds of a 25-basis-point (bps) cut briefly climbed above 20% last week following a weak jobless claims and JOLTS job openings data.

However, CME FedWatch data shows that these odds have now fallen below 20%. There is only a 17% chance they will lower rates at the March FOMC meeting. Meanwhile, there is an 82% chance they hold rates steady, which would extend the rate-pause cycle from last month.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Ethereum Treasury BitMine Adds 50,928 ETH as Tom Lee Predicts March Bottom For Crypto Prices

- Bitget Champions Women’s Role in Crypto as Part of International Women’s Day Campaign

- Breaking: Michael Saylor’s Strategy Adds 3,015 BTC as Bitcoin Holds Steady Despite U.S.-Iran War

- BitMine’s Tom Lee Bets on ‘March Turnaround’ to Spark Crypto Market Recovery

- Bitget Unveils MotoGP-Inspired ‘Smarter Speed Challenge’ for Crypto, Stocks, and Gold Trading in Latest UEX Push

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

Buy $GGs

Buy $GGs