Dogecoin Price Stalls as 200M DOGE Floods Exchanges

Highlights

- Dogecoin price has been stalling within a tight consolidation range between $).17 and $0.20.

- Meanwhile, a whale address has transferred 200M DOGE to the OKX exchange.

- A spike in the Age Consumed Metric suggests that whales may be looking to sell as dormant coins move.

Dogecoin (DOGE) has stalled since the May 11 swing high of $0.25. At press time, Dogecoin price trades at $0.17, representing a 32% drop from this level as daily trading volumes on July 14 reached $936 million. However, the price faces the risk of dropping further as 200M DOGE tokens move to exchanges, increasing the likelihood of selling activity increasing in the near term.

Dogecoin Price Stalls as Shorts Dominate

Dogecoin has been trading within a consolidation for the last two weeks, as the price fluctuates between $0.16 and $0.20. The volatility of this top meme coin has dropped significantly, which signals indecision from both buyers and sellers. However, as the price tests support at the lower boundary of the consolidation range, past trends hint that selling activity may surge.

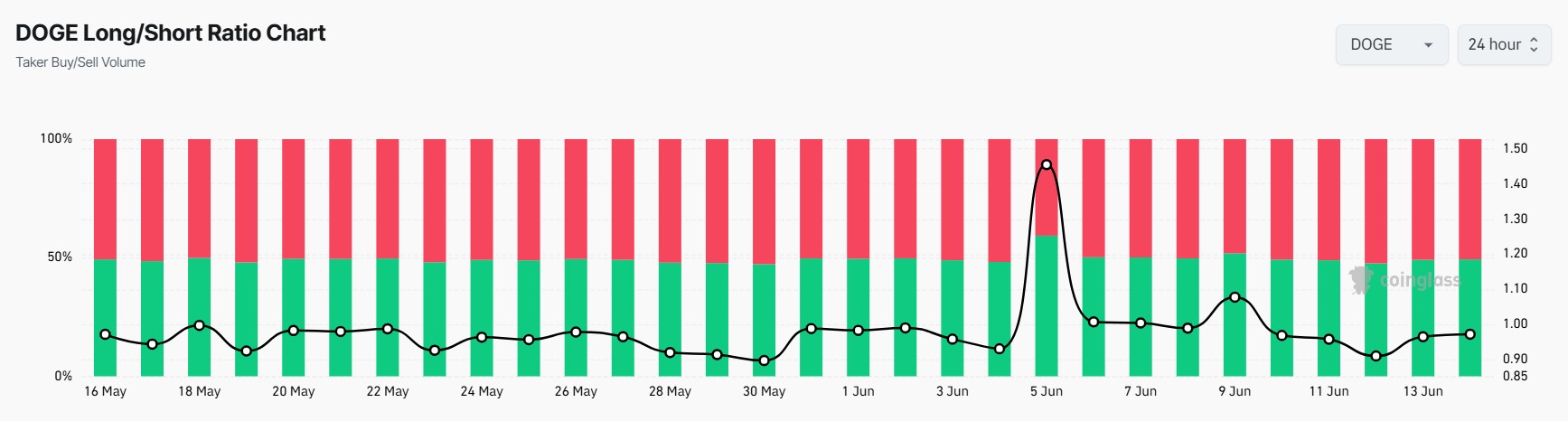

A look at the derivatives market, from Coinglass’ data, reveals that short sellers are dominating the Dogecoin market. This indicates that most futures traders are betting against Dogecoin’s price performance and anticipate it will drop.

The long/short ratio has dropped to 0.95, and it has been sitting below 1 in the last four days. With short sellers holding their positions despite the recent decline, it shows that they expect the price to drop even further.

However, recent CoinGape analysis identified Dogecoin’s bullish bottom pattern that hints towards an 84% price increase. The analysis also noted that DOGE whale holdings have surged to a record high, signalling optimism from large holders who usually buy during bottoms.

As short-term trends show weakness, the long-term Dogecoin price forecast from 2025 and beyond is showing strength.

