Defi Lending Platform dYdX Records Over $1 Billion In Loans In A Year, Bullish Signals For Ethereum?

- Defi lending platform, dYdX, records $1 billion in total loans over the past year.

- Ethereum (ETH) remains the leading asset originating close to half of the amount.

- The growing Defi space looks to propel ETH price in the coming weeks.

Open finance is gaining gradual adoption despite the slow the stagnant performance the cryptocurrency industry is showing since the “Black Thursday crash” on Mar. 12. dYdX, a decentralized lending platform, recorded a milestone in the early trading hours on Saturday reaching the billion-dollar mark in total loans originating from the platform.

In the past year, dYdX has originated well over $1 Billion in loans ?? pic.twitter.com/ZJynUQ7JXy

— dYdX (@dydxprotocol) April 18, 2020

The increasing interest in Defi products may set bullish sentiments on Ethereum as the lending Defi products grow in the near future.

dydX records $1.1 billiard in loans borrowed

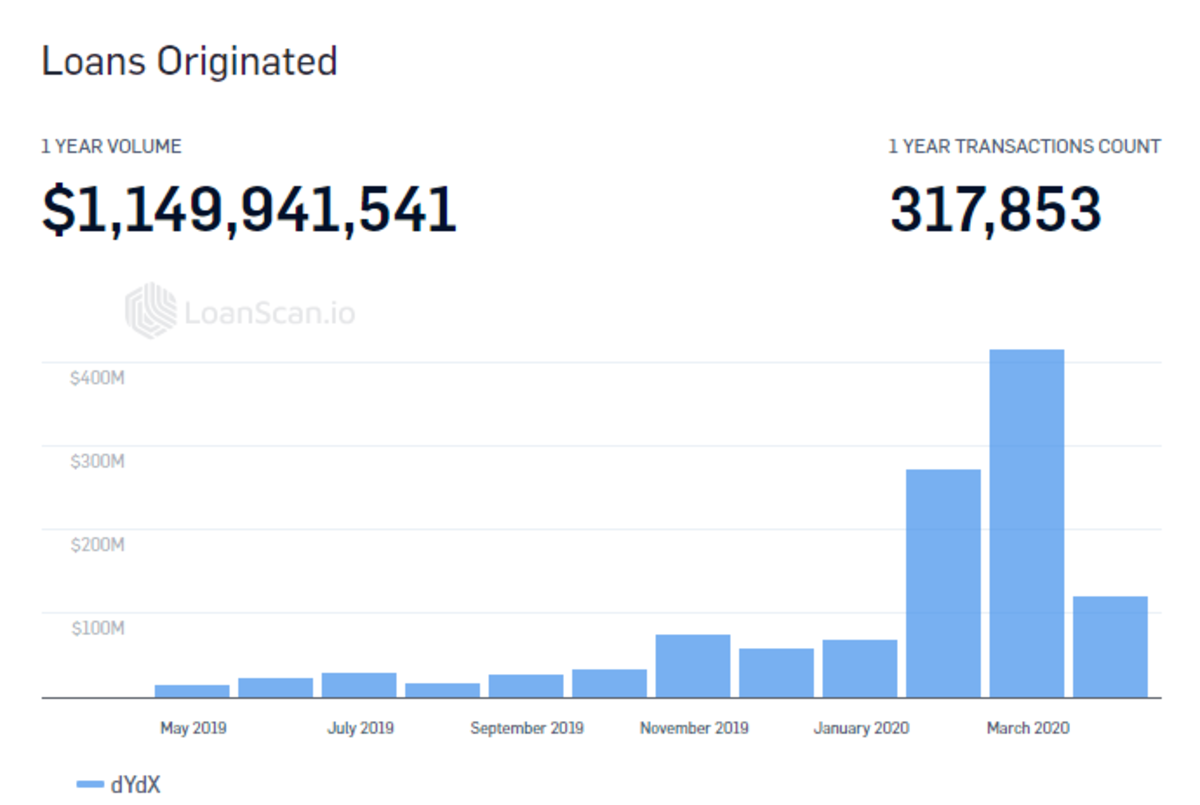

According to LoanScan, a Defi tracking aggregator, dYdX, is witnessing a meteoric rise in the number of loans borrowed on the exchange. The decentralized app has distributed over $1.1 billion in loans on the platform over the past year.

Ethereum (ETH) is the leading borrowed asset on dYdX with a total borrowed amount of $$516,647,969representing 45% of the total amount borrowed over the past year. Dai (which split to a multi-asset and single-asset backed token –SAI) and USDC recorded a total of $378,674,732 (SAI -$126,538,385) and $128,080,455 respectively.

dYdX leads in loans originated on the platform in the decentralized lending space with Compound and Maker also bootstrapping some loan facilities to their users. Over the past year a total of $310,299,625 and $215,706,480 in loans were disbursed from the respective platform.

Ethereum set to benefit from swelling Defi markets?

The growth in the Defi space has been nothing short of remarkable as these platforms offer the unbanked and underbanked citizens quick financial access. Could this growth positively impact the price of Ethereum in the coming weeks?

Since Mar. 12 capitulation to sub-$100 levels, the crypto field has responded rather bullishly with ETH/USD soaring over 80% in that time period. Currently, the second largest crypto trades at $182 touching a key resistance which if broken may spark a bullish momentum in the price in the coming days.

ETH/USD crossed above the SMA 50 line which offers a near term resistance level at $160. Furthermore the relative strength resistance (RSI) is oscillating at 61 (in a buy zone) offering a bullish price outlook for ETH. Can the swelling DeFi market tip the bull market in upcoming days?

Image from LoanScan.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- US-Iran War: Reports Confirm Bombings In UAE, Bahrain and Kuwait As Crypto Market Makes Recovery

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

- Analysts Predict Where XRP Price Could Close This Week – March 2026

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

Buy $GGs

Buy $GGs