Odds for December Rate Cut Soar to 71% After Michigan Consumer Sentiment Hits 2nd-Lowest in History

Highlights

- The consumer sentiment index fell to 50.3 the second-lowest in history, which is boosting a Fed rate cut forecast.

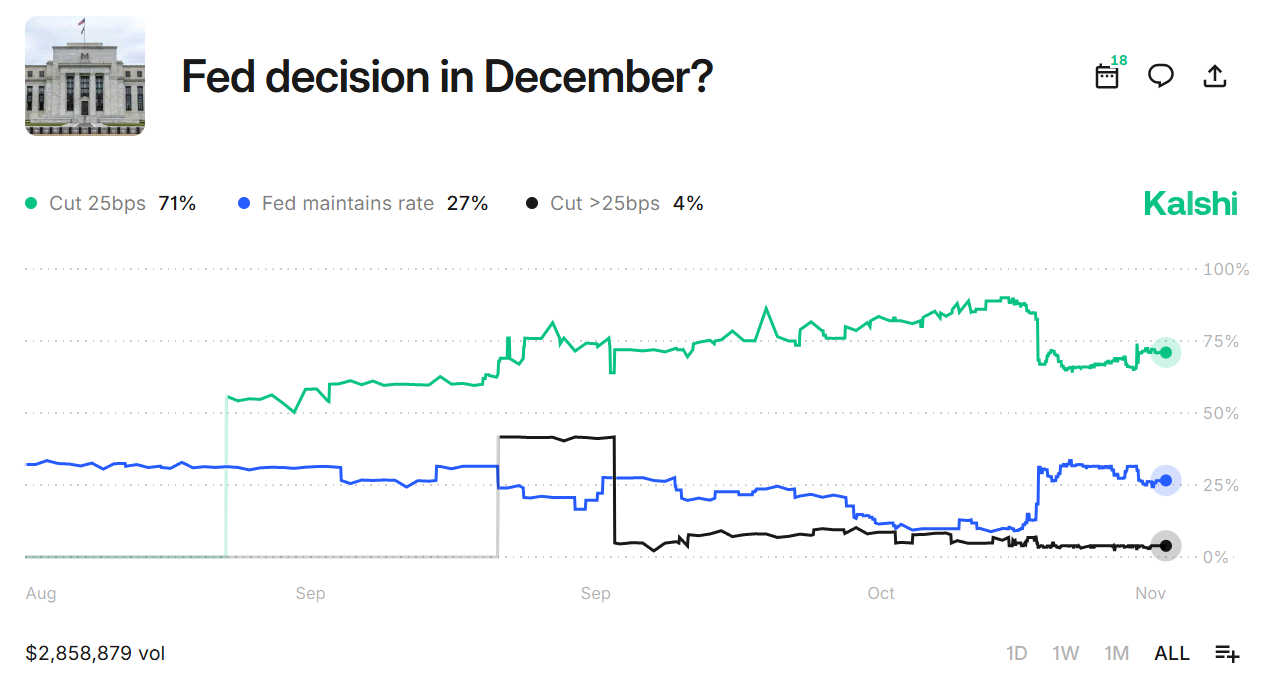

- Growing concerns are manifested by Kalshi traders who have put the likelihood of a Fed rate reduction in December at 71%.

- Fed Chair Powell cautioned that the markets should not be too optimistic about a rate cut next month.

The possibility of Fed rate cut in December has increased sharply. This is because the consumer confidence in the United States has dropped towards the all-time low. Data from the University of Michigan showed that its Consumer Sentiment Index dropped sharply to 50.3 in November, marking its second-lowest reading in history.

Consumer Confidence Falls Below 2008 Recession Levels

According to the Kobeissi Letter, the 3.3-point decline missed expectations of 53.0 and continued a four-month losing streak. The Kobeissi analysts say the fall reflects deepening pessimism about the economy as inflation remains stubborn and job growth slows.

US consumer sentiment is collapsing:

The University of Michigan’s Consumer Sentiment Index fell -3.3 points in November, to 50.3, the 2nd-lowest in history.

This significantly missed expectations of 53.0 points and marks the 4th consecutive monthly decline.

Current conditions… pic.twitter.com/1htEqmvRsu

— The Kobeissi Letter (@KobeissiLetter) November 8, 2025

Also, a sharp rise in job cuts has intensified pressure on the Fed to deliver a rate cut, deepening investor caution. The index’s current conditions subindex also plunged 6.3 points to 52.3, the lowest ever recorded. Meanwhile, the expectations gauge slipped to 49.0, its third-lowest level since July 2022.

Statistics reveal that American households are witnessing a grim economic future. According to The Kobeissi Letter, consumer sentiment now sits below levels seen during past recessions, including 2008. This can result in a drop in expenditure which drives more than two-thirds of the U.S. economic activity.

Market Bets on Fed Rate Cut Surge to 71%

The collapse in sentiment has already shifted market expectations for monetary policy. Prediction market platform Kalshi shows a 71% probability that the Fed will cut interest rates by 25 basis points in December.

Only 26% of traders expect the Fed to hold rates steady, while a small 4% see the chance of a larger cut. Based on these odds, the steep fall in household sentiment might push the Fed to reduce rates earlier than anticipated. Fed officials such as Governor Christopher Waller have hinted at a rate cut in December despite Powell’s firmer stance.

Most of them hope that the central bank will focus on making the efforts to avoid unnecessary recession. Based on historical data, the connection between sentiment index and consumption trends suggests that a change of policy has become necessary.

Nonetheless, Fed might continue to wait until additional information on labor and inflation is obtained before taking a decision on rates. While consumer mood has worsened, wage growth and employment remain relatively stable. The December meeting will provide the clearest test of how policymakers balance weakening confidence against still-elevated prices.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Breaking: Ethereum Treasury BitMine Adds 50,928 ETH as Tom Lee Predicts March Bottom For Crypto Prices

- Bitget Champions Women’s Role in Crypto as Part of International Women’s Day Campaign

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

Buy $GGs

Buy $GGs