DeFi Loses Over $200 Million USD In Value As Ethereum (ETH) Slips Below $250 USD

Ethereum (ETH) opens the market a percentage lower as price dips below the psychological $250 USD mark. The bearish pattern follows on the decentralized finance (DeFi) market, which witnessed a $200 million deflation of funds from the platforms in the past ten days. Can the second largest cryptocurrency bulls hold on to $250 preventing a possible dip to $238 support levels?

DeFi products shed $200 million in a fortnight

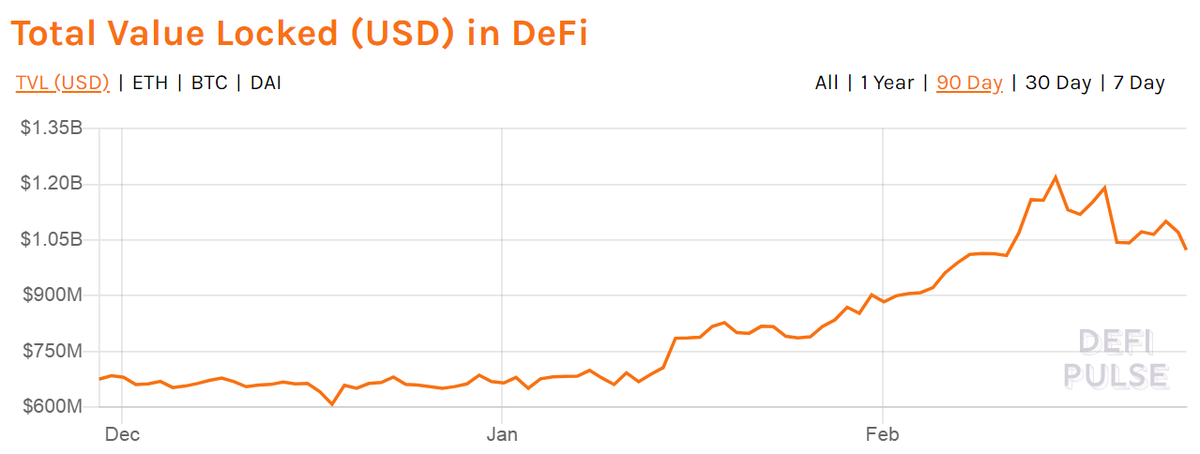

Since the bZx exchange saga broke, the field of decentralized finance has suffered hard, losing over $200 million in locked funds value in the period since. On Feb 15, total value locked in DeFi products on both Ethereum and Bitcoin hit an all-time high of $1.219 billion USD, as Ethereum’s price recorded a yearly high of $288.00 USD.

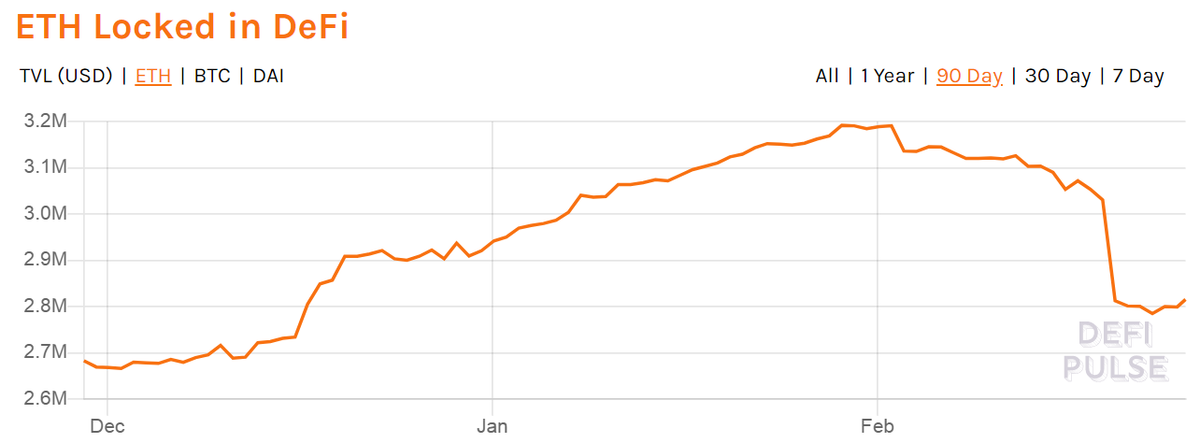

The relation between the ETH token and TVL on DeFi is also prevalent in bearish times but this time, the DeFi industry is suffering a bit more. While the number of ETH tokens locked on DeFi reduced as the TVL shot up to ATH, the reverse is not happening as ETH plummets below the $250 USD region.

On Feb. 17, the number of ETH tokens locked on DeFi amounted to 3.072 million tokens. The number has since plummeted over 8% in that period to approx. 2.8 million ETH.

As Ethereum bulls struggle to maintain the price above the $250 mark, a quick turnaround in DeFi value will be needed.

Will Ether survive the sub-$250 levels?

ETH/USD currently changes hands at a $248 dollar rate across major exchanges signaling a possible completion of the triple top formation on the 4-hour charts. A drop below minor resistance levels at $245 and $238, does not look good for the ‘smart contract’ token as bears gain momentum.

A bounce off these support levels will be key for bulls to regain their push towards $300. However, the relative strength index breaking below the sell signal level at 41 signals a push further towards key support levels.

- Bitcoin Sell-Off Ahead? Garett Jin Moves $760M BTC to Binance Amid Trump’s New Tariffs

- CLARITY Act: Trump’s Crypto Adviser Says Stablecoin Yield Deal Is “Close” as March 1 Deadline Looms

- Trump Tariffs: U.S. To Impose 10% Global Tariff Following Supreme Court Ruling

- CryptoQuant Flags $54K Bitcoin Risk As Trump Considers Limited Strike On Iran

- Why Is Bitdeer Stock Price Dropping Today?

- Ethereum Price Rises After SCOTUS Ruling: Here’s Why a Drop to $1,500 is Possible

- Will Pi Network Price See a Surge After the Mainnet Launch Anniversary?

- Bitcoin and XRP Price Prediction As White House Sets March 1st Deadline to Advance Clarity Act

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?