DeFi Mania: Ethereum [ETH] Miners Earned More than Double of Bitcoin [BTC] Miners in 2020

Ethereum (ETH) miners are making a fortune this year in 2020! Thanks to the mad craze in the Decentralized Finance (DeFi) market that has helped to fuel the growth of the Ethereum network. As per the latest data by Coinmetrics, Ethereum miners have pocketed over $350 million in transaction fees so far this year. Interestingly, this is more than twice of what Bitcoin (BTC) miners earned during the same time.

Ethereum Total Transaction Fees during 2020 are now over $350m and more than twice Bitcoin'shttps://t.co/FlYXc0tMy9 pic.twitter.com/wKW4aYM8SA

— CoinMetrics.io (@coinmetrics) September 28, 2020

For many years, BTC miners have dominated over ETH miners in terms of transactions. But since the majority of DeFi tokens are based on Ethereum, the game has completely flipped in favor of ETH miners.

The above chart by CoinMetrics clearly shows that ETH miners surpassed the BTC miners last month in August. Since then, the gap between the two has expanded very rapidly. CoinMetrics has also shown an interesting comparison for 2019, with a completely opposite scenario. It tweeted,

By comparison, this time last year, cumulative Bitcoin Transaction Fees were $135M and Ethereum Transaction Fees were $27Mhttps://t.co/dtsJfPrFaM pic.twitter.com/8sxqgxBjxL

— CoinMetrics.io (@coinmetrics) September 28, 2020

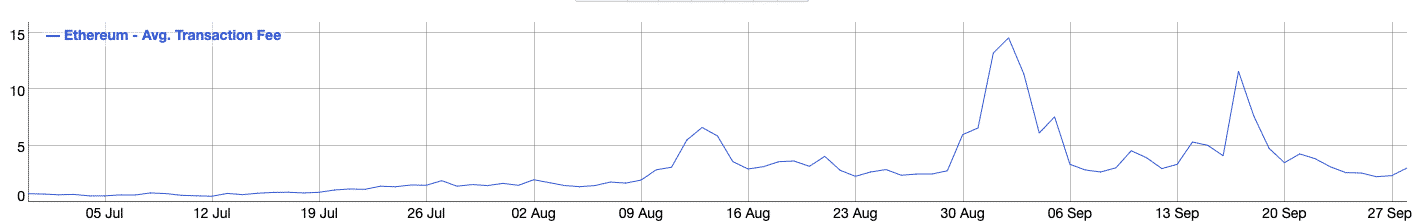

Average Transaction Fee On Ethereum

Over the last month, the average transaction fee on Ethereum has remained around $3, as per data on BitInfoCharts. Several DeFi tokens, stablecoins transfers, and Yield Farming tokens significantly contributed to the surge.

The above chart shows that the ETH transaction fee suddenly spiked during the first week of September. On September 2, the average ETH transaction fee made a high of $14.53. However, is has declined since then as is currently around $3

The DeFi craze on Ethereum soon started after the Compound protocol released its COMP token. Later, the yield farming platform Yearn.Finance released its YFI token taking the DeFi market by storm. The latest release of Uniswap’s UNI governance token has added more fuel to it.

DeFi protocols have attracted massive sums of investments over the last month. As per DeFiPulse, the total-value-locked (TVL) in DeFi smart contracts is currently $11 billion. Since the Ethereum blockchain hosts a majority of the DeFi smart contract, it also has the majority share in Defi TVL. On Monday, Uniswap became the first DeFi token to have over $2 billion in total-value-locked.

Thus, as long Ethereum continues to dominate the lion’s share in DeFi market, ETH miners will continue to make more money.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

Buy $GGs

Buy $GGs