200M DOGE Floods Exchanges

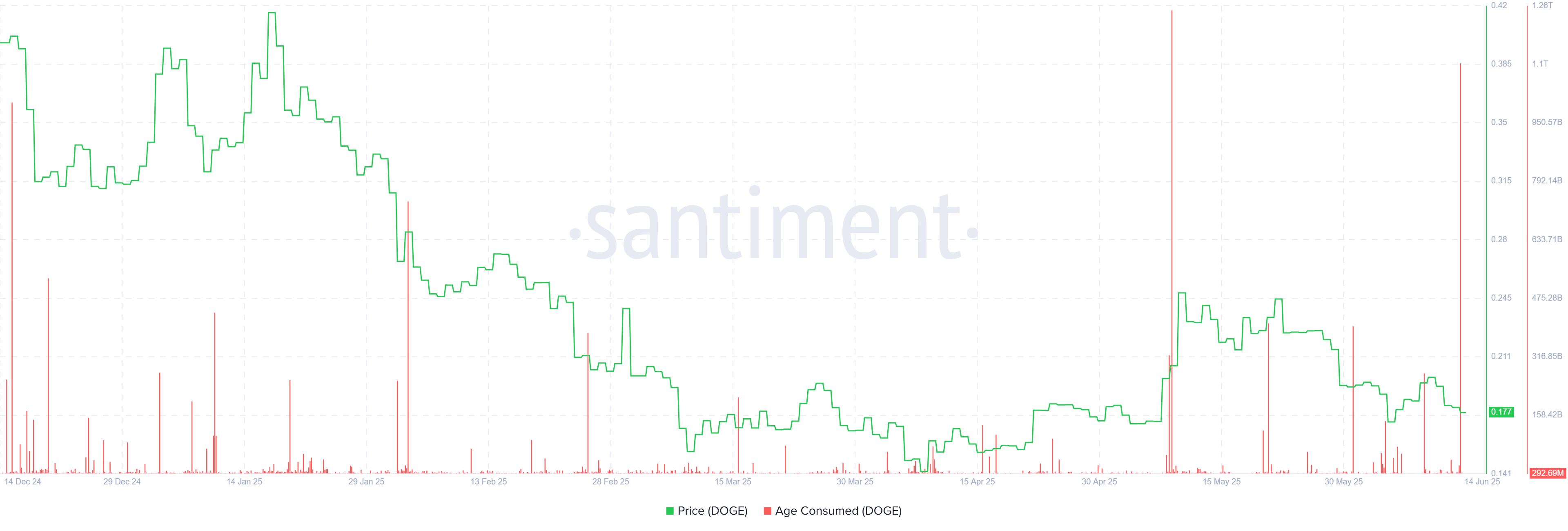

Data from Whale Alert shows a massive increase in the amount of DOGE tokens entering exchanges. On June 14, 200 million DOGE valued at more than $35 million were sent from an unknown wallet to the OKX exchange. Such a move could signal that a large player is looking to sell Dogecoin, and this may worsen the current conditions even as the price fails to make significant moves.

This inflow coincides with a spike in the Age Consumed Metric, which indicates that a large volume of previously unmoved coins has gone to exchanges. This surge usually shows selling behavior as large holders realize profits and exit their positions.

Once the selling pressure from long-term holders eases, Dogecoin price may begin to trend higher if history repeats itself. However, until this happens, it may continue to face weakness within the current consolidation range until there is enough demand to absorb the sold coins.

In conclusion, Dogecoin is at a crucial point as the price stalls within consolidation. The dominance by short sellers could be causing the tight consolidation. Meanwhile, some large holders could be looking to sell after 200M DOGE moved to exchanges while the Age Consumed metric spiked.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Brandt Flips Bullish, Predicts Bitcoin Rally As Price Holds Above $70k

- XRP News: Institutional Use Case Expands as Doppler Finance Integrates WXRP for Multi-Chain Access

- Trump Tariffs: Bitcoin Faces Fresh Headwinds as 15% Global Tariffs Begin This Week Amid Iran War

- Bitget Unveils ‘Crypto Anti-Bias Pledge’ To Support Women’s Inclusion In Crypto

- U.S.-Iran War: Crypto Market Rebounds as Iran Reportedly Reaches Out To U.S. To End Conflict

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

- Bitcoin Price At Risk? Professor Who Predicted US-Iran War Says America Could Lose

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

Buy $GGs

Buy $GGs